ASEAN Hybrid and Electric Vehicle Growth Opportunities

ASEAN Hybrid and Electric Vehicle Growth Opportunities

The Transformative Mega Trends Driving Energy-efficient and Electrification Technologies in Indonesia, Malaysia, and Thailand

20-Oct-2021

Asia Pacific

Description

Major Association of Southeast Asian Nation (ASEAN) countries rely on internal combustion engine (ICE) passenger vehicles. National incomes and infrastructure development also drive motorcycles’ popularity. Hybrid and electric vehicle penetration only accounted for 0.3%, 1.3%, and 9%, respectively, in the total new passenger vehicle sales in Indonesia, Malaysia, and Thailand.

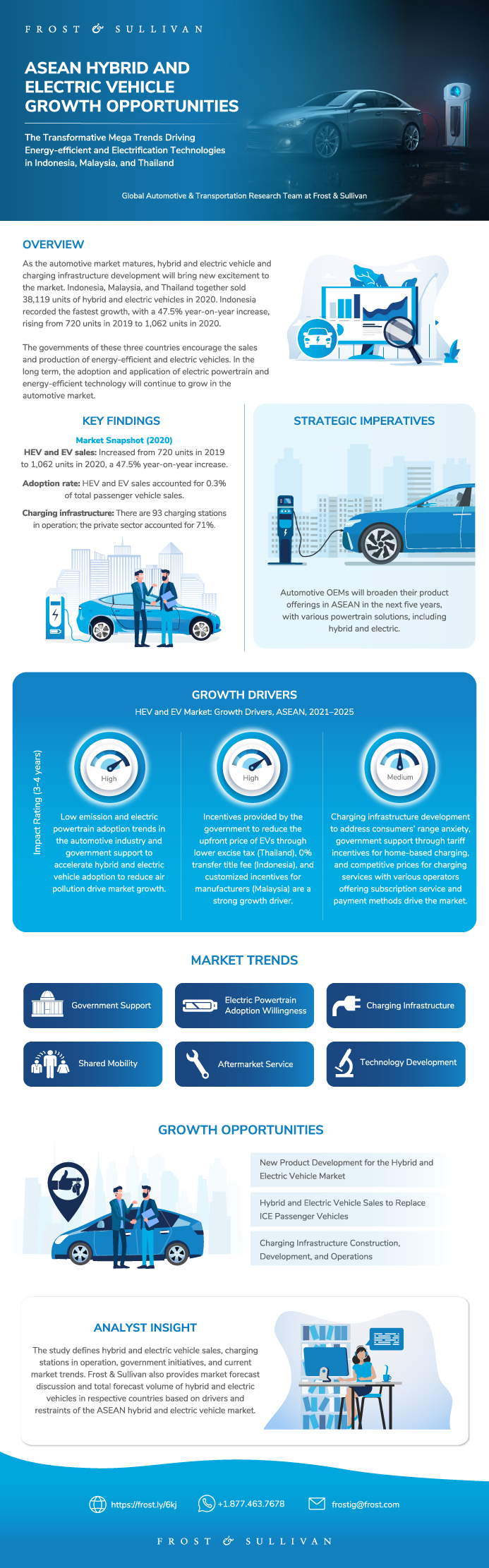

As the automotive market matures, hybrid and electric vehicle and charging infrastructure development will bring new excitement to the market. Indonesia, Malaysia, and Thailand together sold 38,119 units of hybrid and electric vehicles in 2020. Indonesia recorded the fastest growth, with a 47.5% year-on-year increase, rising from 720 units in 2019 to 1,062 units in 2020.

The governments of these three countries encourage the sales and production of energy-efficient and electric vehicles. In the long term, the adoption and application of electric powertrain and energy-efficient technology will continue to grow in the automotive market.

Japanese OEMs have the largest market share in the ASEAN automotive market. They will continue to offer hybrid powertrain through alternative powertrain selections, such as gasoline and hybrid, provided by the same passenger vehicle model in the ASEAN market. Meanwhile, premium OEMs will continue focusing on plug-in hybrid electric vehicles (PHEVs).

The study covers the hybrid and electric passenger vehicles market in ASEAN countries, emphasizing Indonesia, Malaysia, and Thailand. With a market overview based in 2020, the historical period of the study covers 2018–2020, while the forecast period is from 2021 to 2025.

The market overview is based on the overall four-wheeler passenger vehicle market, and hybrid and electric four-wheeler passenger vehicle market. The hybrid and electrified vehicle segment covers hybrid, plug-in hybrid, and battery electric vehicles.

The study defines hybrid and electric vehicle sales, charging stations in operation, government initiatives, and current market trends. Frost & Sullivan also provides market forecast discussion and total forecast volume of hybrid and electric vehicles in respective countries based on drivers and restraints of the ASEAN hybrid and electric vehicle market.

Author: Ming Lih Chan

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why Is It Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top Three Strategic Imperatives on the ASEAN Hybrid and Electric Vehicle Market

Growth Opportunities Fuel the Growth Pipeline Engine™

COVID-19 Impact on World GDP Growth

Global Growth Scenario Analysis—Assumptions

World GDP Growth Under Differing Scenarios

COVID-19 Impact on Key Regions

Scope of Analysis

Segmentation

Growth Drivers

Growth Restraints

Key Findings

Key Growth Metrics

Market Snapshot

Charging Infrastructure Snapshot

Government Initiatives

Market Trends

Sales Forecast

Sales Forecast Analysis

Key Findings

Key Growth Metrics

Market Snapshot

Charging Infrastructure Snapshot

Government Initiatives

Market Trends

Sales Forecast

Sales Forecast Analysis

Key Findings

Key Growth Metrics

Market Snapshot

Charging Infrastructure Snapshot

Government Initiatives

Market Trends

Sales Forecast

Sales Forecast Analysis

Growth Opportunity 1—New Product Development for the Hybrid and Electric Vehicle Market

Growth Opportunity 1—New Product Development for the Hybrid and Electric Vehicle Market (continued)

Growth Opportunity 2—Hybrid and Electric Vehicle Sales to Replace ICE Passenger Vehicles

Growth Opportunity 2—Hybrid and Electric Vehicle Sales to Replace ICE Passenger Vehicles (continued)

Growth Opportunity 3—Charging Infrastructure Construction, Development, and Operations

Growth Opportunity 3—Charging Infrastructure Construction, Development, and Operations (continued)

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Ming Lih Chan |

| Industries | Automotive |

| WIP Number | PB92-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9673-A6,9800-A6,9882-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB