Regulatory and Infrastructure Reforms in India and China Catalyzing the Asian Specialty Generics Market

Regulatory and Infrastructure Reforms in India and China Catalyzing the Asian Specialty Generics Market

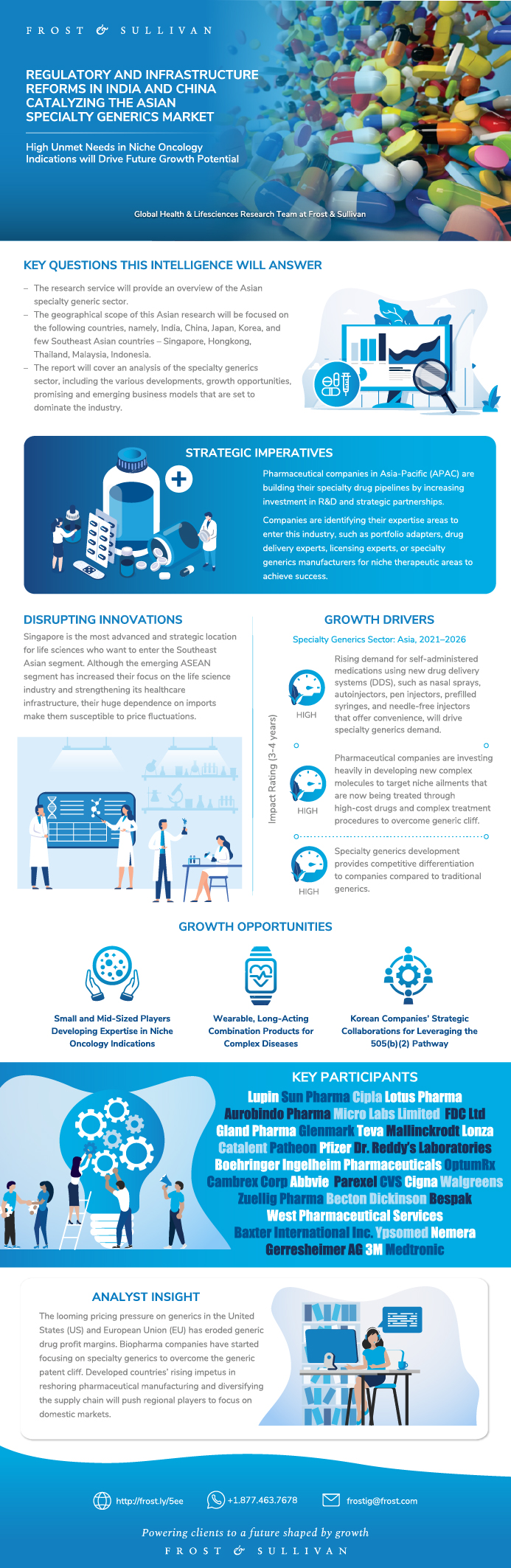

High Unmet Needs in Niche Oncology Indications will Drive Future Growth Potential

19-Feb-2021

North America

Market Research

Frost & Sullivan’s Transformational Health team provides critical insights into the Asian specialty generics market with this research service, highlighting growth opportunities, selected countries’ biopharmaceutical environment, and significant R&D, regulatory, and infrastructure reforms influencing its growth. The report examines similarities and contrasts between various Asian countries in specialty generics R&D, manufacturing, adoption, and access.

Specialty generics do not have a commonly accepted definition, often used interchangeably as complex generics. Specialty pharmaceuticals are often large, injectable, protein-based molecules produced through a biotechnology process. But they may also be small molecules produced through traditional pharmaceutical manufacturing methods.

Specialty generics offer lucrative market opportunities to Asian drug manufacturers to increase profit margins by developing innovative, value-added alternatives of existing drugs to offset traditional generics' shrinking margins in developed countries. The focus on improving the R&D landscape, especially for biologics, will attract global biopharmaceuticals to Asia due to the inherent advantage of a large patient pool and low-cost development and manufacturing.

This report reviews drivers propelling specialty generics adoption in these countries. For example, the rising prevalence of chronic diseases such as diabetes and cancer, where specialty drugs primarily drive treatment, will drive the demand for economic and easy-to-administer generic formulations to improve access. Self?administered medications using new drug delivery systems such as nasal sprays, autoinjectors, pen injectors, prefilled syringes, and needle-free injectors offer convenience that will drive the specialty generics demand. Specialty generics development provides competitive differentiation to companies compared to traditional generics. Compared to the 505(b)(1) pathway for new drug approval (NDA), the 505(b)(2) pathway in the US offers faster approval, lower risk, and market exclusivity from 3 to 7 years in some instances when coupled with the correct development and regulatory strategies.

Research Highlights

The report highlights biopharmaceutical industry dynamics in selected countries. China is the most attractive site due to its strong focus on developing R&D infrastructure and capabilities specifically for biologics. India is the most lucrative location for low-cost manufacturing. Generics participants in India are increasingly focusing on developing innovative products, although the country lags in macroeconomic indicators due to low healthcare spending. Singapore and Hong Kong have a conducive macroeconomic and biopharma environment, followed by Thailand. While the market is nascent, there are signs that strong growth and new regulatory and infrastructure reforms are ahead, and this report will outline and provide commentary regarding those signs.

Author: Surbhi Gupta

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top Three Strategic Imperatives on the Asian Specialty Generics Market

Growth Opportunities Fuel the Growth Pipeline Engine™

Executive Summary—Specialty Generics Market

Key Growth Opportunities—The Asian Specialty Generics Market

Specialty Generics Market Scope of Analysis

Specialty Generics Market Segmentation

New Drug Application Regulatory Pathways in the US—Specialty Generics Market

Potential Regional Biopharma Players for Strategic Partnerships—Specialty Generics Market

Potential Regional Biopharma Players for Strategic Partnerships—Specialty Generics Market (continued)

Growth Drivers for the Specialty Generics Market

Growth Restraints for the Specialty Generics Market

Specialty Drugs Share in Overall Drugs Spending—Specialty Generics Market

Selected Countries’ Market Attractiveness—Specialty Generics Market

Biopharmaceutical Market Landscape in Selected Asian Countries—Specialty Generics Market

Biopharmaceutical Market Landscape in Selected ASEAN Countries—Specialty Generics Market

Biopharmaceutical Industry Readiness (India and China)—Specialty Generics Market

Biopharmaceutical Industry Readiness (Singapore and Hong Kong)—Specialty Generics Market

Biopharmaceutical Industry Readiness (Emerging ASEAN Countries)—Specialty Generics Market

Growth Opportunity 1: Small and Mid-Sized Players Developing Expertise in Niche Oncology Indications

Growth Opportunity 1: Small and Mid-Sized Players Developing Expertise in Niche Oncology Indications (continued)

Case Study—Developing Drugs for Niche Oncology Indications and Orphan Diseases with High Unmet Needs

Growth Opportunity 2: Wearable, Long-Acting Combination Products for Complex Diseases

Growth Opportunity 2: Wearable, Long-Acting Combination Products for Complex Diseases (continued)

Case Study—Improving Patient Care and Reducing Healthcare Costs Through Innovative Drug-device Combinations

Growth Opportunity 3: Korean Companies’ Strategic Collaborations for Leveraging the 505(b)(2) Pathway

Growth Opportunity 3: Korean Companies’ Strategic Collaborations for Leveraging the 505(b)(2) Pathway (continued)

Case Study—Korean Companies Should Focus on Global Markets and Leverage Their Specialty Generics Capabilities

List of Exhibits

Legal Disclaimer

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

Research Highlights

The report highlights biopharmaceutical industry dynamics in selected countries. China is the most attractive site due to its strong focus on developing R&D infrastructure and capabilities specifically for biologics. India is the most lucrative location for low-cost manufacturing. Generics participants in India are increasingly focusing on developing innovative products, although the country lags in macroeconomic indicators due to low healthcare spending. Singapore and Hong Kong have a conducive macroeconomic and biopharma environment, followed by Thailand. While the market is nascent, there are signs that strong growth and new regulatory and infrastructure reforms are ahead, and this report will outline and provide commentary regarding those signs.

Author: Surbhi Gupta

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Author | Surbhi Gupta |

| Industries | Healthcare |

| WIP Number | PBA0-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9600-B1,99C1-B1,9568-B1,9611-B1 |