Unified Communications and Collaboration (UCC)

Businesses increasingly acknowledge the need to leverage advanced technologies to improve business agility and gain operational efficiencies. Long gone are the days when businesses relied solely on telephony and email to conduct their daily tasks. Today, businesses are deploying a broad array of communications and collaboration applications including telephony, email, voicemail and unified messaging, instant messaging (IM) and presence, audio, web and video conferencing, file sharing and white-boarding, mobility, social networking and more. New generations of business users are choosing more social and visual modes of collaboration accessible on the devices and interfaces of their choice, anywhere, anytime.

As businesses look to consolidate and more effectively manage their communications infrastructure, they are integrating multiple technologies and tools into unified communications and collaboration (UC&C) solutions powered by session management, virtualization, cloud architectures and software-defined networks. To ensure higher ROI and future-proof their technology investments, businesses are investing in best-of-breed, standards-based solutions that can be tightly integrated for greater end-user productivity and more efficient IT management.

The combination of dramatic demographic changes and accelerated technology evolution is creating demand for a new approach to IT and business communications. We are seeing a powerful shift in IT towards new cloud delivery models that enable more flexible and cost-effective technology management and consumption. Holistic digital transformation initiatives are driving business IT and communications towards a Social, Mobile, Collaborative Cloud future.

Organizations around the world—large and small—have never before faced a more complex environment in which to operate and compete successfully. Vendors, service providers, channel partners and end users alike need information, advice and guidance to help them chart their course through this turbulent transition to a competitive advantage powered by advanced communication and collaboration technologies. With analysts covering all aspects of the UC&C technology stack, including infrastructure, applications, services and end-user devices, Frost & Sullivan is uniquely positioned to provide comprehensive coverage with a global perspective for all value-chain participants.

Frost & Sullivan’s UC&C team provides the following benefits to vendors, service providers, channel partners, and end-user organizations:

Extensive back catalogue of research in the majority of UC&C market sectors, as follows:

- Services: UCaaS, CPaaS, Managed UC Services, Audio, Web, Video Conferencing Services, VoIP Access and SIP Trunking

- Applications: UC Applications, Mobile UC, Web Conferencing, Web/Virtual Events, Social Media, Desktop Video, Content Collaboration, Team Collaboration

- Endpoints: Desk Phones, Soft Phones, Mobile Clients, Audio and Video Conferencing Endpoints, Professional and Consumer Headsets, Microphones

- Platforms & Infrastructure: Enterprise Telephony, VM/UM, IM/Presence, Video Conferencing Infrastructure, Media Gateways, SBC, VDI

- Technology: API, VoIP, SIP, WebRTC, Virtualization, SDN, Video

Comprehensive global coverage with local expertise in all major world regions

Experienced and expert team of analysts with decades of experience in the communications and collaboration industry

Accurate market forecasts and market share analysis coupled with thought leadership perspective on major industry trends

-

01 Dec 2020 | North America

Robust Adoption of Cloud Video and UCaaS will Continue to Drive the Global Tabletop Audio Conferencing Endpoints Market

Customer Experience Driven by Rising Video and Multimedia Collaboration Creates Growth Opportunities for Tabletop Audio

This study captures the market dynamics in the tabletop audio conferencing endpoints market, including the changing trends in the tabletop audio, the impact of the COVID-19 pandemic on the adoption of different types of endpoints as well as the forecast of endpoint revenue and unit shipments until 2026. The trends, forecast, and market shares have ...

$4,950.00

Special Price $3,712.50 save 25 %

-

20 Oct 2020 | Global

Global Video Conferencing Endpoints and Infrastructure Market, Forecast to 2025

2020 Market Update

The sudden shift to remote work for millions of people has created an exponential demand for video meetings. In H1 2020, cloud video meeting providers reported massive growth in usage. Growth in video devices was primarily driven by webcams and all-in-one appliances for remote workers while meeting rooms remained in a holding pattern during the CO...

$1,500.00

Special Price $1,125.00 save 25 %

-

28 Jul 2020 | Latin America

Growth Opportunities in the Global Professional Headset Market, Forecast to 2026

Explosion of Cloud Meeting Services is Visibly Igniting Professional Headset Sales

The global professional headset market earned revenues of $1.41 billion in 2019, a 3.8 percent growth when compared to 2018. Almost all major professional headset vendors reported healthy growth rates in 2019 except for Poly which faced some internal restructuring difficulties that resulted in the company earning lower-than-expected revenues. Desp...

$4,950.00

Special Price $3,712.50 save 25 %

-

26 Jun 2020 | Latin America

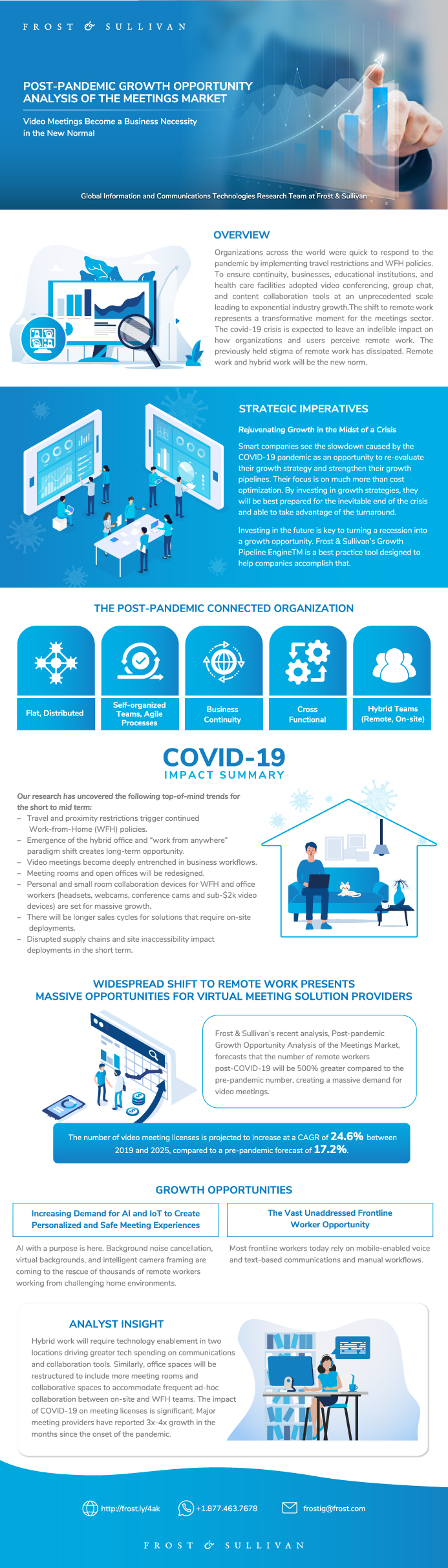

Post-pandemic Growth Opportunity Analysis of the Meetings Market

Video Meetings Become a Business Necessity in the New Normal

The socio-economic impact of the COVID-19 pandemic is difficult to fully predict with many factors in a flux. One thing is amply clear – it will be a disruptive catalyst across the UCC industry. In particular, it will forever change the way we meet and collaborate. Organizations across the world were quick to respond to the pandemic by implemen...

$4,950.00

Special Price $3,712.50 save 25 %

-

23 Jun 2020 | Latin America

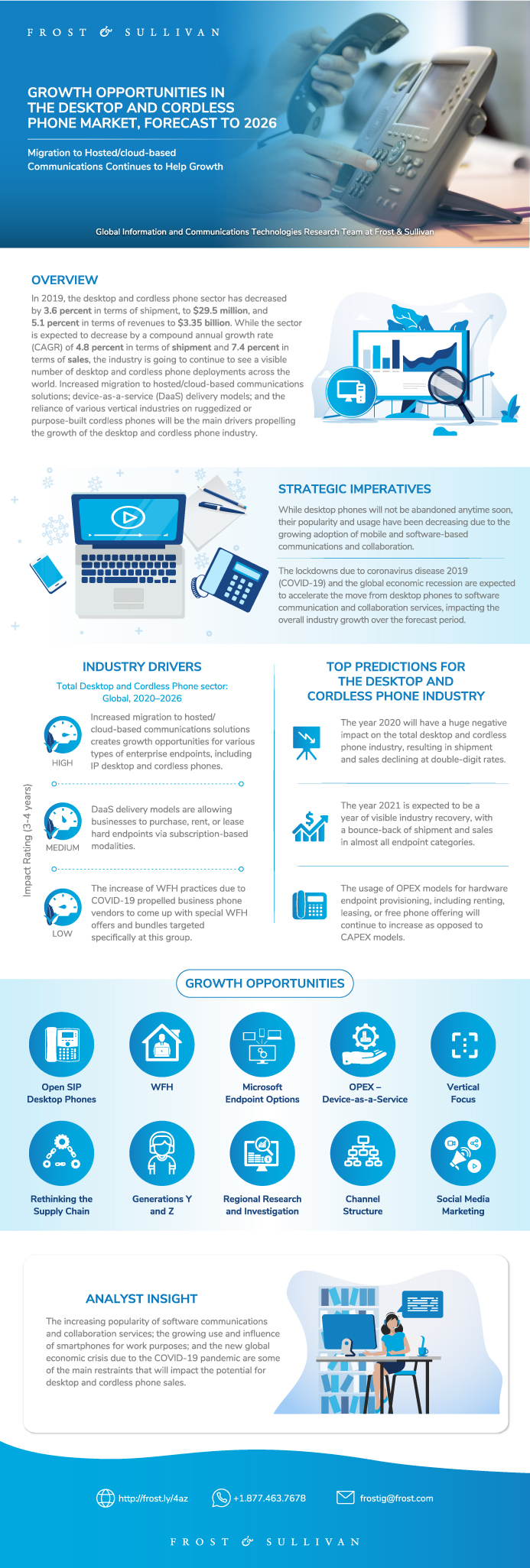

Growth Opportunities in the Desktop and Cordless Phone Market, Forecast to 2026

Migration to Hosted/cloud-based Communications Continues to Help Growth

In 2019, the desktop and cordless phone market has decreased by 3.6 percent in terms of shipment, to 29.5 million, and 5.1 percent in terms of revenues to $3.35 billion. While the market is expected to decrease by a compound annual growth rate (CAGR) of 4.8 percent in terms of shipment and 7.4 percent in terms of sales, the industry is going to sti...

$4,950.00

Special Price $3,712.50 save 25 %

-

13 Mar 2020 | Global

Global Video Conferencing Endpoints and Infrastructure Market, Forecast to 2024

Market Update

Software and cloud-centric solutions are driving the video conferencing industry to morph significantly. Companies that are innovating at a fast pace are growing while others are becoming less relevant. As video communications become an integral part of the digital transformation strategy, the user demand continues to expand. The impact of software...

$1,500.00

Special Price $1,125.00 save 25 %

-

26 Feb 2020 | North America

UCC Industry Trends to Watch, 2020

The Foundation is Set for Rapid Advancement

Frost & Sullivan’s 2020 UCC Industry Trends to Watch report delivers an over-arching perspective of technologies and business models, rather than specific applications or providers, that will be most influential in terms of development direction and evolving value propositions in the unified communications and collaboration (UCC) market. The in...

$3,000.00

Special Price $2,250.00 save 25 %

-

31 Jan 2020 | North America

Analysis of the Global Consumer Headphones Market

Opportunities and Threats in a Dynamic Music, Sports , and Mono Bluetooth Landscape

Consumer headphones have grown into a double-digit billion-dollar market over the last years, which generated revenue of almost USD 14.13 Billion in 2018. Apple-owned Beats Electronics, and Bose, have been leading the market. Harman has stood out for particular growth momentum over the last years. At the same time, the mono Bluetooth (BT) headset m...

$1,500.00

Special Price $1,125.00 save 25 %

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB