US Acoustic Sensing Technologies Growth Opportunities

US Acoustic Sensing Technologies Growth Opportunities

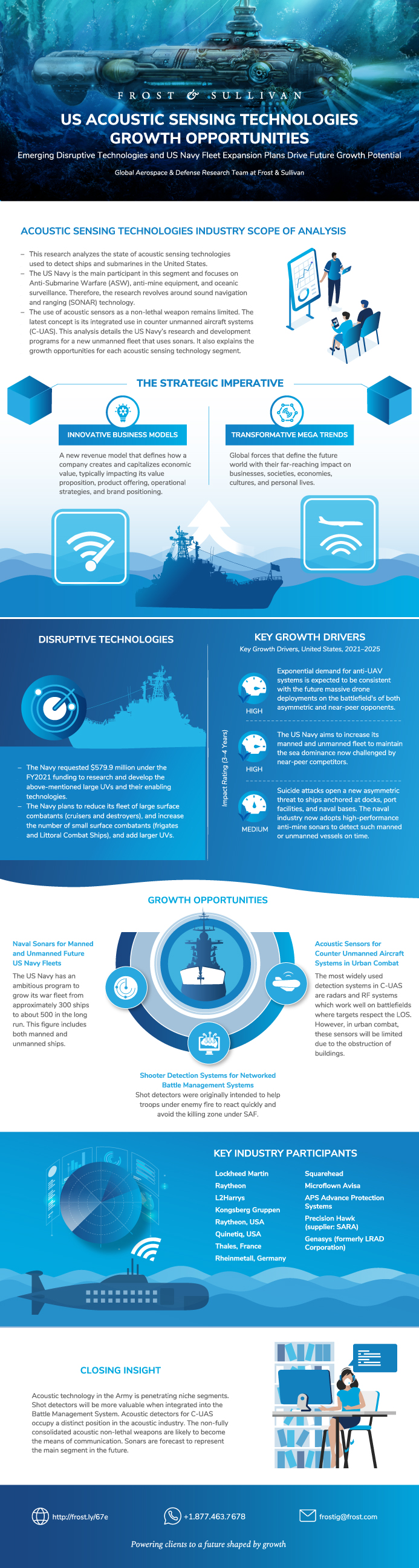

Emerging Disruptive Technologies and US Navy Fleet Expansion Plans Drive Future Growth Potential

27-Jul-2021

North America

$2,450.00

Special Price $1,837.50 save 25 %

Description

This report analyzes the state of acoustic sensing technologies in the United States. Naval acoustics is the most important segment; its development is mostly in response to the advances of US adversary world powers, especially the progress of China’s naval programs. The development of naval acoustics is on a two-track basis to equip an entire unmanned fleet, which comprises offensive unmanned undersea and surface vehicles and a defensive underwater network of unmanned devices. Other segments in this study are acoustic detection devices of unmanned air vehicles, acoustic detection of gunshots, and acoustic devices as non-lethal weapons.

Information to derive spending data is from US 2019–21 defense budget documents. The data includes expenditures for research, development, testing, and evaluation, and procurement. Some development projects involve classified sensitive information not releasable to the public; therefore, the actual current and future spending may be higher than forecast. The competitive landscape for this analysis is compiled from defense contracts awarded during the fiscal years 2019–21. The ranking of competitors is according to the awarded contracts’ total face value.

Drivers and restraints cited in this analysis are primarily for naval acoustic technologies. Additional drivers and restraints are expected to arise when the development phase completes and production commences. The military sonar market’s future is promising due to the US Navy’s strategic decision to almost double its fleet in the coming decades.

The analysis also highlights viable growth opportunities for companies currently involved in acoustic sensors development and those contemplating to enter the future acoustic sensing technologies market.

Author: Jorge Carbonell

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why Is It Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top Three Strategic Imperatives on the Acoustic Sensing Technologies Industry

Growth Opportunities Fuel the Growth Pipeline Engine™

Acoustic Sensing Technologies Market Scope of Analysis

Acoustic Sensing Technologies Segmentation

Acoustic Sensing Technologies Key Competitors by Segment

Growth Drivers for Acoustic Sensing Technologies

Growth Restraints for Acoustic Sensing Technologies

Growth Opportunity Analysis, Naval Sonars

US Navy Acoustic Technology and Unmanned Vehicles Contract Awards Share

US Navy Program for Unmanned Vehicles

US Navy Program for Unmanned Vehicles (continued)

DARPA’s Persistent Aquatic Living Sensors Program

DARPA´s Anti-Submarine Warfare Continuous Trail Unmanned Vessel

Growth Opportunity Analysis, Shot Detection Systems

Growth Opportunity Analysis, Counter Unmanned Aircraft Systems

Growth Opportunity Analysis, Non-Lethal Weapon Acoustic Systems

Growth Opportunity 1—Naval Sonars for Manned and Unmanned Future US Navy Fleets

Growth Opportunity 1—Naval Sonars for Manned and Unmanned Future US Navy Fleets (continued)

Growth Opportunity 2—Shooter Detection Systems for Networked Battle Management Systems

Growth Opportunity 2—Shooter Detection Systems for Networked Battle Management Systems (continued)

Growth Opportunity 3—Acoustic Sensors for Counter Unmanned Aircraft Systems in Urban Combat

Growth Opportunity 3—Acoustic Sensors for Counter Unmanned Aircraft Systems in Urban Combat (continued)

Conclusions

Conclusions (continued)

List of Exhibits

Legal Disclaimer

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Jorge Carbonell |

| Industries | Aerospace, Defence and Security |

| WIP Number | K65F-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9000-A1 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB