Post COVID-19 Growth Opportunities in the Global Medium/Heavy Commercial Vehicle Aftermarket, 2020

Post COVID-19 Growth Opportunities in the Global Medium/Heavy Commercial Vehicle Aftermarket, 2020 Updated Research Available

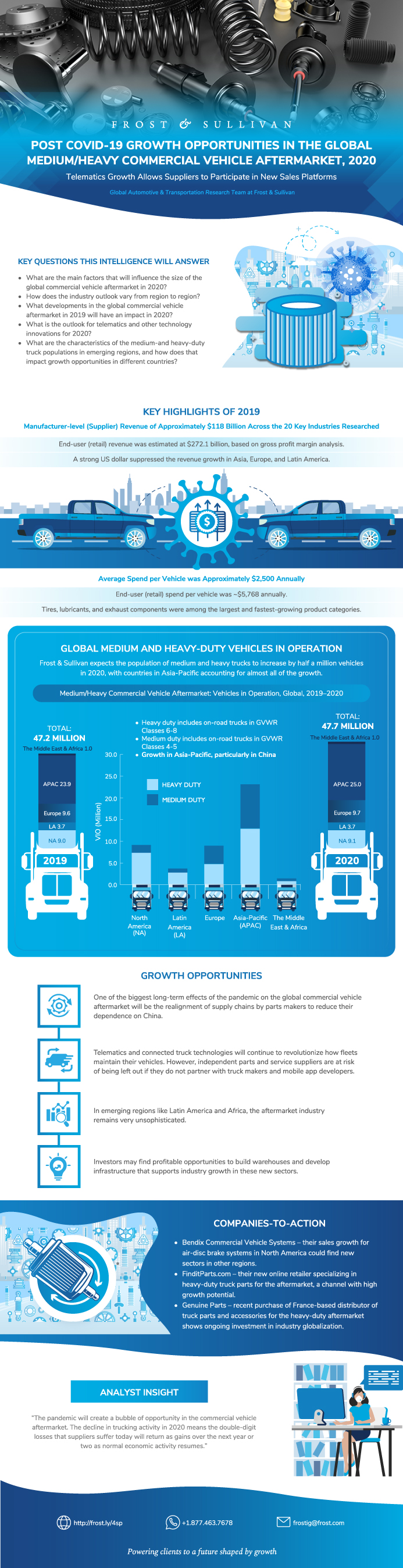

Telematics Growth Allows Suppliers to Participate in New Sales Platforms

27-Oct-2020

Global

$4,950.00

Special Price $3,712.50 save 25 %

Description

The COVID-19 pandemic will affect industries worldwide, but few can feel it as directly as the global commercial vehicles aftermarket. The collapse of economic activity in many regions means companies will drive their work trucks less, and they will spend less to maintain them. The aim of this study is to identify the size of the global commercial vehicle parts and services aftermarket, and its growth opportunities in 2020, given the unique challenges posed by the pandemic. Commercial vehicles include medium- and heavy-duty on-road trucks. Revenue includes parts only and excludes service. Revenue is measured at the manufacturer level and is expressed in US dollars. This research is the culmination of the work of Frost & Sullivan’s analysts located all over the world. Frost & Sullivan’s analysts have used multiple sources and statistical analysis in markets where information is missing to increase the confidence level of the research findings. Revenue is presented at the manufacturer, distributor, and end-user levels. The markets covered are the United States, Canada, Mexico, Brazil, Argentina, the United Kingdom, Germany, France, Italy, Spain, Russia, Turkey, Saudi Arabia, South Africa, India, Japan, Thailand, Australia, Taiwan, and China. The research covers the impact of connected trucks on vehicle maintenance. This includes the penetration of truck telematics by region as well as an analysis of services offered. Growth opportunities and companies to action are covered as well. The research includes a global economic outlook with top trends for 2019 and predictions for 2020, as well as analysis of the COVID-19 pandemic on each region. It identifies the main factors that will influence the size of the global commercial vehicle aftermarket, as well as how the industry outlook varies from region to region. The findings cover developments in the global commercial vehicle aftermarket in 2019 that will have an impact on the market in 2020. Data sources include primary and secondary research, existing Frost & Sullivan studies, statistical modeling, and analysis. Other exhibits include spend per vehicle and market attractiveness analyses. To determine market attractiveness, Frost & Sullivan has analyzed each of the 20 countries for their growth outlook, barriers to entry, and economic competitiveness. The research ends with key conclusions and the outlook for 2020.

Author: Stephen Spivey

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Highlights of 2019

Top 5 Predictions for 2020

2019 Spend Per Vehicle Analysis

2019 Spend Per Vehicle Analysis Discussion

Research Scope

Geographic Scope

Research Aims and Objectives

Key Questions this Study will Answer

Data Sources

Research Process

COVID-19 Impact on World GDP Growth

COVID-19 Impact on Key Regions

COVID-19 Impact on the US and China

Global Medium and Heavy-duty Vehicles in Operation

2019–2020 Revenue and Spend Per Vehicle by Region

2019 Spend Per Vehicle Analysis

Global Average Annual Miles Driven—2019 and 2020

Global Distribution Channel Analysis

Fleet Telematics

Telematics Installed Base Growth Forecast—Possible Growth Scenarios

Growth Opportunities in the Truck Telematics Aftermarket

Key Policies and Regulations—2019

Regional Outlook—North America

North America Aftermarket Dashboard

Aftermarket Outlook—Revenue by Parts Type

VIO Ownership Pattern

Vehicles in Operation Model Mix—North America

Distribution Channel Analysis

Medium/Heavy Commercial Vehicle Aftermarket Opportunity Areas

Regional Outlook—Europe

Europe—Aftermarket Dashboard

Aftermarket Outlook—Revenue by Parts Type

VIO Ownership Pattern

Vehicles in Operation Model Mix—Europe

Distribution Channel Analysis

Medium/Heavy Commercial Vehicle Aftermarket Opportunity Areas

Regional Outlook—Latin America

Latin America Aftermarket Dashboard

Aftermarket Outlook—Revenue by Parts Type

VIO Ownership Pattern

Vehicles in Operation Model Mix

Distribution Channel Analysis

Medium/Heavy Commercial Vehicle Aftermarket Opportunity Areas

Regional Outlook

Aftermarket Dashboard

Aftermarket Outlook—Revenue by Parts Type

VIO Ownership Pattern

Vehicles in Operation Model Mix

Distribution Channel Analysis

Medium/Heavy Commercial Vehicle Aftermarket Opportunity Areas

Regional Outlook

Aftermarket Dashboard

Aftermarket Outlook—Revenue by Parts Type

VIO Ownership Pattern

Vehicles in Operation Model Mix

Distribution Channel Analysis

Medium/Heavy Commercial Vehicle Aftermarket Opportunity Areas

Growth Opportunity 1: Private Labeling to Attain Fast Market Share Growth in a New Product Category, 2020

Growth Opportunity 1: Private Labeling to Attain Fast Market Share Growth in a New Product Category, 2020 (continued)

Growth Opportunity 2: Brand Licensing to Win Recognition from New Customers, 2020

Growth Opportunity 2: Brand Licensing to Win Recognition from New Customers, 2020 (continued)

Growth Opportunity 3: Direct Importing to Reduce Product Acquisition and Distribution Costs, 2020

Growth Opportunity 3: Direct Importing to Reduce Product Acquisition and Distribution Costs, 2020 (continued)

Growth Opportunity 4: Specialization in Niche Products or Services to Maximize Profitability, 2020

Growth Opportunity 4: Specialization in Niche Products or Services to Maximize Profitability, 2020 (continued)

Growth Opportunity 5: Joint Ventures to Manufacture Overseas and Protect Quality, 2020

Growth Opportunity 5: Joint Ventures to Manufacture Overseas and Protect Quality, 2020 (continued)

The Last Word—3 Big Predictions

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

Legal Disclaimer

2020 Planned Research—Commercial Vehicle Aftermarket

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Predecessor | K35D-01-00-00-00 |

| Author | Stephen Spivey |

| Industries | Automotive |

| WIP Number | K472-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9B01-A6,9801-A6,9963-A6,9694 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB