Saudi Arabia Logistics Industry—Growth Insights, Forecast to 2024

Saudi Arabia Logistics Industry—Growth Insights, Forecast to 2024

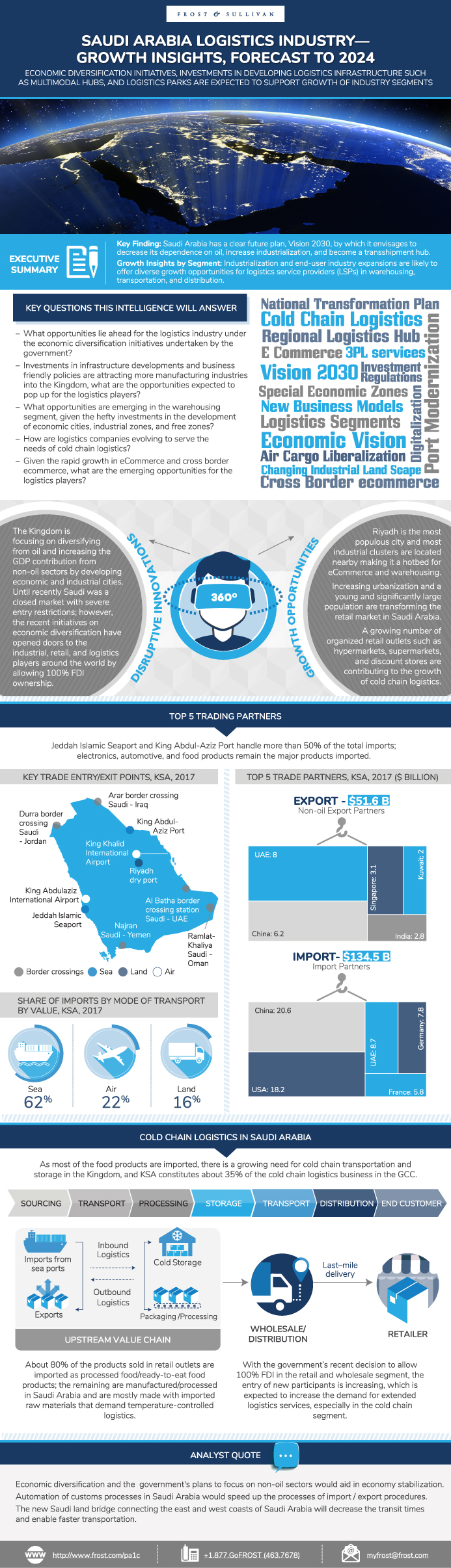

Economic Diversification Initiatives, Investments towards Developing Logistics Infrastructure such as Multimodal Hubs, and Logistics Parks are Expected to Support Growth of Industry Segments

07-Sep-2018

South Asia, Middle East & North Africa

Description

The logistics industry in Saudi Arabia is evolving rapidly to meet the dynamic demands of customers, changing industrial landscape, and expansion of trade. Economic diversification initiatives, tax policy reforms, and FDI policies are encouraging open economy and private investment. Technology advancements and the nation’s vision on economic diversification are creating opportunities across sectors such as retail, eCommerce, healthcare, and other non-oil based industries.

The freight transportation sector is undergoing significant transformation driven by investments in port modernization, rail developments, and airport expansions, while the growth in eCommerce is driving the demand for built-to-suit and modern warehousing solutions. The new rail developments are expected to decrease the nation’s dependency on road as the primary mode of transport and also reduce the time taken to transport goods from coast to coast. Linking of rail infrastructure with ports would also improve multimodal connectivity.

Saudi Arabia is an import-based economy that is dependent on other nations for most products, except oil, for domestic consumption. Key imports include automotive, machinery, electronics, and, more importantly, food products. China, the US, and UAE continue to be the major import sources for Saudi Arabia. The nation’s food-related demands are met from countries like Egypt, Pakistan, and India. These food products find their way inward via containers through sea and are then sold to the consumers via organized supermarket / hypermarket outlets. Saudi Arabia constitutes around 35% of the cold chain business in the GCC region, and is expected to benefit more from its economic diversification initiatives as such measures would bring in more food processing industries which would depend on cold chain logistics service providers for services. This study provides a detailed analysis of the key trends and their implications for the logistics industry segments in Saudi Arabia for the period from 2018 to 2024.

Key Issues Addressed

- What opportunities lie ahead of the logistics industry, under the economic diversification initiatives undertaken by the government?

- Investments in infrastructure developments and business friendly policies are attracting more manufacturing industries into the Kingdom, what are the opportunities expected to pop up for the logistics players?

- What opportunities are emerging in the warehousing segment, given the hefty investments in the development of economic cities, industrial zones, and free zones?

- Saudi Arabia being reliant on imports for its food and related products, how are logistics companies evolving to serve the needs of cold chain logistics?

- Given the rapid growth in eCommerce and cross border eCommerce, what are the emerging opportunities for the logistics players?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Growth Insights by Segment

Top Predictions for 2018–2020

Research Scope

Key Questions this Study will Answer

Economic Snapshot

Reforms and Economic Diversification Initiatives

Saudi Arabia’s Competitiveness

Economic Targets of Vision 2030

Top 5 Trading Partners

Regulatory Environment—Overview

Regulatory Environment—Overview (continued)

Regulatory Environment—VAT and Expat Levy

License Requirements

GDP by Economic Activities and Share of Logistics

Logistics Performance Index

Transportation Sector—Overview

Sea Freight Development

Sea Freight

Road Freight Development

Road Freight

Air Freight Development

Market Drivers and Restraints

Key Drivers for the Logistics Industry

Key Restraints for the Logistics Industry

Transportation and Logistics Industry

Cold Chain Logistics in Saudi Arabia

Cold Chain Logistics in Saudi Arabia (Continued)

Market Drivers

Market Drivers (continued)

Service Offerings

Economic Cities

Saudization

eCommerce

Competition among Regional Ports

Competition among Regional Ports (continued)

Digital Technologies

Tech Trends

Growth Opportunity by Segments

Growth Opportunity by Segments (continued)

The 3 Big Disruptors

Growth Opportunity—Logistics Services

Strategic Imperatives for Success and Growth

The Last Word—3 Big Predictions

Legal Disclaimer

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

The Frost & Sullivan Story

Value Proposition—Future of Your Company & Career

Global Perspective

Industry Convergence

360º Research Perspective

Implementation Excellence

Our Blue Ocean Strategy

Popular Topics

Research scope

The aim of this study is to research and analyze the key developments and trends related to economy and trade and the freight transportation, logistics, and warehousing sectors in Saudi Arabia.

Key Issues Addressed

- What opportunities lie ahead of the logistics industry, under the economic diversification initiatives undertaken by the government?

- Investments in infrastructure developments and business friendly policies are attracting more manufacturing industries into the Kingdom, what are the opportunities expected to pop up for the logistics players?

- What opportunities are emerging in the warehousing segment, given the hefty investments in the development of economic cities, industrial zones, and free zones?

- Saudi Arabia being reliant on imports for its food and related products, how are logistics companies evolving to serve the needs of cold chain logistics?

- Given the rapid growth in eCommerce and cross border eCommerce, what are the emerging opportunities for the logistics players?

| No Index | No |

|---|---|

| Podcast | No |

| Author | Senthil Kumar |

| Industries | Automotive |

| WIP Number | PA1C-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9B01-A6,9694,9AF6-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB