Strategic Overview of Start-ups Disrupting the Global Autonomous Vehicle Market

Strategic Overview of Start-ups Disrupting the Global Autonomous Vehicle Market

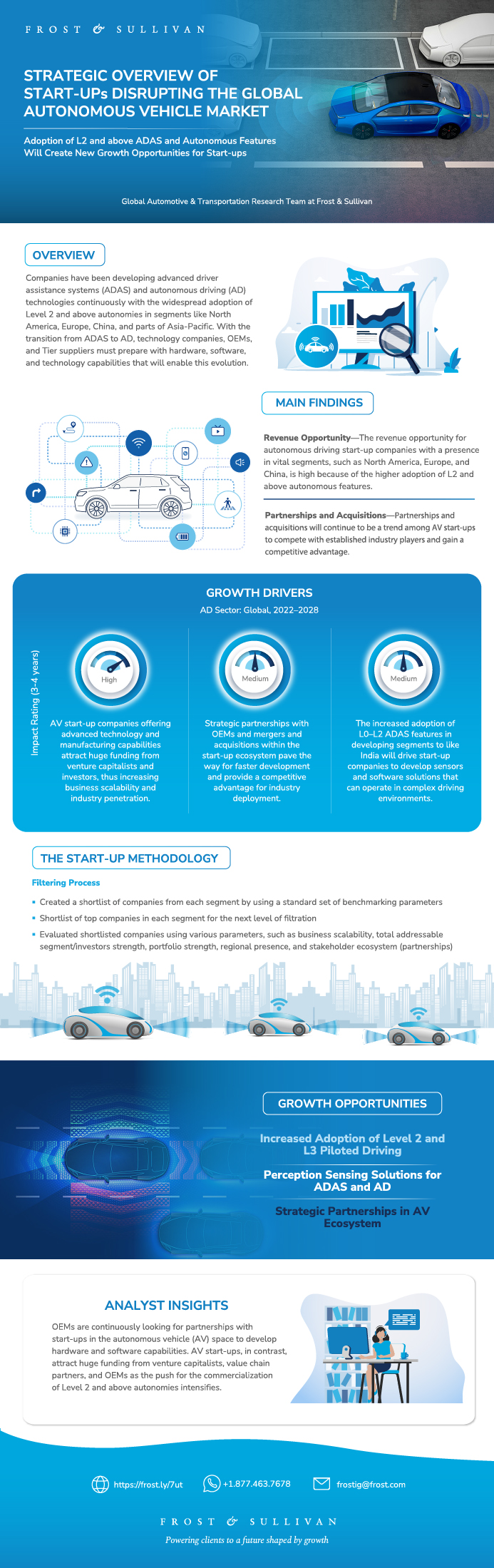

Adoption of L2 and above ADAS and Autonomous Features Will Create New Growth Opportunities for Start-ups

15-Sep-2022

North America

Description

Companies have been developing advanced driver assistance systems (ADAS) and autonomous driving (AD) technologies continuously with the widespread adoption of Level 2 and above autonomies in markets like North America, Europe, China, and parts of Asia-Pacific. With the transition from ADAS to AD, technology companies, OEMs, and Tier suppliers must prepare with hardware, software, and technology capabilities that will enable this evolution.

OEMs are continuously looking for partnerships with start-ups in the autonomous vehicle (AV) space to develop hardware and software capabilities. AV start-ups, in contrast, attract huge funding from venture capitalists, value chain partners, and OEMs as the push for the commercialization of Level 2 and above autonomies intensifies.

Research Scope

The scope of this study covers start-up companies in the ADAS and AD space under the following key segments: ADAS/AD software; ADAS/AD hardware; development, localization, and validation software; LiDAR; camera and vision systems; radar; and autonomous vehicles. Frost & Sullivan short listed more than 175 companies in global regions and evaluated them based on several parameters, such as regional impact, global market presence, business scalability, portfolio strength, funding, and investments, and then ranked them on a scale of 10. Profiles of the leading 3 companies under each segment are provided.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top 3 Strategic Imperatives on the Autonomous Vehicle Start-up Space

Growth Opportunities Fuel the Growth Pipeline Engine™

Research Scope

Market Segmentation and Definitions

Autonomous Driving—Key Competitors

Global AV Forecast, 2021–2028

Analysis by Region—North America

Analysis by Region—Europe

Analysis by Region—APAC

Growth Drivers for Autonomous Driving Start-ups

Growth Restraints for Autonomous Driving Start-ups

Start-up Definition

The Start-up Methodology

Step 1 of the Benchmarking Criteria—Definition

Step 2 of the Benchmarking Criteria—Definition

Autonomous Driving Start-ups—Benchmark Overview

The Startup Ecosystem—175+ Start-ups Disrupting the Value Chain

Main Participants Investing in Start-ups

Autonomous Driving Start-ups by Region

North America as Emerging Global Destination for Start-up Investments in Autonomous Driving

Main Findings

Step 1 of the Benchmarking Criteria—Definition

Shortlisting Exercise

Shortlisting Exercise (continued)

Shortlisting Exercise (continued)

Frost & Sullivan's Criteria to Shortlist Companies

Step 2 of the Benchmarking Criteria—Definition

Frost & Sullivan Start-up Evaluation Radar—Scorecard

Frost & Sullivan Start-up Evaluation Radar—Scorecard (continued)

Horizon.ai Profile

Wayve Profile

Tier IV Profile

Step 1 of the Benchmarking Criteria—Definition

Shortlisting Exercise

Shortlisting Exercise (continued)

Frost & Sullivan's Criteria to Shortlist Companies

Step 2 of the Benchmarking Criteria—Definition

Frost & Sullivan Start-up Evaluation Radar—Scorecard

Frost & Sullivan Start-up Evaluation Radar—Scorecard (continued)

Scale AI Profile

Applied Intuition Profile

Tactile Mobility Profile

Step 1 of the Benchmarking Criteria—Definition

Shortlisting Exercise

Frost & Sullivan's Criteria to Shortlist Companies

Step 2 of the Benchmarking Criteria—Definition

Frost & Sullivan Start-up Evaluation Radar—Scorecard

TTTech Auto Profile

Hailo Profile

Calmcar Vision System Profile

Step 1 of the Benchmarking Criteria—Definition

Shortlisting Exercise

Shortlisting Exercise (continued)

Step 2 of the Benchmarking Criteria—Definition

Frost & Sullivan's Criteria to Shortlist Companies

Frost & Sullivan Start-up Evaluation Radar—Scorecard

Luminar Profile

Hesai Technologies Profile

Velodyne Profile

Step 1 of the Benchmarking Criteria—Definition

Shortlisting Exercise

Frost & Sullivan's Criteria to Shortlist Companies

Step 2 of the Benchmarking Criteria—Definition

Frost & Sullivan Start-up Evaluation Radar—Scorecard

StradVision Profile

Calmcar Vision System Profile

TriEye Profile

Step 1 of the Benchmarking Criteria—Definition

Shortlisting Exercise

Frost & Sullivan's Criteria to Shortlist Companies

Step 2 of the Benchmarking Criteria—Definition

Frost & Sullivan Start-up Evaluation Radar—Scorecard

Vayyar Imaging Profile

Arbe Robotics Profile

Echodyne Profile

Step 1 of the Benchmarking Criteria—Definition

Shortlisting Exercise

Shortlisting Exercise (continued)

Frost & Sullivan's Criteria to Shortlist Companies

Step 2 of the Benchmarking Criteria—Definition

Frost & Sullivan Start-up Evaluation Radar—Scorecard

Cruise Profile

DiDi Autonomous Driving Profile

Waymo Profile

Growth Opportunity 1—Increased Adoption Level 2 and L3 Piloted Driving

Growth Opportunity 1—Increased Adoption of L2 and L3 Piloted Driving (continued)

Growth Opportunity 2—Perception Sensing Solutions for ADAS and AD

Growth Opportunity 2—Perception Sensing Solutions for ADAS and AD (continued)

Growth Opportunity 3—Strategic Partnerships in AV Ecosystem

Growth Opportunity 3—Strategic Partnerships in AV Ecosystem (continued)

Your Next Steps

Why Frost, Why Now?

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

Research Scope

The scope of this study covers start-up companies in the ADAS and AD space under the following key segments: ADAS/AD software; ADAS/AD hardware; development, localization, and validation software; LiDAR; camera and vision systems; radar; and autonomous vehicles. Frost & Sullivan short listed more than 175 companies in global regions and evaluated them based on several parameters, such as regional impact, global market presence, business scalability, portfolio strength, funding, and investments, and then ranked them on a scale of 10. Profiles of the leading 3 companies under each segment are provided.

| Author | Deexeta Mohan Kumar |

|---|---|

| Industries | Automotive |

| No Index | No |

| Is Prebook | No |

| Keyword 1 | advanced driver assistance systems (ADAS) |

| Keyword 2 | autonomous vehicle (AV) |

| Keyword 3 | ADAS to AD |

| Podcast | No |

| WIP Number | PD72-01-00-00-00 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB