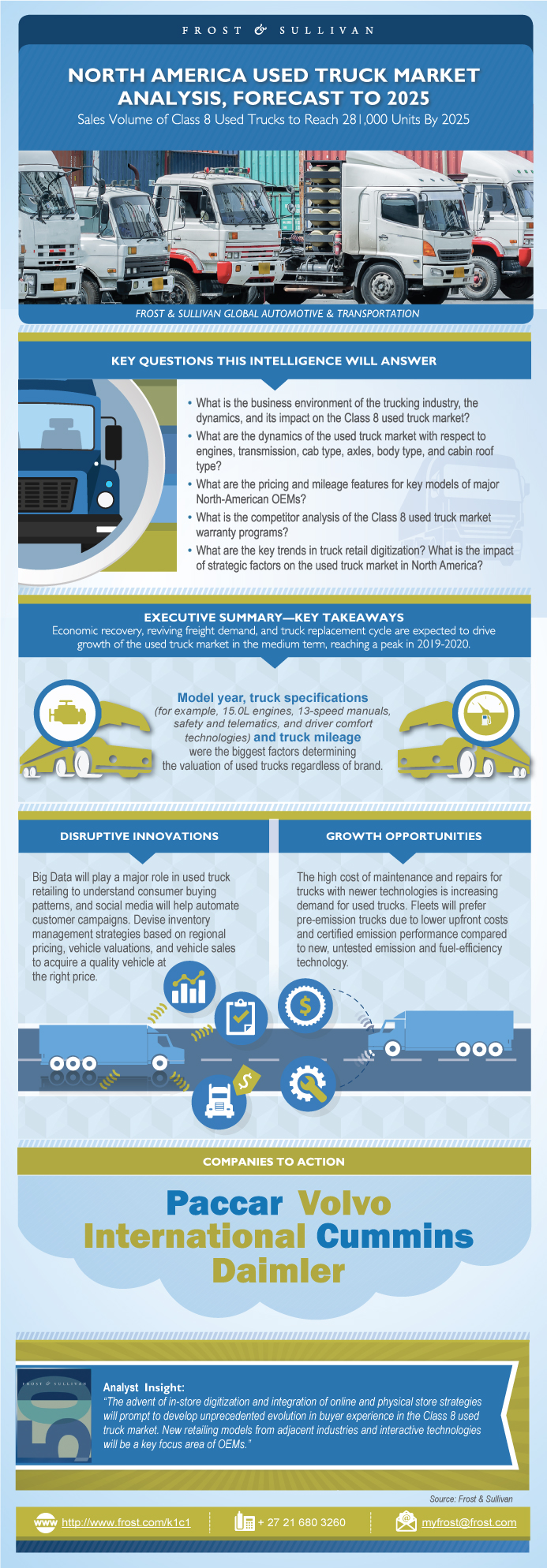

North America Used Truck Market Analysis, Forecast to 2025

North America Used Truck Market Analysis, Forecast to 2025

Sales Volume of Class 8 Used Trucks to Reach 281,000 Units By 2025

22-Feb-2018

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

The demand for used trucks is expected to remain flat in the short term and gain strength in the medium term following the implementation of greenhouse gas (GHG) phase 2 regulations, combined with the upcoming fleet replacement cycle in 2019-2020. Many owner-operators and other smaller fleets are still uncomfortable with the low used truck prices and so are not willing to dispose their old trucks. There is now a high supply of 3- to 5-year-old trucks with increasing mileage, resulting in sustained low prices in the market. Dealer lots having high-mileage trucks are unappealing to buyers in the market, leading to an increase in new truck sales over the short term.

Truck specification will play a key role in determining the valuation of used trucks. There is a strong demand for higher-displacement engines in the used truck market. There is also an increasing trend toward AMT transmission in the line-haul tractor segment due to the fuel efficiency improvements offered. Freightliner Cascadia registered the highest volume among sleeper tractors sold in 2016, while Kenworth emerged as the strong player in the vocational market. Volvo and Mack trucks are finding higher acceptance in the construction segment due to the improved freight environment.

With advancement in truck technologies, newer model year (MY) trucks will increase the reliability and durability of the vehicles, thereby reducing downtime. Fleets will be able to hold their cabs for a longer period of time, while also maintaining strong performance standards and reduced upkeep costs. Additionally, warranty will play a key role as an asset value multiplier, increasing the valuation of used trucks. The implementation of stricter emission and fuel efficiency regulations will require OEMs and dealers to educate customers on new technologies. Retail dealership controls more than 75% market share of distribution channels and offers better sales and service support compared to the other channels.

Digitization, big data, and analytics are making strong inroads in the used truck market. They enable OEMs and dealers to automate their customer outreach campaigns, generate large lead volumes, reach target customers, and facilitate in the management of optimal inventory based on vehicle valuation and regional pricing.

Key Issues Addressed

- What is the business environment of the trucking industry, the dynamics, and its impact on the class 8 used truck market?

- What are the dynamics of the used truck market with respect to key vehicle specifications – such as Engines, Transmission, Cab Type, Axles, Body Type, and Cabin Roof Type – over MY 2010-2016?

- Pricing and mileage analysis of key models of major North American OEMs

- Competitor analysis of warranty programs in the class 8 used truck market warranty

- What are key trends in truck retail digitization?

- What is the impact of strategic factors on the analysis of the used truck market in North America?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Executive Summary—Key Takeaways

Top Trends Influencing Used Truck Valuation

Importance of Specifications on Used Truck Valuation

Class 8 Used Truck Sales and Distribution Channel Forecast

Class 8 Vehicles in Operation (VIO) by Brand

Executive Summary—Findings and Future Outlook

Research Scope

Research Aims and Objectives

Study Assumptions and Definitions

Research Background

Research Methodology

Class 8 New Truck Production

Class 8 Used Truck Sale Volumes

VIO by Class

Average Annual Miles Traveled by Class

Key Consumer Factors When Purchasing a Used Truck

Importance of Specifications on Used Truck Valuation

2016 Class 8 Used Truck Sales Overview

Class 8 Average Age of Vehicles in Operation

Class 8 Export Market Analysis

Class 8 Used Truck Market—Average Pricing Trends by Truck Model Year

Class 8 Used Truck Market—Used Truck Mileage Analysis

Medium Duty (MD) Used Truck Market Share by Engine Manufacturer

Heavy Duty (HD) Used Truck Market Share by Engine Manufacturer

MD Used Truck Transmission Supplier Market Share

HD Used Truck Transmission Supplier Market Share over MY 2010-16

MD and HD Used Truck Unit Shipments by Transmission Speed

MD and HD Used Truck Unit Shipments by Cab Type

MD and HD Used Truck Unit Shipments by Cabin Roof Type

MD and HD Used Truck Unit Shipments by Body Type

MD and HD Used Truck Unit Shipments by Axle Type

Competitor Market Shares of Class 8 New Trucks

Kenworth

Freightliner Used Trucks

Peterbilt

Volvo

International

OEM Used Truck Brand Holdings

OEM Used Truck Brands Inventory Holding Pattern

NTP—Largest Independent Warranty Provider

NTP Warranty Offerings

NTP & ATP Class 8 Pricing

OEM Warranty Offerings

OEM Warranty Offerings—Basic Engine Components

OEM Warranty Offerings—Cylinder Head and Valve Train

OEM Warranty Offerings—Lubrication System, Valve Train

Evolution of Online and Digital Truck eRetail

Future Automotive Retail Ecosystem

Connected Supply Chain—Impact on Service Aftermarket

Connected Trucks Open Opportunities in Predictive Maintenance

Application of Big Data in Maintenance Cost Optimization

Trucking Industry Digitalization Reinforces Aftermarket Evolution

Macro Trends

Advanced Truck Technology

Digital Retailing

Warranty

OEM Strategy

Growth Opportunity—Growing Segment and New Capabilities

Strategic Imperatives for Success and Growth

The Last Word—3 Big Predictions

Legal Disclaimer

List of Exhibits

Table of Acronyms Used

Market Engineering Methodology

- 1. Used Truck Market: Key Takeaways, North America, 2016

- 2. Used Truck Market: Top Trends, North America, 2016

- 3. Used Truck Market: Aggregate Options, North America, 2016

- 4. Used Truck Market: Findings and Future Outlook, North America, 2016 and 2025

- 5. Used Truck Market: List of Key Participants, North America, 2016

- 6. Used Truck Market: Aggregate Options, North America, 2016

- 7. Used Truck Market: Class 8 Truck Export Market Analysis, North America, 2016–2025

- 8. Used Truck Market: OEM Used Brand Holdings, North America, 2016

- 9. Used Truck Market: Benefits of NTP’s Program for various stakeholders, North America, 2016

- 10. Used Truck Market: NTP Warranty Offerings, North America, 2016

- 11. Used Truck Market: NTP & ATP Class 8 Pricing, North America, 2016

- 12. Used Truck Market: OEM Warranty Offerings, North America, 2016

- 13. Used Truck Market: Basic Engine Components OEM Warranty Offerings, North America, 2016

- 14. Used Truck Market: Basic Engine Components OEM Warranty Offerings, North America, 2016

- 15. Used Truck Market: Lubrication System, Valve Components OEM Warranty Offerings, North America, 2016

- 16. Used Truck Market: Evolution of Online and Digital Auto eRetail, North America, 2016–2025

- 17. Used Truck Market: Future Retail Ecosystem, Global, 2016–2025

- 18. Used Truck Market: Connected Supply Chain–Impact on Service Aftermarket, North America, 2016

- 19. Used Truck Market: Opportunities in Predictive Maintenance, North America, 2016

- 20. Used Truck Market: Maintenance-related Data Sources and Optimization, North America, 2016

- 21. Used Truck Market: Aftermarket Evolution based on Digitalization, North America, 2016

- 22. Used Truck Market: Impact of Macro Trends, North America, 2016

- 23. Used Truck Market: Impact of Advanced Truck Technology, North America, 2016

- 24. Used Truck Market: Impact of Digital Retailing, North America, 2016

- 25. Used Truck Market: Impact of Warranty, North America, 2016

- 26. Used Truck Market: Impact of OEM Strategy, North America, 2016

- 27. Used Truck Market: Strategic Imperatives, North America, 2016

- 1. Used Truck Market: Impact of Specifications on Valuation, North America, 2016

- 2. Used Truck Market: Class 8 Used Truck Sales and Distribution Channel Forecast, North America, 2016–2025

- 3. Used Truck Market: Class 8 Vehicles in Operation by Brand, North America, 2016–2025

- 4. Used Truck Market: Class 8 New Truck Production Forecast, North America, 2016–2025

- 5. Used Truck Market: Class 8 Sales Volume Forecast, North America, 2016–2025

- 6. Used Truck Market: VIO by Class, North America, 2016–2025

- 7. Used Truck Market: Average Annual Miles Travelled by Vehicle Class, North America, 2016–2025

- 8. Used Truck Market: Key Purchasing Factors, North America, 2016

- 9. Used Truck Market: Impact of Specifications on Valuation, North America, 2016

- 10. Used Truck Market: Class 8 Used Truck Sales Overview, North America, 2016

- 11. Used Truck Market: Class 8 Average VIO Age, North America, 2016–2025

- 12. Used Truck Market: Class 8 Used Truck Average Pricing Trends, North America, 2010–2016

- 13. Used Truck Market: Class 8 Truck Average Mileage Forecast, North America, 2010–2016

- 14. Used Truck Market: Percent Unit Shipment of MD Used Truck by Engine Manufacturer, North America, 2010–2016

- 15. Used Truck Market: Percent Unit Shipment of MD Used Truck by Engine Manufacturers’ Top 3 Models, North America, 2016

- 16. Used Truck Market: Percent Unit Shipment of HD Used Truck by Engine Manufacturer, North America, 2010–2016

- 17. Used Truck Market: Percent Unit Shipment of HD Used Truck by Engine Manufacturers’ Top 3 Models, North America, 2016

- 18. Used Truck Market: Percent Unit Shipment of MD Used Truck by Transmission Supplier, North America, 2010–2016

- 19. Used Truck Market: Percent Unit Shipment of MD Used Truck by Transmission Suppliers’ Top 5 Models, North America, 2016

- 20. Used Truck Market: Percent Unit Shipment of HD Used Truck by Transmission Supplier, North America, 2010–2016

- 21. Used Truck Market: Percent Unit Shipment of HD Used Truck by Transmission Suppliers’ Top 3 Models, North America, 2016

- 22. Used Truck Market: Percent Unit Shipment of HD Used Truck by Transmission Speed, North America, 2010–2016

- 23. Used Truck Market: Percent Unit Shipment of MD Used Truck by Transmission Speed, North America, 2010–2016

- 24. Used Truck Market: Percent Unit Shipment of HD Used Truck by Cab Type, North America, 2010–2016

- 25. Used Truck Market: Percent Unit Shipment of MD Used Truck by Cab Type, North America, 2010–2016

- 26. Used Truck Market: Percent Unit Shipment of HD Used Truck by Cab Type, North America, 2010–2016

- 27. Used Truck Market: Percent Unit Shipment of MD Used Truck by Cab Type, North America, 2010–2016

- 28. Used Truck Market: Percent Unit Shipment of HD Used Truck by Cab Type, North America, 2010–2016

- 29. Used Truck Market: Percent Unit Shipment of MD Used Truck by Cab Type, North America, 2010–2016

- 30. Used Truck Market: Percent Unit Shipment of HD Used Truck by Body Type, North America, 2010–2016

- 31. Used Truck Market: Percent Unit Shipment of MD Used Truck by Body Type, North America, 2010–2016

- 32. Used Truck Market: Percent Unit Shipment of HD Used Truck by Axle Type, North America, 2010–2016

- 33. Used Truck Market: Percent Unit Shipment of MD Used Truck by Axle Type, North America, 2010–2016

- 34. Used Truck Market: Class 8 OEM Market Shares, North America, 2016

- 35. Used Truck Market: KWT600 & KWT 800 Average Sale Price & Mileage through MY 2008–2014, North America, 2016

- 36. Used Truck Market: Freightliner Cascadia Average Sale Price & Mileage MY 2009–2014, North America, 2016

- 37. Used Truck Market: Peterbilt 386 and 387 Average Sale Price & Mileage MY 2007–2014, North America, 2016

- 38. Used Truck Market: VLN 670 & VNL 780 Average Sale Price & Mileage MY 2007–2014, North America, 2016

- 39. Used Truck Market: Prostar Average Sale Price & Mileage MY 2007–2014, North America, 2016

- 40. Used Truck Market: OEM Used Truck Brands’ Inventory Holding Pattern, North America, 2016

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Executive Summary—Key Takeaways~ || Top Trends Influencing Used Truck Valuation~ || Importance of Specifications on Used Truck Valuation~ || Class 8 Used Truck Sales and Distribution Channel Forecast~ || Class 8 Vehicles in Operation (VIO) by Brand~ || Executive Summary—Findings and Future Outlook~ | Research Scope, Objectives, Background, and Methodology~ || Research Scope~ || Research Aims and Objectives~ || Study Assumptions and Definitions~ || Research Background~ || Research Methodology~ | Market Overview~ || Class 8 New Truck Production~ || Class 8 Used Truck Sale Volumes~ || VIO by Class~ || Average Annual Miles Traveled by Class~ || Key Consumer Factors When Purchasing a Used Truck~ || Importance of Specifications on Used Truck Valuation~ || 2016 Class 8 Used Truck Sales Overview~ || Class 8 Average Age of Vehicles in Operation~ || Class 8 Export Market Analysis~ | Dynamics of MD and HD Used Truck Market~ || Class 8 Used Truck Market—Average Pricing Trends by Truck Model Year~ || Class 8 Used Truck Market—Used Truck Mileage Analysis~ || Medium Duty (MD) Used Truck Market Share by Engine Manufacturer~ || Heavy Duty (HD) Used Truck Market Share by Engine Manufacturer~ || MD Used Truck Transmission Supplier Market Share~ || HD Used Truck Transmission Supplier Market Share over MY 2010-16~ || MD and HD Used Truck Unit Shipments by Transmission Speed~ || MD and HD Used Truck Unit Shipments by Cab Type~ || MD and HD Used Truck Unit Shipments by Cabin Roof Type~ || MD and HD Used Truck Unit Shipments by Body Type~ || MD and HD Used Truck Unit Shipments by Axle Type~ | Competitor Analysis~ || Competitor Market Shares of Class 8 New Trucks~ || Kenworth~ || Freightliner Used Trucks~ || Peterbilt~ || Volvo~ || International~ || OEM Used Truck Brand Holdings~ || OEM Used Truck Brands Inventory Holding Pattern~ | Warranty Analysis~ || NTP—Largest Independent Warranty Provider~ || NTP Warranty Offerings~ || NTP & ATP Class 8 Pricing~ || OEM Warranty Offerings~ || OEM Warranty Offerings—Basic Engine Components~ || OEM Warranty Offerings—Cylinder Head and Valve Train~ || OEM Warranty Offerings—Lubrication System, Valve Train~ | Digital Retailing~ || Evolution of Online and Digital Truck eRetail~ || Future Automotive Retail Ecosystem~ || Connected Supply Chain—Impact on Service Aftermarket~ || Connected Trucks Open Opportunities in Predictive Maintenance~ || Application of Big Data in Maintenance Cost Optimization~ || Trucking Industry Digitalization Reinforces Aftermarket Evolution~ | Impact of Strategic Factors on Used Truck Market Analysis~ || Macro Trends~ || Advanced Truck Technology~ || Digital Retailing~ || Warranty~ || OEM Strategy~ | Growth Opportunities and Companies to Action~ || Growth Opportunity—Growing Segment and New Capabilities~ || Strategic Imperatives for Success and Growth~ | Conclusion~ || The Last Word—3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || List of Exhibits~ || Table of Acronyms Used~ || Market Engineering Methodology~ |

| List of Charts and Figures | 1. Used Truck Market: Key Takeaways, North America, 2016~ 2. Used Truck Market: Top Trends, North America, 2016~ 3. Used Truck Market: Aggregate Options, North America, 2016~ 4. Used Truck Market: Findings and Future Outlook, North America, 2016 and 2025~ 5. Used Truck Market: List of Key Participants, North America, 2016~ 6. Used Truck Market: Aggregate Options, North America, 2016~ 7. Used Truck Market: Class 8 Truck Export Market Analysis, North America, 2016–2025~ 8. Used Truck Market: OEM Used Brand Holdings, North America, 2016~ 9. Used Truck Market: Benefits of NTP’s Program for various stakeholders, North America, 2016~ 10. Used Truck Market: NTP Warranty Offerings, North America, 2016~ 11. Used Truck Market: NTP & ATP Class 8 Pricing, North America, 2016~ 12. Used Truck Market: OEM Warranty Offerings, North America, 2016~ 13. Used Truck Market: Basic Engine Components OEM Warranty Offerings, North America, 2016~ 14. Used Truck Market: Basic Engine Components OEM Warranty Offerings, North America, 2016~ 15. Used Truck Market: Lubrication System, Valve Components OEM Warranty Offerings, North America, 2016~ 16. Used Truck Market: Evolution of Online and Digital Auto eRetail, North America, 2016–2025~ 17. Used Truck Market: Future Retail Ecosystem, Global, 2016–2025~ 18. Used Truck Market: Connected Supply Chain–Impact on Service Aftermarket, North America, 2016~ 19. Used Truck Market: Opportunities in Predictive Maintenance, North America, 2016~ 20. Used Truck Market: Maintenance-related Data Sources and Optimization, North America, 2016~ 21. Used Truck Market: Aftermarket Evolution based on Digitalization, North America, 2016~ 22. Used Truck Market: Impact of Macro Trends, North America, 2016~ 23. Used Truck Market: Impact of Advanced Truck Technology, North America, 2016~ 24. Used Truck Market: Impact of Digital Retailing, North America, 2016~ 25. Used Truck Market: Impact of Warranty, North America, 2016~ 26. Used Truck Market: Impact of OEM Strategy, North America, 2016~ 27. Used Truck Market: Strategic Imperatives, North America, 2016~| 1. Used Truck Market: Impact of Specifications on Valuation, North America, 2016~ 2. Used Truck Market: Class 8 Used Truck Sales and Distribution Channel Forecast, North America, 2016–2025~ 3. Used Truck Market: Class 8 Vehicles in Operation by Brand, North America, 2016–2025~ 4. Used Truck Market: Class 8 New Truck Production Forecast, North America, 2016–2025~ 5. Used Truck Market: Class 8 Sales Volume Forecast, North America, 2016–2025~ 6. Used Truck Market: VIO by Class, North America, 2016–2025~ 7. Used Truck Market: Average Annual Miles Travelled by Vehicle Class, North America, 2016–2025~ 8. Used Truck Market: Key Purchasing Factors, North America, 2016~ 9. Used Truck Market: Impact of Specifications on Valuation, North America, 2016~ 10. Used Truck Market: Class 8 Used Truck Sales Overview, North America, 2016~ 11. Used Truck Market: Class 8 Average VIO Age, North America, 2016–2025~ 12. Used Truck Market: Class 8 Used Truck Average Pricing Trends, North America, 2010–2016~ 13. Used Truck Market: Class 8 Truck Average Mileage Forecast, North America, 2010–2016~ 14. Used Truck Market: Percent Unit Shipment of MD Used Truck by Engine Manufacturer, North America, 2010–2016~ 15. Used Truck Market: Percent Unit Shipment of MD Used Truck by Engine Manufacturers’ Top 3 Models, North America, 2016~ 16. Used Truck Market: Percent Unit Shipment of HD Used Truck by Engine Manufacturer, North America, 2010–2016~ 17. Used Truck Market: Percent Unit Shipment of HD Used Truck by Engine Manufacturers’ Top 3 Models, North America, 2016~ 18. Used Truck Market: Percent Unit Shipment of MD Used Truck by Transmission Supplier, North America, 2010–2016~ 19. Used Truck Market: Percent Unit Shipment of MD Used Truck by Transmission Suppliers’ Top 5 Models, North America, 2016~ 20. Used Truck Market: Percent Unit Shipment of HD Used Truck by Transmission Supplier, North America, 2010–2016~ 21. Used Truck Market: Percent Unit Shipment of HD Used Truck by Transmission Suppliers’ Top 3 Models, North America, 2016~ 22. Used Truck Market: Percent Unit Shipment of HD Used Truck by Transmission Speed, North America, 2010–2016~ 23. Used Truck Market: Percent Unit Shipment of MD Used Truck by Transmission Speed, North America, 2010–2016~ 24. Used Truck Market: Percent Unit Shipment of HD Used Truck by Cab Type, North America, 2010–2016~ 25. Used Truck Market: Percent Unit Shipment of MD Used Truck by Cab Type, North America, 2010–2016~ 26. Used Truck Market: Percent Unit Shipment of HD Used Truck by Cab Type, North America, 2010–2016~ 27. Used Truck Market: Percent Unit Shipment of MD Used Truck by Cab Type, North America, 2010–2016~ 28. Used Truck Market: Percent Unit Shipment of HD Used Truck by Cab Type, North America, 2010–2016~ 29. Used Truck Market: Percent Unit Shipment of MD Used Truck by Cab Type, North America, 2010–2016~ 30. Used Truck Market: Percent Unit Shipment of HD Used Truck by Body Type, North America, 2010–2016~ 31. Used Truck Market: Percent Unit Shipment of MD Used Truck by Body Type, North America, 2010–2016~ 32. Used Truck Market: Percent Unit Shipment of HD Used Truck by Axle Type, North America, 2010–2016~ 33. Used Truck Market: Percent Unit Shipment of MD Used Truck by Axle Type, North America, 2010–2016~ 34. Used Truck Market: Class 8 OEM Market Shares, North America, 2016~ 35. Used Truck Market: KWT600 & KWT 800 Average Sale Price & Mileage through MY 2008–2014, North America, 2016~ 36. Used Truck Market: Freightliner Cascadia Average Sale Price & Mileage MY 2009–2014, North America, 2016~ 37. Used Truck Market: Peterbilt 386 and 387 Average Sale Price & Mileage MY 2007–2014, North America, 2016 ~ 38. Used Truck Market: VLN 670 & VNL 780 Average Sale Price & Mileage MY 2007–2014, North America, 2016 ~ 39. Used Truck Market: Prostar Average Sale Price & Mileage MY 2007–2014, North America, 2016 ~ 40. Used Truck Market: OEM Used Truck Brands’ Inventory Holding Pattern, North America, 2016~ |

| Author | Saideep Sudhakar |

| Industries | Automotive |

| WIP Number | K1C1-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9813-A6,9963-A6,9AF6-A6,9B01-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB