Frost Radar™: US Light and Medium Duty Trucking Autonomous Technology Market, 2022

Frost Radar™: US Light and Medium Duty Trucking Autonomous Technology Market, 2022

A Benchmarking System to Spark Companies to Action - Innovation that Fuels New Deal Flow and Growth Pipelines

18-Jul-2022

North America

Frost Radar

$4,950.00

Special Price $4,207.50 save 15 %

Description

Autonomous trucks are the next logical step to overcome logistics bottlenecks and to keep pace with the rapidly changing freight carriage ecosystem. Unlike human drivers that must limit their operating hours to remain safe, autonomous systems can operate trucks consistently 24x7, effectively increasing commodity flow in the freight value system.

The pivot toward autonomous trucking is fostered largely by increasing consumer commodity consumption, technological advances, safety considerations, and continual effort to improve business efficiency; the pivot will progress as regulations emerge to establish legal and operational direction. Level 4 and above autonomous trucks will influence new business models such as Truck-as-a-Service and usage-based and on-demand services in the freight transportation industry.

Global logistics and retail giants have strategized to improve their freight-handling efficiency, decrease delivery time, and reduce their overall carbon footprint. With trends such as same-day delivery; free-of-cost delivery; and automated store management, distribution, and dispatch, companies are piloting several disruptive technologies that are differentiated from traditional goods management methodologies.

Several leading OEMs have taken initiatives to develop and test their automotive autonomous technologies, while some have invested in emerging technology start-ups. Competition is rising exponentially, with start-ups and retrofit solution providers participating alongside traditional original equipment manufacturers (OEMs).

Retailing giants are exploring advanced technologies to increase efficiency within their supply chain. Collaboration with these emerging companies toward technological and deployment progress creates opportunities to tap into emerging businesses and to maintain a lead during the transition.

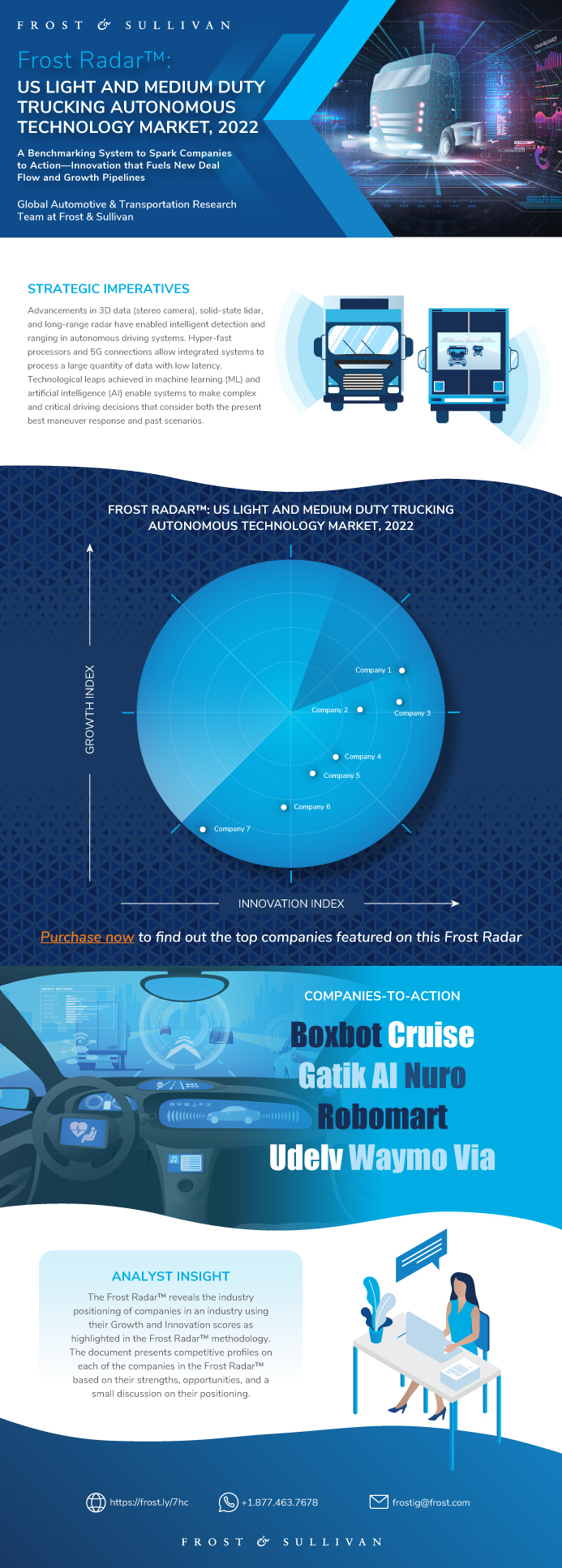

The Frost Radar™ reveals the market positioning of companies in an industry using their Growth and Innovation scores as highlighted in the Frost Radar™ methodology. The document presents competitive profiles on each of the companies in the Frost Radar™ based on their strengths, opportunities, and a small discussion on their positioning. Frost & Sullivan analyzes hundreds of companies in an industry and benchmarks them across 10 criteria on the Frost Radar™, where the leading companies in the industry are then positioned.

Author: Jagadesh Chandran

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

The Strategic Imperative

The Strategic Imperative (continued)

The Strategic Imperative (continued)

The Growth Environment

The Growth Environment (continued)

Frost Radar™: US Light and Medium Duty Trucking Autonomous Technology Market

Frost Radar™: Competitive Environment

Frost Radar™: Competitive Environment (continued)

Frost Radar™: Competitive Environment (continued)

Boxbot

Cruise

Gatik AI

Nuro

Robomart

Udelv

Waymo Via

Strategic Insights

Significance of Being on the Frost Radar™

Frost Radar™ Empowers the CEO’s Growth Team

Frost Radar™ Empowers Investors

Frost Radar™ Empowers Customers

Frost Radar™ Empowers the Board of Directors

Frost Radar™: Benchmarking Future Growth Potential

Frost Radar™: Benchmarking Future Growth Potential

Legal Disclaimer

Popular Topics

| Deliverable Type | Frost Radar |

|---|---|

| Author | Jagadesh Chandran |

| Industries | Automotive |

| No Index | No |

| Is Prebook | No |

| Podcast | No |

| WIP Number | PD45-01-00-00-00 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB