Fintech

The global experience with COVID-19 gave financial services companies a unique opportunity to refocus and rebuild the trust of their customers, ultimately leading to their loyalty. Banking is now embedded in the customers’ lifestyle; and as part of banks' continued digital transformation, they can serve their customers through multiple channels and technologies. The use of technology to automate processes removes internal obstacles and creates a seamless customer experience. Key to this automation is advances like AI, data analytics, and systems that can react quickly to the market.

The acceleration of work-from-home culture and convergence of technology with financial services (Fintech) aligns with Frost & Sullivan's own breadth and depth of expertise. Frost & Sullivan tracks the digital transformation of financial services companies and fintech disruptors. The Fintech industry is extensive. It is comprised of multiple subsectors; each of which have trends specific to them, and to each global region. Having a 360-degree view of emerging technologies, the global financial services industry, and regional expertise creates a unique perspective that is valuable to our research and advisory for clients.

The Fintech subsectors we cover include:

• Verticals: Digital Banking, Insurtech, Wealthtech

• Enablers: Cloud, Data and Analytics, Blockchain, Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT)

• Services: Lending Platforms, Regtech, Paytech

-

04 Mar 2024 | Asia Pacific | Market Research

Indonesian Financial Technology Growth Opportunities, Forecast to 2028

Digital Payment Trends are Fueling the Industry s Growth Potential

Indonesia is undergoing a paradigm shift toward a digital economy, actively integrating financial services and emerging technologies to drive growth. Increasing digitalization, a high internet penetration rate, and a conducive policy and regulatory environment that supports financial inclusion make financial technology (fintech) services a popular ...

¥385,964.92 -

20 Feb 2024 | Asia Pacific | Market Research

Growth Opportunities and Trends in the Asia-Pacific Digital Payment Market Forecast to 2027

Transformative Mega Trends Enabling Growth and Innovation

The growing use of digital payments in Asia-Pacific (APAC) paves the way for innovation and new use cases that address user pain points payment solutions, such as self-checkout, enhance customer experience while software point-of-sale (softPOS) accelerates the merchant onboarding process. The APAC market will become more aware of the benefits of ne...

¥779,806.67 -

22 Jan 2024 | North America | Market Research

Top 10 Growth Opportunities in Enterprise Wireless Services, 2024

Wireless WAN, Fixed Wireless Solutions, and Network Slicing Drive the Global Market

Mobile operators are moving rapidly toward fifth-generation (5G) network deployments. 5G represents a fundamental shift in communication network architectures that will likely accelerate revenue generation through innovative services facilitated via 5G-enabled smartphones, tablets, laptops, and internet of things devices. It delivers a potent combi...

¥385,964.92 -

27 Dec 2016 | Global | Market Research

Australian Fintech, Forecast for 2020

Mobile Apps, Robo-Advice, Customised Analysis Algorithms, and Blockchain will ensure a CAGR of 76.3%.

Australian FinTech revenue will grow at a CAGR of 76.3% and exceed A$4 billion by 2020, driven by reduced taxes on investments in startups, steady increase in mobile payments, and rise of Tech-savy digital natives. The Australian Fintech Sector generated A$247.2 million in 2015. Sharp growth in the Fintech market in 2016 and 2017, followed by stead...

¥472,610.10

Special Price ¥354,457.58 save 25 %

-

16 Nov 2016 | Global | Market Research

Digital Disruption in the Global Financial Services Sector

Innovations Around AI, ML, and Robo-advisory Will Drive Disruptions Over the Next 5 Years

Fintech (financial technology) is disrupting the financial services industry across the globe. As start-ups invade the industry with a slew of solutions that make it easy for consumers to access financial services, the incumbents are also increasing their use of technology and are focusing on innovation - both in-house and external - to improve cus...

¥472,610.10

Special Price ¥354,457.58 save 25 %

-

27 Oct 2016 | Asia Pacific | Market Research

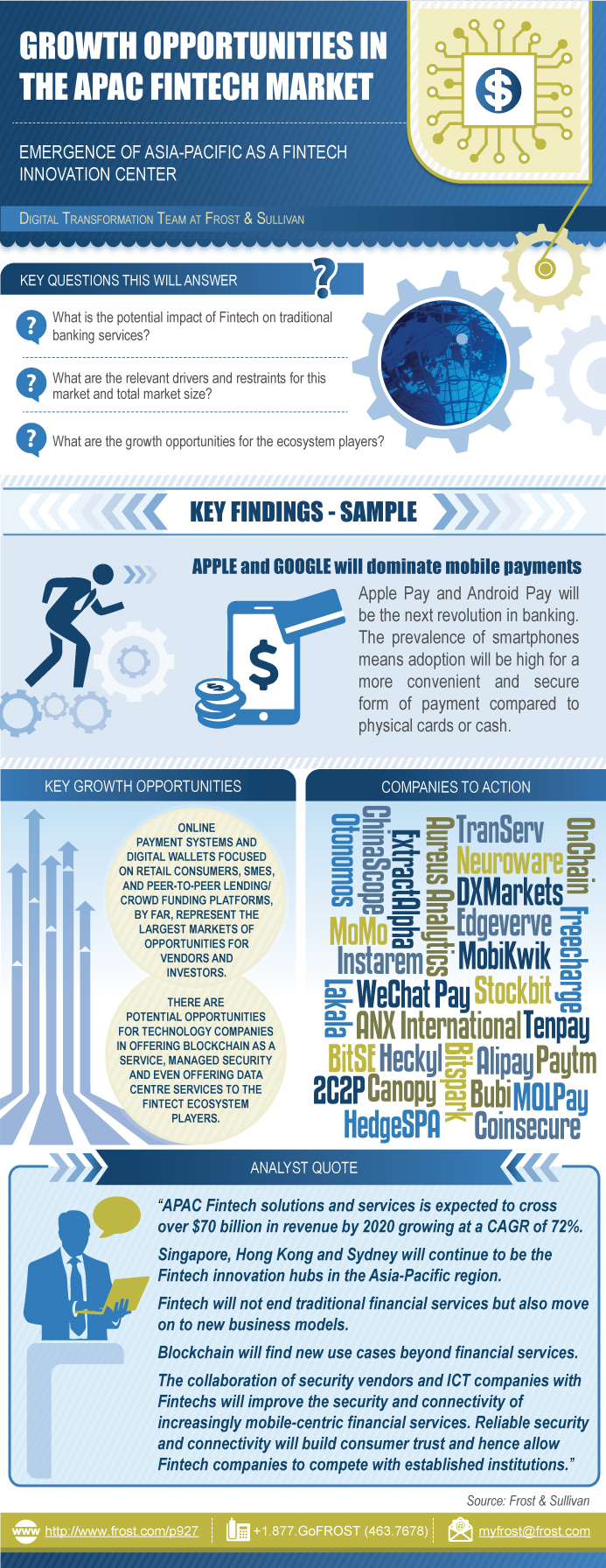

Growth Opportunities in the APAC Fintech Market

Emergence of Asia-Pacific as a Fintech Innovation Center

This research service explores the financial technology (fintech) market in Asia-Pacific and the potential impact on traditional banking services, with the advent of disruptive technologies such as Blockchain. For the purpose of this study, fintech is categorized into Digital Payments, Personal & Business Finance, and Financial Infrastructure & Dat...

¥779,806.67

Special Price ¥584,855.00 save 25 %

-

27 Sep 2016 | Asia Pacific | Market Research

Asia-Pacific Mobile Payments

Spearheading Cashless Societies

Countries within Asia-Pacific are trying to go cashless; mobile payment has been identified as an ideal solution to spearhead the transformation from cash-based to cashless solutions. Asia-Pacific is expected to continue to lead the world in mobile payment developments with smartphone penetration being the highest in the world. With standardization...

¥779,806.67

Special Price ¥584,855.00 save 25 %

-

21 Sep 2016 | North America | Customer Research

Navigating an Era of Digital Transformation in Finance, Insurance and Banking

A Customer Perspective

The state of the finance industry is always changing as the economy becomes increasingly global. Digital transformation is inevitable in this industry, creating opportunities for IT companies over the next few years. This study is derived from a survey of IT decision makers around the world across multiple industries. It provides insightful inform...

¥472,610.10

Special Price ¥354,457.58 save 25 %

-

11 Apr 2016 | Europe | Market Research

Convergence of Artificial Intelligence (AI) and the Finance Industry

Robo-trading, Robo-advisors, Consumer Smart Wallets, Insurance, and Fraud Analytics Set the Stage for Massive Disruption

It is difficult to understand what is happening in the field of artificial intelligence (AI). New developments seem to happen weekly, and vendors use different words to describe their products. Within financial services, some companies use the term Big Data analytics while others use machine learning technologies or artificial intelligent agents. T...

¥236,305.05

Special Price ¥177,228.79 save 25 %

JPY

JPY GBP

GBP CNY

CNY EUR

EUR INR

INR MYR

MYR ZAR

ZAR KRW

KRW THB

THB USD

USD