Executive Report on Global Electric Vehicle (EVs) Sales in 2018 and H1 2019

Executive Report on Global Electric Vehicle (EVs) Sales in 2018 and H1 2019

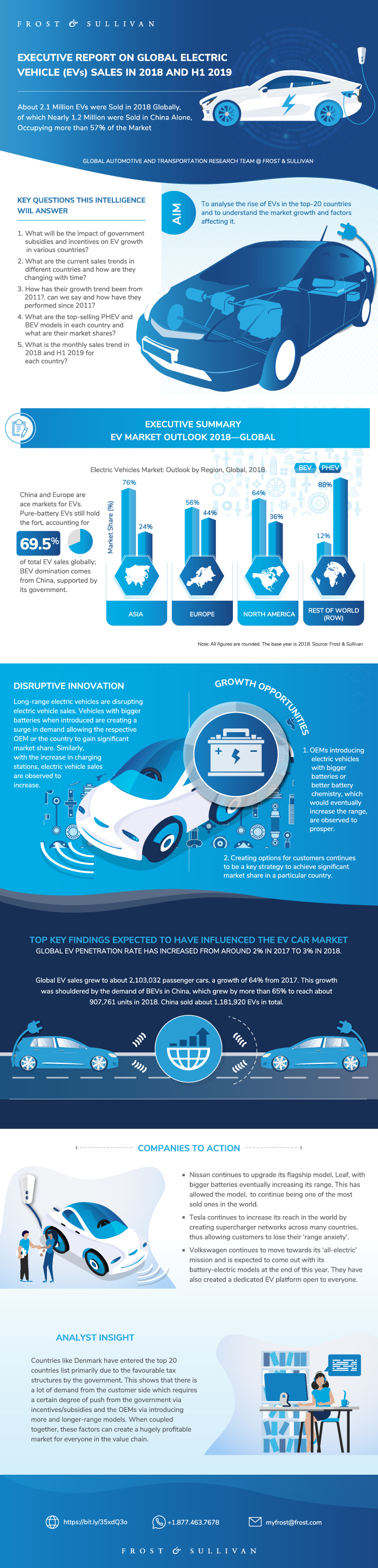

About 2.1 Million EVs were Sold in 2018 Globally, of which Nearly 1.2 Million were Sold in China Alone, Occupying more than 57% of the Market

16-Dec-2019

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

The cost driven EV market is heavily dependent on subsidies and incentives offered by various governments on EV purchase and charging. Netherlands and Hong Kong have witnessed a decrease in EV sales post the removal of grants/subsidies on purchase of EVs. Norway has enjoyed a high growth rate of 4.8% with more than 21% of vehicles sold in the country being EVs through their incentives and subsidy programs. Governments around the world are expected to be target higher growth rates due to the stringent emission norms and fuel economy standards.

OEMs are observed to upgrade vehicle battery packs in order to deliver more electric range and launch new car models in order to nullify the “range anxiety” of drivers. Deployment of charging stations has also been growing steadily with more than 90,000 charging stations across the globe. More and more charging operators/aggregators are entering the market making the EV ecosystem more competitive.

China is dominating the market currently with BYD EC180/200 EV emerging as the most sold EV due to local markets and is followed by vehicles from Tesla, Toyota, Nissan and Renault. China is expected to continue dominating the market but the expected launches of upgraded versions of many existing models in Europe and USA is anticipated to lead to a new model occupying the top spot in 2018 sales.

This study offers key highlights from analysis of the global electric vehicle market sales in 2017 and trends specifically for the most dynamic markets of Europe, North America, China, Japan, and South Korea. It also provides various insights on split between type of vehicles, incentives/subsidies in various countries, charging station deployment (Fast chargers in few countries) and monthly sales data for top 20 countries in 2017. The study covers major markets of Americas (Canada, USA and Mexico), Europe (Germany, UK, Sweden, Italy, Spain, Norway, Netherlands etc.) and Asia (China, Japan, South Korea, Hong Kong, Malaysia etc.).

Key Issues Addressed

- What will be the impact of government subsidies and incentives on EV growth in various countries?

- What are the current sales trends in different countries and how are they changing with time?

- What is the market share for PHEVs and BEVs in each country and their growth trend from 2011?

- What are the top selling PHEV and BEV models in each country and their market share?

- What is the monthly sales trend in 2017 for each country?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Top 8 Findings Expected to have Influenced the EV Car Market

Electric Vehicles Sold in the Last Decade

EV Market Outlook 2018—Global

EV Sales by Country—Top 20

EV Sales by Country—Top 20 (continued)

Sales by Region and Technology—Top 20 Countries

Sales by Region and Technology—Top 20 Countries (continued)

Top 10 OEMs and Model Sales—2017 and 2018

Research Scope

Research Aims and Objectives

Key Questions this Study will Answer

Research Methodology

Product Segmentation—Electric Propulsion Technology

Historic EV Sales—China

2018 Market Outlook—China

H1 2019 Market Outlook—China

Market Outlook—Top 5 EVs by Type

EV Sales by OEM

EV Sales by Model

EV Sales by Model Per Quarter

Historic EV Sales—US

2018 Market Outlook—US

H1 2019 Market Outlook—US

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Norway

2018 Market Outlook—Norway

H1 2019 Market Outlook—Norway

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Germany

2018 Market Outlook—Germany

H1 2019 Market Outlook—Germany

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Japan

2018 Market Outlook—Japan

H1 2019 Market Outlook—Japan

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—UK

2018 Market Outlook—UK

H1 2019 Market Outlook—UK

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—France

2018 Market Outlook—France

H1 2019 Market Outlook—France

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Sweden

2018 Market Outlook—Sweden

H1 2019 Market Outlook—Sweden

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Canada

2018 Market Outlook—Canada

H1 2019 Market Outlook—Canada

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Belgium

2018 Market Outlook—Belgium

H1 2019 Market Outlook—Belgium

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—South Korea

2018 Market Outlook—South Korea

H1 2019 Market Outlook—South Korea

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—The Netherlands

2018 Market Outlook—The Netherlands

H1 2019 Market Outlook—The Netherlands

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Spain

2018 Market Outlook—Spain

H1 2019 Market Outlook—Spain

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Malaysia

2018 Market Outlook—Malaysia

H1 2019 Market Outlook—Malaysia

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Switzerland

2018 Market Outlook—Switzerland

H1 2019 Market Outlook—Switzerland

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Austria

2018 Market Outlook—Austria

H1 2019 Market Outlook—Austria

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Italy

2018 Market Outlook—Italy

H1 2019 Market Outlook—Italy

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Portugal

2018 Market Outlook—Portugal

H1 2019 Market Outlook—Portugal

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Finland

2018 Market Outlook—Finland

H1 2019 Market Outlook—Finland

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Historic EV Sales—Denmark

2018 Market Outlook—Denmark

H1 2019 Market Outlook—Denmark

Market Outlook—Top 5

EV Sales by OEM

EV Sales by Model Per Quarter

Growth Opportunity—Social Collaboration

Strategic Imperatives for Global Electric Vehicles Sales

Conclusion

Legal Disclaimer

Abbreviations and Acronyms Used

EV Incentives—North America

EV Incentives—North America (continued)

EV Incentives—Europe

EV Incentives—Europe (continued)

EV Incentives—Europe (continued)

EV Incentives—Asia

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

Popular Topics

Key Issues Addressed

- What will be the impact of government subsidies and incentives on EV growth in various countries?

- What are the current sales trends in different countries and how are they changing with time?

- What is the market share for PHEVs and BEVs in each country and their growth trend from 2011?

- What are the top selling PHEV and BEV models in each country and their market share?

- What is the monthly sales trend in 2017 for each country?

| No Index | No |

|---|---|

| Podcast | No |

| Author | Arvind Noel Xavier Leo |

| Industries | Automotive |

| WIP Number | MDE9-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9673-A6,9800-A6,9807-A6,9813-A6,9882-A6,9AF6-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB