US Commercial Unmanned Aerial Systems (UAS) Growth Opportunities

US Commercial Unmanned Aerial Systems (UAS) Growth Opportunities

Strategic Partnering and New Product Development to Propel Growth

29-Oct-2021

North America

Description

This Frost & Sullivan research service focuses on the US commercial unmanned aerial system (UAS) market. The base year for spending information is 2020, and example market participants and market size estimates for 2021 are provided. This study discusses market participants, customers, and government agencies that influence the industry.

The various UAS platform types are outlined by their design and use segment. Also included are insights on the software and services essential to the US UAS market. In addition, market applications, growth opportunities, industry participants, technology trends, and market drivers and restraints are discussed.

The COVID-19 pandemic response has highlighted many applications for commercial UAS. These use cases have helped the general public and the media to become more aware of the many benefits that leveraging UAS technology can bring to the commercial market. In particular, business-to-business applications and UAS delivery advantages have become well known.

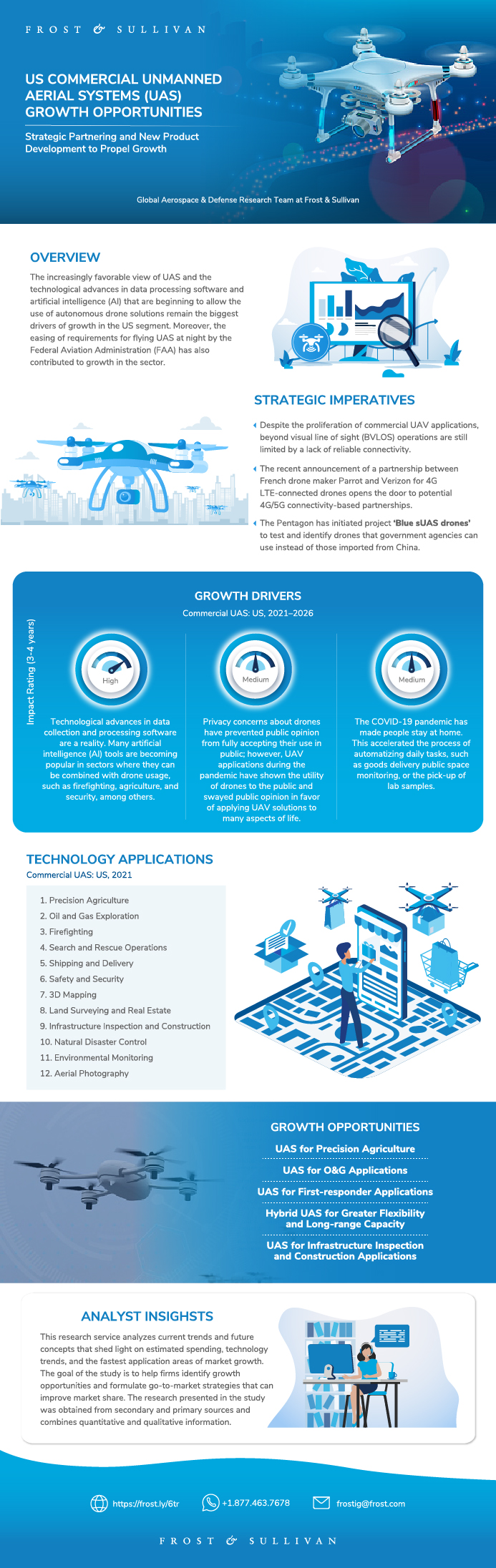

The increasingly favorable view of UAS and the technological advances in data processing software and artificial intelligence (AI) that are beginning to allow the use of autonomous drone solutions remain the biggest drivers for growth in the US market. Moreover, the easing of requirements for flying UAS at night by the Federal Aviation Administration (FAA) has also contributed to growth in the sector.

This research service analyzes current trends and future concepts that shed light on estimated spending, technology trends, and the fastest application areas of market growth. The goal of the study is to help firms identify growth opportunities and formulate go-to-market strategies that can improve market share. The research presented in the study was obtained from secondary and primary sources and combines quantitative and qualitative information.

Information has been garnered from existing reports and project material within the Frost & Sullivan database, including data from technical papers, specialized magazines, seminars, and internet research. Senior consultants/industry analysts have conducted telephone interviews with original equipment suppliers, services providers, distributors, customers, and government authorities. Primary research accounts for approximately 25% of the total research.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top Three Strategic Imperatives on the Commercial UAS Industry

Growth Opportunities Fuel the Growth Pipeline Engine™

Purpose/Overview/Trends/Challenges

Types of Commercial UAS by End-user Segment

Types of Commercial UAS by Flight Design

Technology Applications

Growth Drivers

Growth Restraints

Representative Industry Participants

Growth Opportunity 1: UAS for Precision Agriculture

Growth Opportunity 1: UAS for Precision Agriculture (continued)

Growth Opportunity 2: UAS for O&G Applications

Growth Opportunity 2: UAS for O&G Applications (continued)

Growth Opportunity 3: UAS for First-responder Applications

Growth Opportunity 3: UAS for First-responder Applications (continued)

Growth Opportunity 4: Hybrid UAS for Greater Flexibility and Long-range Capacity

Growth Opportunity 4: Hybrid UAS for Greater Flexibility and Long-range Capacity (continued)

Growth Opportunity 5: UAS for Infrastructure Inspection and Construction Applications

Growth Opportunity 5: UAS for Infrastructure Inspection and Construction Applications (continued)

Key Takeaways

List of Exhibits

Legal Disclaimer

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Juan Perl |

| Industries | Aerospace, Defence and Security |

| WIP Number | K6BF-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9000-A1 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB