New Business Models are Disrupting the Latin American Carsharing Market

New Business Models are Disrupting the Latin American Carsharing Market

Innovative Technologies and Business Models are Driving a B2C and P2P Market Transformation

05-Mar-2021

Latin America

Market Research

$4,950.00

Special Price $3,712.50 save 25 %

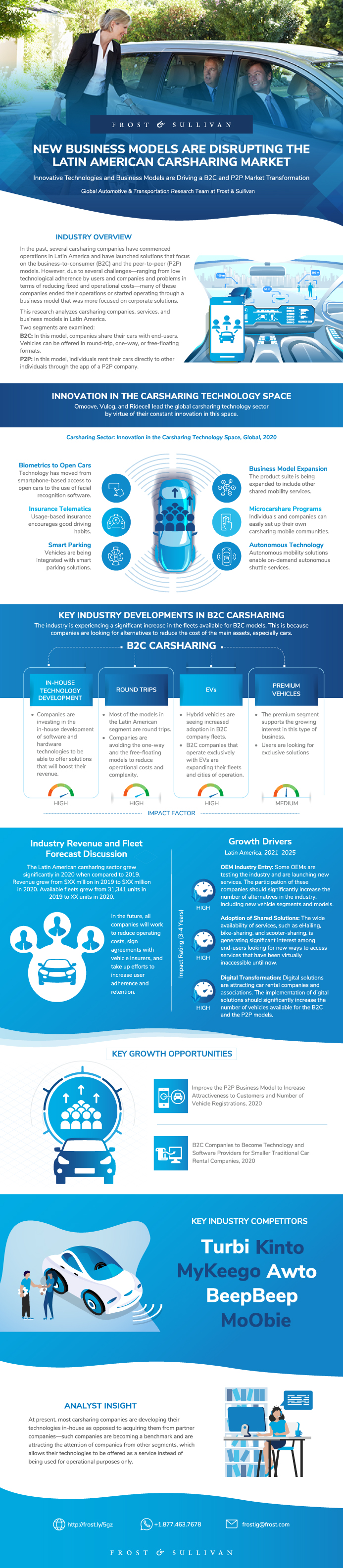

In the past, several carsharing companies have commenced operations in Latin America and have launched solutions that focus on the business to consumer (B2C) and the peer-to-peer (P2P) models. However, due to several challenges—ranging from low technological adherence by users and companies and problems in terms of reducing fixed and operational costs—many of these companies ended their operations or started operating through a business model that was more focused on corporate solutions.

Despite all this, the Latin American carsharing market has been able to sustain growth. Although the COVID-19 pandemic impacted the use of these services for approximately 6 months during 2020, this growth continues to be sustainable and is gaining strength every day.

At present, most carsharing companies are developing their technologies in-house as opposed to acquiring them from partner companies—such companies are becoming a benchmark and are attracting the attention of companies from other segments, which allows their technologies to be offered as a service instead of being used for operational purposes only.

This Frost & Sullivan study analyzes B2C and P2P services in the Latin American carsharing market (forecast up to 2025). It includes an analysis of current business models, fleet size, number of vehicles registered on B2C and P2P platforms, revenue, and a detailed business model analysis of key carsharing companies (12 companies that operate either through the B2C model or the P2P model).

In terms of geographic breakdown, the study considers the following countries—Brazil, Argentina, Chile, and Colombia. The B2C (traditional model) includes round trips, free-floating services, and one-way services, while the P2P service involves the rental of private vehicles—either by the hour, the day, or the month—through a third-party operator through the Web or a mobile platform. B2C and P2P innovations are examined, the impact of the COVID-19 pandemic on the market is analyzed, and operator profitability is discussed. Market growth drivers and restraints alongside pricing trends, competitive environment, and market share are examined. The study concludes with growth opportunities and recommendations that market participants can leverage.

Author: Guira Barretto

Why Is It Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top Three Strategic Imperatives on the Latin American Carsharing Market

Growth Opportunities Fuel the Growth Pipeline Engine™

Latin American Carsharing Market Overview

Latin American Carsharing Market Segmentation

Definition of Traditional Carsharing

Definition of P2P Carsharing

Business Models—A Comparison

Carsharing Stakeholder Ecosystem—Present and Future

Innovation in the Carsharing Technology Space

Key Market Trends in B2C Carsharing

Key Market Trends in P2P Carsharing

Impact of the COVID-19 Pandemic on the Carsharing Business

Carshare Operator Profitability

Key Competitors in the Latin American Carsharing Market

Evolution of Carsharing Companies in Latin America

Growth Drivers in the Latin American Carsharing Market

Growth Restraints in the Latin American Carsharing Market

Forecast Assumptions

Key Growth Metrics

Total Market Revenue and Fleet Forecast, 2017–2025

Total Market Revenue and Fleet Forecast Discussion

Revenue Forecast by Business Type

Fleet Forecast by Business Type

Pricing Trends and Forecast Analysis—B2C Model, 2017–2025

Pricing Trends and Forecast Analysis—P2P Model, 2017–2025

Competitive Environment—B2C

Competitive Environment—P2P

Market Share Analysis

Market Share Analysis (continued)

Companies to Action—SWOT Analysis

Companies to Action—Turbi

Companies to Action—Awto

Companies to Action—Kinto Share

Companies to Action—MoObie

Key Growth Metrics—B2C Market

B2C Revenue Forecast

B2C Fleet Forecast

B2C Revenue Forecast Discussion

Key Growth Metrics—P2P Market

P2P Revenue Forecast

P2P Fleet Forecast

P2P Revenue Forecast Discussion

Growth Opportunity 1: Improve the P2P Business Model to Increase Attractiveness to Customers and Number of Vehicle Registrations, 2020

Growth Opportunity 1: Improve the P2P Business Model to Increase Attractiveness to Customers and Number of Vehicle Registrations, 2020 (continued)

Growth Opportunity 2: B2C Companies to Become Technology and Software Providers for Smaller Traditional Car Rental Companies, 2020

Growth Opportunity 2: B2C Companies to Become Technology and Software Providers for Smaller Traditional Car Rental Companies, 2020 (continued)

Your Next Steps

Why Frost, Why Now?

List of Exhibits

List of Exhibits (continued)

Legal Disclaimer

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Author | Guira Barretto |

| Industries | Automotive |

| WIP Number | K58E-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9965-A6,9A57-A6,9AF6-A6 |