Strategic Analysis of Electric Vehicle (EV) Ecosystem in the United Kingdom, 2018–2025

Strategic Analysis of Electric Vehicle (EV) Ecosystem in the United Kingdom, 2018–2025

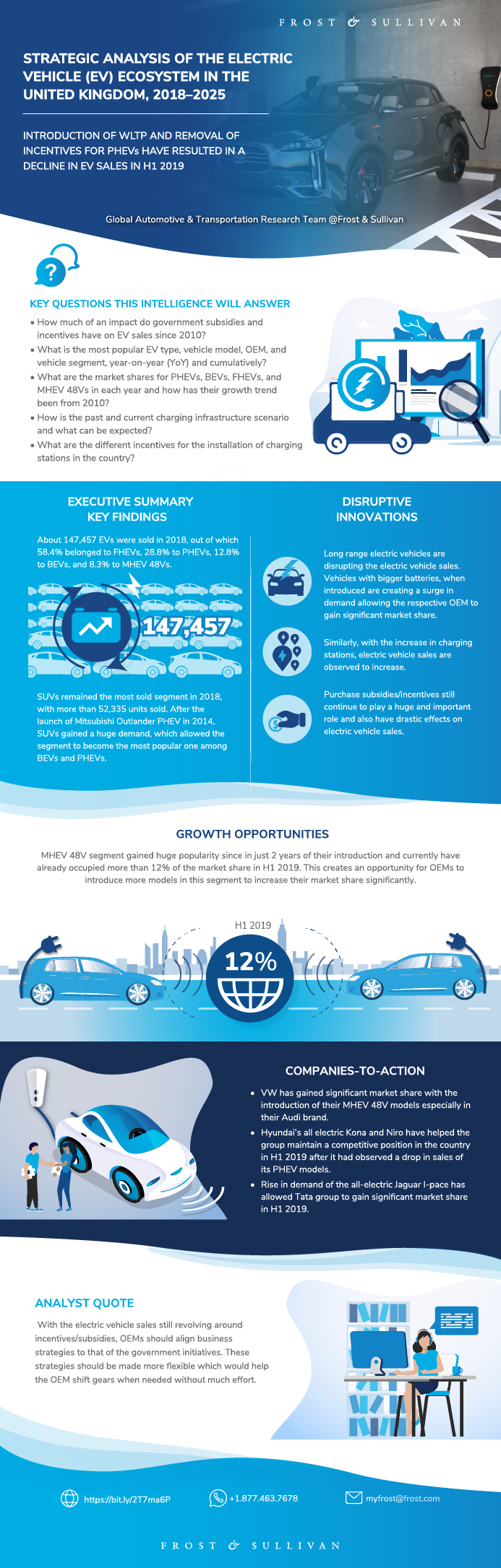

Introduction of WLTP and Removal of Incentives for PHEVs Have Resulted in a Decline in EV Sales in H1 2019

24-Dec-2019

Europe

Market Research

$4,950.00

Special Price $3,712.50 save 25 %

The automotive industry is rapidly evolving in terms of technology, as well as tackling environmental issues. Electric vehicles (EVs) have been introduced as a clean energy initiative, as they have low or zero emissions and have come a long way to becoming an integral part of OEMs’ business strategies. Automakers are creating separate EV business units to be prepared for the expected EV boom in the short term. However, the surge in demand will create a need for huge charging infrastructure and safety regulations and standards.

The United Kingdom is a country that is aggressively pushing the country towards electrification, especially in the automotive and transportation sector. Stringent emission regulations, liberal incentives/subsidies for consumers and manufacturers, high level of localisation, concrete safety standards, and an established technology roadmap are some of the key steps taken by the government to ensure the success of electric vehicles in the near future.

Major OEMs such as Tata-JLR, Volkswagen, and Daimler have announced ambitious sales targets, and are expected to launch a large number of new and constructive electric vehicle models (from city-suited to long-range and powerful ones). Charging infrastructure, which is one of the major factors driving electric vehicle adoption, is also picking up pace, with many new companies entering the market. It has opened up new business models, enabling companies to position themselves either as manufacturers or operators or as a payment gateway.

The study gives a detailed analysis of the current and future prospects of electric vehicle sales in the United Kingdom—by model, by OEM, and by type of vehicle, until 2025. It provides insights into how charging stations have evolved over time and how companies have designed their strategies to establish a profitable supply chain. It also lists the various kinds of investments made in the electric vehicle space, promoting adoption.

Key Issues Addressed

- How much of an impact did government subsidies and incentives have on the sales of electric vehicles from 2010?

- What is the most popular EV type, vehicle model, OEM, and vehicle segment, year-on-year (YoY) and cumulatively?

- What were the market shares for PHEVs, BEVs, FHEVs, and MHEV 48Vs for each year and how has their growth trend been from 2010?

- How are the past and current charging infrastructure scenarios and what can be expected in the near future?

- What are the different incentives for the installation of charging stations in the country?

Top 10 Findings Expected to Influence the UK EV Cars Market

Research Scope

Research Aims and Objectives

Key Questions this Study will Answer

Research Methodology

Product Segmentation—Electric Propulsion Technology

Historical PEV and HEV Sales, 2010–2018

Historical PEV and HEV Sales by xEV Type

Historical PEV and HEV Sales by Segment

PEV Cumulative (BEVs and PHEVs)

HEV Cumulative (FHEVs and MHEV 48Vs)

2018 Market Snapshot—UK

PEV Sales Top 10—2018 (BEVs and PHEVs)

HEV Sales Top 10—2018 (FHEVs and MHEV 48Vs)

H1 2019 Market Snapshot—UK

EV Sales Top 10—H1 2019 (BEVs and PHEVs)

HEV Sales Top 10—H1 2019 (FHEVs and MHEV 48V)

H1 2018 Vs. H1 2019

PEV Sales Forecast

PEV Sales Forecast by xEV Type

PEV Sales Forecast by Segment

PEV Sales Top 10—2025 (BEVs and PHEVs)

Incentives and Taxation Structure

Company Car Tax for BIK

Vehicle Excise Duty (VED)

Import Duties on Battery or Vehicle Imports from Outside the EU

LEZ/ULEZ Areas in the UK

LEZ/ULEZ Areas in UK (continued)

LEZ/ULEZ Areas in London

National Target for EV Sales

Emission Regulation Standards

Non-financial Incentives for EVs

Public and Private Investments in the EV Market

Public and Private Investments in the EV Market (continued)

EV Investment Strategy Driving EV Adoption

Evolution from 2010 to 2019

Normal and Fast Charging Points (2010–2019)

Charging Connectors by Location

Deployment of Public Charging Points—Slow (AC) and Fast (DC)

Value Chain Partnerships, Projects, and Investments

Policy Supporting EV Infrastructure Deployment

AC Level 2+ Charging—The Future of AC Fast Charging

DC Fast Charging—Future Configurations and Requirements

List of Participants Within Identified Value Chain in the UK

Value Chain Set-up—EV Charging Value Chain Role and Links

Electric Vehicle Charging Value Chain

EV Charging Ecosystem—Value Creation

Growth Opportunity—Social Collaboration

Strategic Imperatives for the UK EV Market

Conclusions

Legal Disclaimer

Abbreviations and Acronyms Used

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

Key Issues Addressed

- How much of an impact did government subsidies and incentives have on the sales of electric vehicles from 2010?

- What is the most popular EV type, vehicle model, OEM, and vehicle segment, year-on-year (YoY) and cumulatively?

- What were the market shares for PHEVs, BEVs, FHEVs, and MHEV 48Vs for each year and how has their growth trend been from 2010?

- How are the past and current charging infrastructure scenarios and what can be expected in the near future?

- What are the different incentives for the installation of charging stations in the country?

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Author | Naga Karthik Voruganti |

| Industries | Automotive |

| WIP Number | MEC4-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9807-A6,9813-A6,9882-A6,9AF6-A6 |