Communications and Collaboration Investment Priorities

Communications and Collaboration Investment Priorities

IT/Telecom Buyers’ Perspective

18-Feb-2021

Europe

Description

This study provides the data collected through an online survey of 1,129 IT and telecom decision makers across customer size segments, industries and world regions. The survey was conducted in November-December 2020. Respondents were qualified as follows:

• IT/telecom decision maker in organizations with 10+ employees

• Having knowledge on communications and collaboration services

The overall research objective is to measure the current use and future decision-making behavior toward communications and collaboration solutions across industry verticals, customer segments, job roles and geographic regions. More specifically, this study provides data on adoption drivers and restraints, deployment plans, perceived benefits and concerns, and allocated budgets with regard to the following technologies and tools: enterprise telephony, video conferencing, team collaboration, instant messaging and presence, mobile apps, artificial intelligence (AI), big data and analytics, customer experience management, and other transformative technologies.

Research Scope

- Understand the IT-related challenges organizations face today

- Monitor the status of digital transformation

- Assess the current and future use of business communications technologies

- Evaluate factors that drive investments in communications technologies

- Gauge IT and communications trends

- Appraise available IT budgets

- Discover opportunities in different regions, verticals, and business size

Key Features

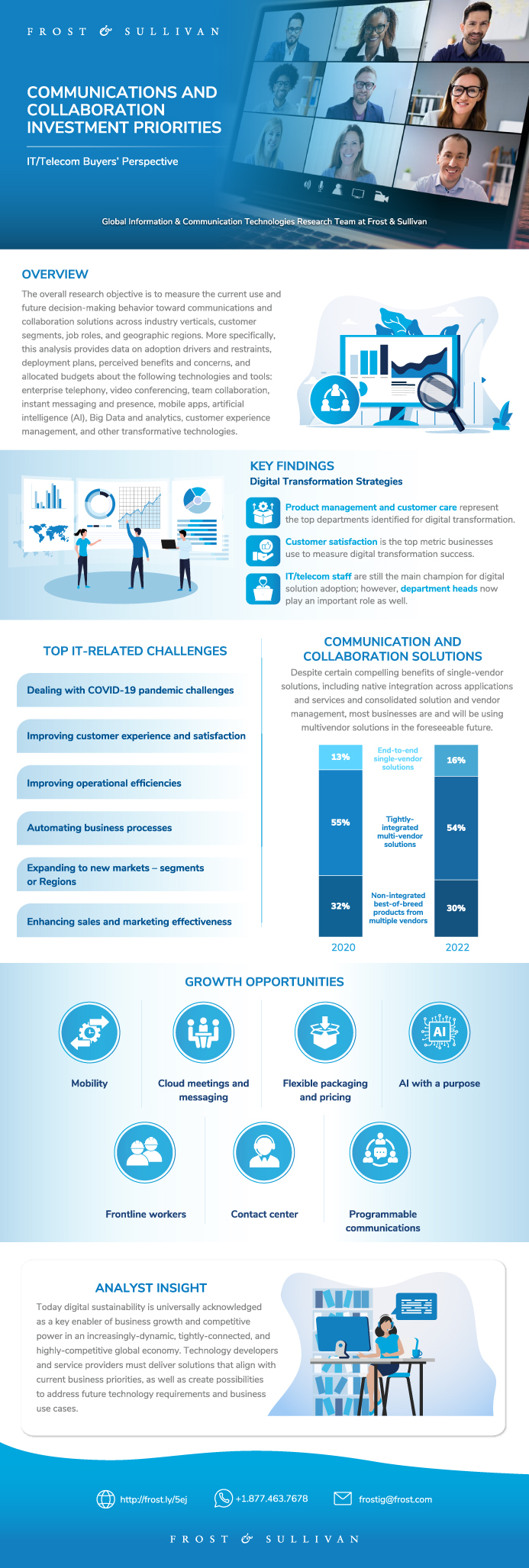

Dealing with COVID-19 challenges (43%) far outranks other business goals in 2020 and 2021, a marked departure from previous data ranking customer experience and satisfaction at the top of the list, followed by operational efficiencies. Addressing security concerns, multi-vendor systems integration, and ensuring network reliability continue to dominate IT challenges, most likely exacerbated by rushed or delayed technology deployments during the pandemic. Understandably, COVID-19-related challenges (55%) are identified as the largest hurdle to the adoption of transformative technologies.

Product management and customer care (both at 37%) represent the top departments identified for digital transformation. Customer satisfaction (43%) is the top metric businesses use to measure digital transformation success. IT/telecom staff (48%) are still the main champion for digital solution adoption; however, department heads (43%) now play an important role as well.

The rise in remote work (66%) and concerns about employee and customer safety (65%) rank the highest among challenges created by the pandemic. Government, professional services, banking and finance organizations were most impacted by the rise in remote work, whereas the hospitality industry saw the largest decline in employee morale.

COVID-19 accelerated technology investments for more (46%) businesses than it slowed down (28%), whereas video conferencing (48%) ranked as the top technology businesses adopted to support remote workers. Adapting to new work modes (34%) and accelerating digital customer engagement (32%) represent key digital transformation objectives driven by COVID-19. Cloud applications (29%) will be the main focus in post-pandemic investments. In the next two years, cyber security (50%) will represent a key technology focal area.

Author: Elka Popova

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Research Objectives

Research Methodology

Sample Distribution—Country

Respondent Profile—Decision-Making Authority

Respondent Profile—Familiarity with IT Budget

Respondent Profile—Involvement in IT/Telecom-Related Purchases

Organization Profile—Industry Segments

Organization Profile—Size of Organization

2019 Organization Revenue

Estimated Change in Organization Revenue 2020

Summary of Key Findings

Summary of Key Findings (continued)

Summary of Key Findings (continued)

Key Business Goals

Top IT-Related Challenges

Current Stage of Digital Transformation Strategy

Hurdles to Purchasing Transformative Technologies

Priority Departments for Digital Transformation Investment

Digital Transformation Success measurement

Departments Driving the Adoption of Digital Solutions

Impact of COVID-19 on the Organization

Top Industries for Increased Remote Work due to Covid-19

Top Industries with Low Employee Morale due to Covid-19

Top it Challenges in Supporting Remote work

Covid-19 Impact on Technology Investments

Covid-19 Impact on Digital Transformation Objectives

Covid-19 Impact on Technology to Monitor Office Safety

Covid-19 Impact on Technologies for Remote Workers

Covid-19 Impact on Physical Office Space and Real Estate

Technology Prioritization Post Covid-19

Organization Focus Post Covid-19

Current Work from Home Status

Workplace Evolution over the Next Year

Carpeted Offices Within Organizations

Future Office Space Expectations

Future Investment in Open Offices

Future Investment Prioritization

Future Deployment “In The Cloud”

Cloud or Cloud Communications Provider Selection

Use of Communications and Collaboration Tools

Communications and Collaboration Tools Deployment

Communications and Collaboration Investment Drivers

Factors Determining not to Invest in or Use Communications and Collaboration

Communications and Collaboration Environments

Technologies Used in Meeting Rooms Today

Video Technologies Used in Huddle/ Small Meeting Rooms Today

Video Technologies Used in Mid/Large Meeting Rooms Today

Solutions—Video Conferencing Solutions

Top Factors for Room Video Conferencing Device Purchases

Features Lacking in Room Video Conferencing Devices

Top Reasons For AI Investments

Importance of AI To Enhance Enterprise Communications and Contact Center

Anticipated Benefits of Using AI to Enhance Business Communications and Contact Center Capabilities

Risks of Using AI

Top Purchase Factors in Selecting Big Data Analytics Solutions

Features Lacking in Big Data Analytics Solutions

Number of Mobile Apps Provided to Employees

Plans to Introduce Additional Mobile Apps

Worker Categories Equipped with Mobile Apps

Tactics to Encourage Mobile App Usage

Unauthorized Mobile App Usage

Top Reasons for Providing Mobile Apps to Employees

Top Reasons for not Providing Apps to Employees

Importance of Mobile App Use

Company Support for BYOD

Support for Personally-owned Mobile Devices

Support for Mobile Operating Systems

Expectations for BYOD Implementation

Usage of Mobile Devices

Preferred Strategic Partner for Mobile Apps

Top Potential Benefit of 5G Connectivity

Awareness of 5G Network Slicing Capabilities

Mobile App Deployment Preferences

Mobile App Partner Selection Criteria

Value of Integrated Web Portals To Track Mobile Resources

Communications and Collaboration Investment Factors

Covid-19 Impact on Revenue 2020

Estimated Change in IT/Telecom Budgets in 2021

Percent of Revenue Allocated To IT/Telecom Budgets

Conclusion

Growth Opportunities

Your Next Steps

Why Frost, Why Now?

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

Research Scope

- Understand the IT-related challenges organizations face today

- Monitor the status of digital transformation

- Assess the current and future use of business communications technologies

- Evaluate factors that drive investments in communications technologies

- Gauge IT and communications trends

- Appraise available IT budgets

- Discover opportunities in different regions, verticals, and business size

Key Features

Dealing with COVID-19 challenges (43%) far outranks other business goals in 2020 and 2021, a marked departure from previous data ranking customer experience and satisfaction at the top of the list, followed by operational efficiencies. Addressing security concerns, multi-vendor systems integration, and ensuring network reliability continue to dominate IT challenges, most likely exacerbated by rushed or delayed technology deployments during the pandemic. Understandably, COVID-19-related challenges (55%) are identified as the largest hurdle to the adoption of transformative technologies.

Product management and customer care (both at 37%) represent the top departments identified for digital transformation. Customer satisfaction (43%) is the top metric businesses use to measure digital transformation success. IT/telecom staff (48%) are still the main champion for digital solution adoption; however, department heads (43%) now play an important role as well.

The rise in remote work (66%) and concerns about employee and customer safety (65%) rank the highest among challenges created by the pandemic. Government, professional services, banking and finance organizations were most impacted by the rise in remote work, whereas the hospitality industry saw the largest decline in employee morale.

COVID-19 accelerated technology investments for more (46%) businesses than it slowed down (28%), whereas video conferencing (48%) ranked as the top technology businesses adopted to support remote workers. Adapting to new work modes (34%) and accelerating digital customer engagement (32%) represent key digital transformation objectives driven by COVID-19. Cloud applications (29%) will be the main focus in post-pandemic investments. In the next two years, cyber security (50%) will represent a key technology focal area.

Author: Elka Popova

| No Index | No |

|---|---|

| Podcast | No |

| Author | Elka Popova |

| Industries | Telecom |

| WIP Number | K5F0-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9528-C1,9535-C3,9717-C3,9A59-C1,9705-C1,9A5B-C1,9610,9656,9655,9724 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB