Frost Radar™: Global Automotive LiDAR, 2021

Frost Radar™: Global Automotive LiDAR, 2021

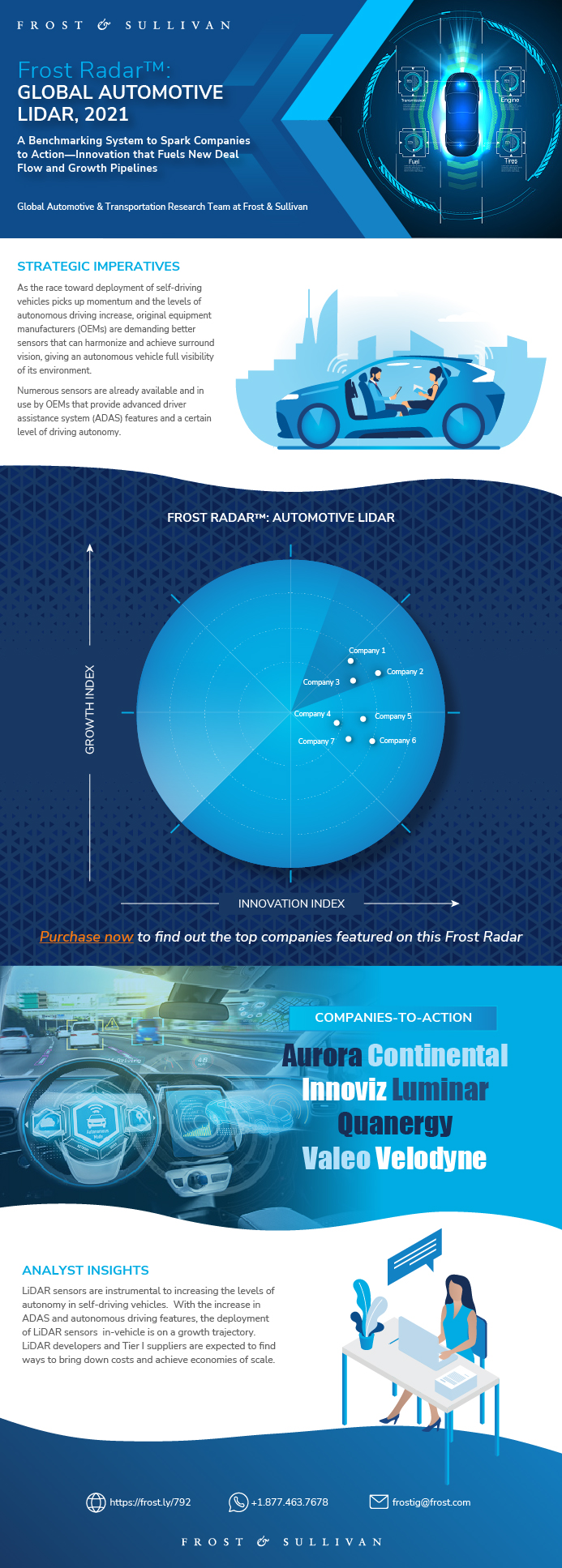

A Benchmarking System to Spark Companies to Action - Innovation that Fuels New Deal Flow and Growth Pipelines

21-Jan-2022

Global

Description

As the race toward deployment of self-driving vehicles picks up momentum and the levels of autonomous driving increase, original equipment manufacturers (OEMs) are demanding better sensors that can harmonize and achieve surround vision, giving an autonomous vehicle full visibility of its environment.

Numerous sensors are already available and in use by OEMs that provide advanced driver assistance system (ADAS) features and a certain level of driving autonomy.

Even though most OEMs are at present staying away from light detection and ranging (LiDAR) solutions for various reasons,

Frost & Sullivan concludes that they will shift to include LiDAR features in their sensor suites for autonomous driving level 3 (L3) and above.

LiDAR solutions are known for their ability to view and perceive surrounding objects in all weather and light conditions.

LiDAR systems cover various parameters, depending on the technology used:

· Key factors for success in the LiDAR segment include range, accuracy, resolution, data, and power consumption.

· New LiDAR developers are coming up with different solutions and changing the dynamics of the LiDAR value chain, leading to its

compression and collaborations between Tier I suppliers (Tier Is) and OEMs.

· New technologies such as optical phased array (OPA) and frequency modulated continuous wave (FMCW) are creating disruptions

by forcing OEMs and Tier Is to move away from traditional micro-electro-mechanical systems (MEMS) technology.

· As LiDAR technology progresses, economies of scale and lower cost sensors are possible. The initial company to do so will gain

first-mover advantage and likely penetrate the mass market with low-cost LiDAR solutions.

Frost & Sullivan independently plotted the top 7 companies in this Frost Radar™ analysis. The Radar™ reveals the market positioning of each company using its Growth and Innovation scores as highlighted in the Frost Radar™ methodology. The document presents competitive profiles on each company based on its strengths, opportunities, and market positioning. We discuss strategic market imperatives and the competitive environment that vendors operate in as well as make recommendations for each provider to spur growth.

Author: Thirumalai Narasimhan

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Strategic Imperative

Growth Environment

Frost Radar™: Automotive LiDAR

Frost Radar™: Competitive Environment

Aurora

Continental

Innoviz

Luminar

Quanergy

Valeo

Velodyne

Strategic Insights

Significance of Being on the Frost Radar™

Frost Radar™ Empowers the CEO’s Growth Team

Frost Radar™ Empowers Investors

Frost Radar™ Empowers Customers

Frost Radar™ Empowers the Board of Directors

Frost Radar™: Benchmarking Future Growth Potential

Frost Radar™: Benchmarking Future Growth Potential

Legal Disclaimer

Popular Topics

| Author | Thirumalai Narasimhan |

|---|---|

| GPS Codes | 9800-A6,9B13-A6 |

| Industries | Automotive |

| No Index | No |

| Is Prebook | No |

| Keyword 1 | Automotive Sensors Market |

| Keyword 2 | Automotive Adhesives Market |

| Keyword 3 | Global Automotive Industry Forecast 2025 |

| Podcast | No |

| WIP Number | PC9C-01-00-00-00 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB