US DoD Helicopter Market

US DoD Helicopter Market

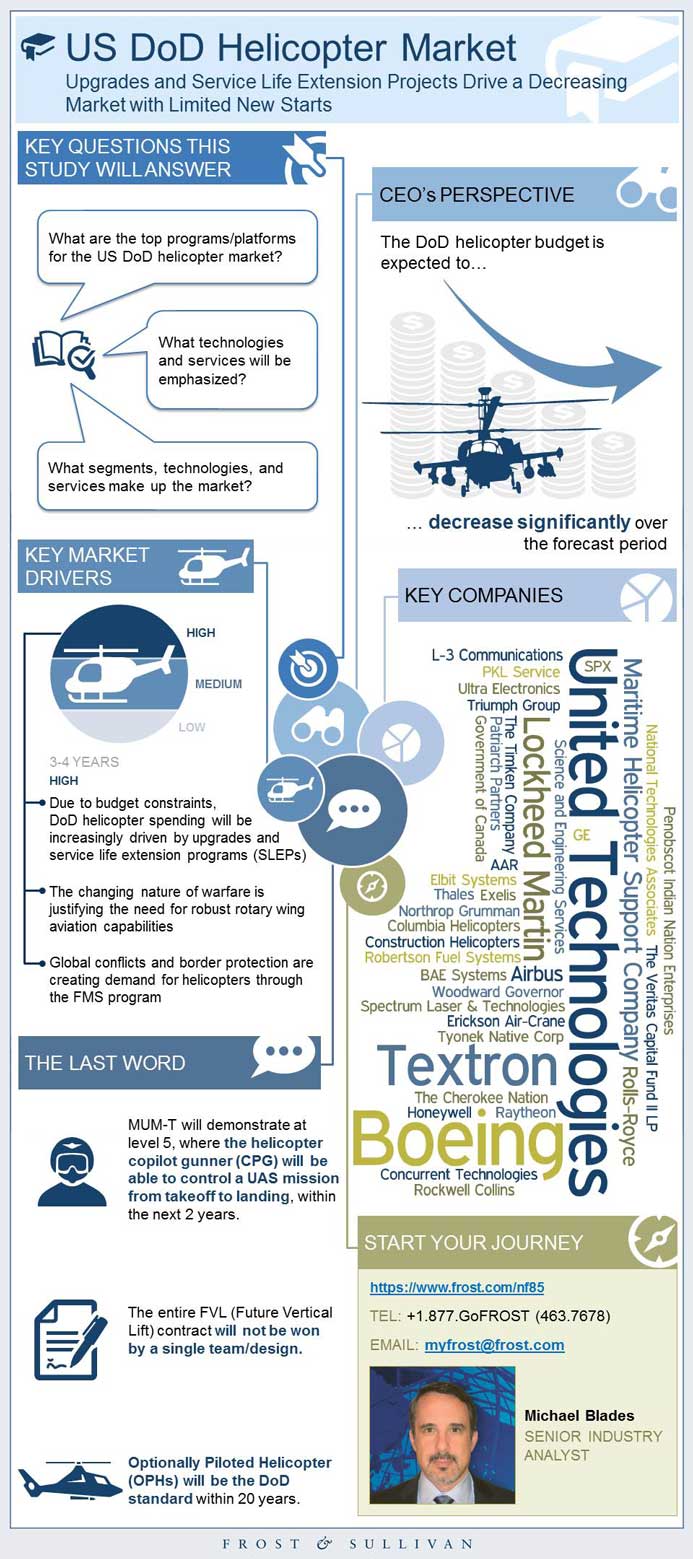

Upgrades and Service Life Extension Projects Drive a Decreasing Market with Limited New Starts

19-Aug-2015

North America

Market Research

Description

Research Overview

This Frost & Sullivan research service on the United States (US) Department of Defense (DoD) helicopter market provides detailed revenue forecasts, drivers and restraints as well as market shares and competitive analyses of participants from 2014 to 2020. In this research, Frost & Sullivan's expert analysts thoroughly examine the following market segments:

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Market Engineering Measurements

Market Engineering Measurements- A Realistic View

- CEO’s Perspective

Market Definitions

Market Overview- Definitions

Market Segmentation

- Scope

Market Drivers

Market Restrains

Market Engineering Measurements

DoD Budget Forecast- Program Funding

DoD Budget Forecast- A realistic View

Competitive Analysis- Market Share by Prime Contractor

Market Share Evolution

Prime Contractor Market Share Analysis

Competitive Analysis- Market Share by Company

Company Market Share Analysis

Competitive Environment

Top Competitors

Competitive Factors and Assessment

Competitive Factors Assessment-FMS

Total DoD Helicopter Market: Contracts

DoD Helicopter Industry: CEO’s 360 Degree Perspective, US, 2015

Assault/Transport Helicopters

Attack/Recon Helicopters(Funding/ Contracts)

Executive Transport Helicopters(Funding/Contracts)

Heavy Lift Helicopters(Funding/Contracts)

Maritime Helicopters(Funding/Contracts)

Search and Rescue Helicopters(Funding/Contracts)

Special Operations Helicopters(Funding/Contracts)

Miscellaneous Parts/Services(Funding/Contracts)

3 big predictions

Legal disclaimer

List of exhibits

Other prime contractors/companies

Other platforms

Other companies(Attack/Recon segment)

Other companies(Miscellaneous Parts/Services Segment)

Market engineering methodology

- 1. Total DoD Helicopter Market: Market Engineering Measurements from the 2016 PB, US, 2015 Page numbers to be removed.

- 2. Total DoD Helicopter Market: Funding Forecast by Department, US, 2014–2020(PAGE-34)

- 3. Total DoD Helicopter Market: Funding Forecast by Category, US, 2014–2020(PAGE-34)

- 4. Total DoD Helicopter Market: Funding Forecast by Segment, US, 2014–2020(PAGE-36)

- 5. Total DoD Helicopter Market: Funding Forecast by Platform, US, 2014–2020(PAGE-38-40)

- 6. Total DoD Helicopter Market: Prime Contractor Market Share Analysis of Top 5 Participants,

- 7. US, 2014(PAGE-45)

- 8. Total DoD Helicopter Market: Company Market Share Analysis of Top 5 Participants,

- 9. US, 2014(PAGE-47)

- 10. Assault/Transport Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-61)

- 11. Assault/Transport Helicopters Segment: Funding Forecast by Department, US, 2014–2020(PAGE-62)

- 12. Assault/Transport Helicopters Segment: Contracts by Platform, US, 2014(PAGE-63)

- 13. Assault/Transport Helicopters Segment: Contracts by Prime Contractor/Company, US, 2014(PAGE-63)

- 14. Attack/Recon Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-66)

- 15. Attack/Recon Helicopters Segment: Funding Forecast by Department, US, 2014–2020(PAGE-77)

- 16. Attack/Recon Helicopters Segment: Contracts by Platform, US, 2014(PAGE-68)

- 17. Attack/Recon Helicopters Segment: Contracts by Company, US, 2014(PAGE-68)

- 18. Executive Transport Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-71)

- 19. Executive Transport Helicopters Segment: Funding Forecast by Department, US, 2012–2018(PAGE-71)

- 20. Executive Transport Helicopters Segment: Contracts by Platform, US, 2014(PAGE-72)

- 21. Executive Transport Helicopters Segment: Contracts by Company, US, 2014(PAGE-72)

- 22. Heavy Lift Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-75)

- 23. Heavy Lift Helicopters Segment: Funding Forecast by Department, US, 2014–2020(PAGE-75)

- 24. Heavy Lift Helicopters Segment: Contracts by Platform, US, 2014(PAGE-76)

- 25. Heavy Lift Helicopters Segment: Contracts by Company, US, 2014(PAGE-76)

- 26. Maritime Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-79)

- 27. Maritime Helicopters Segment: Funding Forecast by Department, US, 2014–2020(PAGE-80)

- 28. Maritime Helicopters Segment: Contracts by Platform, US, 2014(PAGE-81)

- 29. Maritime Helicopters Segment: Contracts by Company, US, 2014(PAGE-81)

- 30. Search and Rescue Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-84)

- 31. Search and Rescue Helicopters Segment: Funding Forecast by Department, US, 2014–2020(PAGE-84)

- 32. Search and Rescue Helicopters Segment: Contracts by Platform, US, 2014(PAGE-85)

- 33. Search and Rescue Helicopters Segment: Contracts by Company, US, 2014(PAGE-85)

- 34. Special Operations Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-88)

- 35. Special Operations Helicopters Segment: Funding Forecast by Department, US, 2014–2020(PAGE-88)

- 36. Special Operations Helicopters Segment: Contracts by Platform, US, 2014(PAGE-89)

- 37. Special Operations Helicopters Segment: Contracts by Company, US, 2014(PAGE-89)

- 38. Miscellaneous Parts/Services Segment: Funding Forecast by Program, US, 2014–2020(PAGE-92)

- 39. Miscellaneous Parts/Services Segment: Funding Forecast by Department, US, 2014–2020(PAGE-93)

- 40. Miscellaneous Parts/Services Segment: Contracts by Type, US, 2014(PAGE-94)

- 41. Miscellaneous Parts/Services Segment: Contracts by Company, US, 2014(PAGE-94)

- 1. Total DoD Helicopter Market: Market Engineering Measurements from the 2016 PB, US, 2015(PAGE-7)

- 2. Total DoD Helicopter Market: Market Engineering Measurements from the 2016 PB with Additional Procurement Estimates, US, 2015(PAGE-9)

- 3. Total DoD Helicopter Market: Percent of Budget Breakdown, US, 2015(PAGE-17)

- 4. Total DoD Helicopter Market: Funding Forecast, US, 2014–2020(PAGE-32)

- 5. Total DoD Helicopter Market: Funding Forecast–Procurement and RDT&E, US, 2014–2020(PAGE-33)

- 6. Total DoD Helicopter Market: Funding Forecast by Department and Category, US, 2014–2020(PAGE-35)

- 7. Total DoD Helicopter Market: Funding Forecast by Segment, US, 2014–2020(PAGE-37)

- 8. Total DoD Helicopter Market: Realistic Funding Forecast, US, 2014–2020(PAGE-41)

- 9. Total DoD Helicopter Market: Percent of Contracts by Prime Contractor, US, 2014(PAGE-43)

- 10. Total DoD Helicopter Market: Absolute Market Share Trend, US, 2012 and 2014(PAGE-44)

- 11. Total DoD Helicopter Market: Percent Market Share Trend, US, 2012 and 2014(PAGE-44)

- 12. Total DoD Helicopter Market: Percent of Contracts by Company, US, 2014(PAGE-46)

- 13. Total DoD Helicopter Market: Contracts by Department, US, 2014(PAGE-53)

- 14. Total DoD Helicopter Market: Percent of Contract Spending by Platform, US, 2014(PAGE-54)

- 15. Total DoD Helicopter Market: Percent of Contract Spending by Segment, US, 2014(PAGE-55)

- 16. Total DoD Helicopter Market: Contract Spending by Month, US, 2014(PAGE-56)

Popular Topics

Research Overview

This Frost & Sullivan research service on the United States (US) Department of Defense (DoD) helicopter market provides detailed revenue forecasts, drivers and restraints as well as market shares and competitive analyses of participants from 2014 to 2020. In this research, Frost & Sullivan's expert analysts thoroughly examine the following market segments:

- assault/transport helicopters

- attack/recon helicopters

- executive transport helicopters

- heavy lift helicopters

- maritime helicopters

- search and rescue helicopters

- special operations helicopters

- miscellaneous parts/services

Market Overview

Upgrades and service life extension to drive revenues in the US DoD helicopter market

Helicopter procurement by the DoD will decrease significantly over the next five years due to military budget constraints. Instead, focus will increase on the service life of new and existing rotary-winged weapons systems. The cancellation of the Army Aerial Scout (AAS) program and the delay of Future Vertical Lift (FVL) procurement are further compelling the army to invest in servicing and modernization to keep its aging helicopters operational. Military helicopter training-as-a-service will also gain traction, as it is more cost effective than the purchase and maintenance of a new fleet. As such, upgrades, service life extension programs (SLEPs), and maintenance repair and overhaul (MRO) contracts will drive the market as procurement of expensive helicopter weapon systems will steadily decrease.

Global conflicts create demand for helicopters

Due to reduced funding, the US market will focus on helicopter exports through the Foreign Military Sales (FMS) program, which facilitates sales of U.S defense equipment to foreign governments. Global conflicts and border protection are creating demand for helicopters in many global hot spots. While the European market may be difficult to sell into due to its shrinking defense budgets, regions such as the Middle East and Asia-Pacific hold promise. Saudi Arabia, South Korea, Indonesia and Qatar are purchasing more helicopters to equip special operations forces. This is contributing significantly to US DoD helicopter revenues.

Currently, Boeing is the top company in the DoD military helicopter market. The only all-new platform program on the horizon is the FVL, which aspires to replace OH-58, AH-64, UH-60 and CH-47. FVL also aspires to provide a new ultra-size vertical lift platform that can accomplish the missions of current C-130 aircraft. The company that wins this FVL contract will easily be the industry leader, but the program is not likely to receive considerable funding until 2020.

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Market Engineering Measurements~ || Market Engineering Measurements- A Realistic View~ ||| CEO’s Perspective~ | Market Overview~ || Market Definitions~ ||| Scope~ || Market Overview- Definitions~ ||| Total DoD Helicopter Market: Helicopter Market Segments, US, 2015~ |||| Assault/Transport~ |||| Attack/Reconnaissance(Recon)~ |||| Executive Transport~ |||| Heavy Life~ |||| Others ~ || Market Segmentation~ |||| Assault/transport~ |||| Attack/recon~ |||| Heavy lift~ |||| Maritime ~ |||| Others~ | Drivers and Restraints—Total DoD Helicopter Market~ || Market Drivers~ |||| Due to budget constraints, of DoD helicopter market spending will be increasingly driven~ |||| The changing nature of warfare~ |||| Global conflicts and border protection~ |||| Others~ || Market Restrains~ |||| The Army’s ARI~ |||| UASs are assuming more helicopter missions~ |||| Increased internal research and development (IRAD) oversight by the DoD~ |||| Others~ | Forecast and Trends—Total DoD Helicopter Market~ || Market Engineering Measurements ~ || DoD Budget Forecast- Program Funding~ || DoD Budget Forecast- A realistic View~ | Market Share and Competitive Analysis— Total DoD Helicopter Market~ || Competitive Analysis- Market Share by Prime Contractor~ |||| United technologies~ |||| Boeing ~ |||| Bell-Boeing JPO~ |||| Textron~ |||| Others~ || Market Share Evolution~ || Prime Contractor Market Share Analysis~ || Competitive Analysis- Market Share by Company~ || Company Market Share Analysis~ || Competitive Environment~ ||| Total DoD Helicopter Market: Competitive Structure, US, 2015~ || Top Competitors~ ||| Total DoD Helicopter Market: SWOT Analysis, US, 2015~ |||| Boeing~ |||| United Technologies~ |||| Textron~ |||| Lockheed Martin~ || Competitive Factors and Assessment~ || Competitive Factors Assessment-FMS~ || Total DoD Helicopter Market: Contracts~ |||| Army~ |||| Navy~ |||| Joint~ |||| Air Force~ | CEO’s 360 Degree Perspective on the DoD Helicopter Industry~ || DoD Helicopter Industry: CEO’s 360 Degree Perspective, US, 2015~ ||| Competitive~ ||| Customer~ ||| Technology~ ||| Economy~ | Assault/Transport Helicopters Segment Breakdown~ || Assault/Transport Helicopters~ ||| Funding~ ||| Contracts~ | Attack/Recon Helicopters Segment Breakdown~ || Attack/Recon Helicopters(Funding/ Contracts)~ | Executive Transport Helicopters Segment Breakdown~ || Executive Transport Helicopters(Funding/Contracts)~ | Heavy Lift Helicopters Segment Breakdown~ || Heavy Lift Helicopters(Funding/Contracts)~ | Maritime Helicopters Segment Breakdown~ || Maritime Helicopters(Funding/Contracts)~ | Search and Rescue Helicopters Segment Breakdown~ || Search and Rescue Helicopters(Funding/Contracts)~ | Special Operations Helicopters Segment Breakdown~ || Special Operations Helicopters(Funding/Contracts)~ | Miscellaneous Parts/Services Segment Breakdown~ || Miscellaneous Parts/Services(Funding/Contracts)~ | The Last Word~ || 3 big predictions~ || Legal disclaimer~ | Appendix~ || List of exhibits~ || Other prime contractors/companies~ || Other platforms~ || Other companies(Attack/Recon segment)~ || Other companies(Miscellaneous Parts/Services Segment)~ || Market engineering methodology~ |

| List of Charts and Figures | 1. Total DoD Helicopter Market: Market Engineering Measurements from the 2016 PB, US, 2015 Page numbers to be removed.~ 2. Total DoD Helicopter Market: Funding Forecast by Department, US, 2014–2020(PAGE-34)~ 3. Total DoD Helicopter Market: Funding Forecast by Category, US, 2014–2020(PAGE-34)~ 4. Total DoD Helicopter Market: Funding Forecast by Segment, US, 2014–2020(PAGE-36)~ 5. Total DoD Helicopter Market: Funding Forecast by Platform, US, 2014–2020(PAGE-38-40)~ 6. Total DoD Helicopter Market: Prime Contractor Market Share Analysis of Top 5 Participants,~ 7. US, 2014(PAGE-45)~ 8. Total DoD Helicopter Market: Company Market Share Analysis of Top 5 Participants,~ 9. US, 2014(PAGE-47)~ 10. Assault/Transport Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-61)~ 11. Assault/Transport Helicopters Segment: Funding Forecast by Department, US, 2014–2020(PAGE-62)~ 12. Assault/Transport Helicopters Segment: Contracts by Platform, US, 2014(PAGE-63)~ 13. Assault/Transport Helicopters Segment: Contracts by Prime Contractor/Company, US, 2014(PAGE-63)~ 14. Attack/Recon Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-66)~ 15. Attack/Recon Helicopters Segment: Funding Forecast by Department, US, 2014–2020(PAGE-77)~ 16. Attack/Recon Helicopters Segment: Contracts by Platform, US, 2014(PAGE-68)~ 17. Attack/Recon Helicopters Segment: Contracts by Company, US, 2014(PAGE-68)~ 18. Executive Transport Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-71)~ 19. Executive Transport Helicopters Segment: Funding Forecast by Department, US, 2012–2018(PAGE-71)~ 20. Executive Transport Helicopters Segment: Contracts by Platform, US, 2014(PAGE-72)~ 21. Executive Transport Helicopters Segment: Contracts by Company, US, 2014(PAGE-72)~ 22. Heavy Lift Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-75)~ 23. Heavy Lift Helicopters Segment: Funding Forecast by Department, US, 2014–2020(PAGE-75)~ 24. Heavy Lift Helicopters Segment: Contracts by Platform, US, 2014(PAGE-76)~ 25. Heavy Lift Helicopters Segment: Contracts by Company, US, 2014(PAGE-76)~ 26. Maritime Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-79)~ 27. Maritime Helicopters Segment: Funding Forecast by Department, US, 2014–2020(PAGE-80)~ 28. Maritime Helicopters Segment: Contracts by Platform, US, 2014(PAGE-81)~ 29. Maritime Helicopters Segment: Contracts by Company, US, 2014(PAGE-81)~ 30. Search and Rescue Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-84)~ 31. Search and Rescue Helicopters Segment: Funding Forecast by Department, US, 2014–2020(PAGE-84)~ 32. Search and Rescue Helicopters Segment: Contracts by Platform, US, 2014(PAGE-85)~ 33. Search and Rescue Helicopters Segment: Contracts by Company, US, 2014(PAGE-85)~ 34. Special Operations Helicopters Segment: Funding Forecast by Platform, US, 2014–2020(PAGE-88)~ 35. Special Operations Helicopters Segment: Funding Forecast by Department, US, 2014–2020(PAGE-88)~ 36. Special Operations Helicopters Segment: Contracts by Platform, US, 2014(PAGE-89)~ 37. Special Operations Helicopters Segment: Contracts by Company, US, 2014(PAGE-89)~ 38. Miscellaneous Parts/Services Segment: Funding Forecast by Program, US, 2014–2020(PAGE-92)~ 39. Miscellaneous Parts/Services Segment: Funding Forecast by Department, US, 2014–2020(PAGE-93)~ 40. Miscellaneous Parts/Services Segment: Contracts by Type, US, 2014(PAGE-94)~ 41. Miscellaneous Parts/Services Segment: Contracts by Company, US, 2014(PAGE-94)~| 1. Total DoD Helicopter Market: Market Engineering Measurements from the 2016 PB, US, 2015(PAGE-7)~ 2. Total DoD Helicopter Market: Market Engineering Measurements from the 2016 PB with Additional Procurement Estimates, US, 2015(PAGE-9)~ 3. Total DoD Helicopter Market: Percent of Budget Breakdown, US, 2015(PAGE-17)~ 4. Total DoD Helicopter Market: Funding Forecast, US, 2014–2020(PAGE-32)~ 5. Total DoD Helicopter Market: Funding Forecast–Procurement and RDT&E, US, 2014–2020(PAGE-33)~ 6. Total DoD Helicopter Market: Funding Forecast by Department and Category, US, 2014–2020(PAGE-35)~ 7. Total DoD Helicopter Market: Funding Forecast by Segment, US, 2014–2020(PAGE-37)~ 8. Total DoD Helicopter Market: Realistic Funding Forecast, US, 2014–2020(PAGE-41)~ 9. Total DoD Helicopter Market: Percent of Contracts by Prime Contractor, US, 2014(PAGE-43)~ 10. Total DoD Helicopter Market: Absolute Market Share Trend, US, 2012 and 2014(PAGE-44)~ 11. Total DoD Helicopter Market: Percent Market Share Trend, US, 2012 and 2014(PAGE-44)~ 12. Total DoD Helicopter Market: Percent of Contracts by Company, US, 2014(PAGE-46)~ 13. Total DoD Helicopter Market: Contracts by Department, US, 2014(PAGE-53)~ 14. Total DoD Helicopter Market: Percent of Contract Spending by Platform, US, 2014(PAGE-54)~ 15. Total DoD Helicopter Market: Percent of Contract Spending by Segment, US, 2014(PAGE-55)~ 16. Total DoD Helicopter Market: Contract Spending by Month, US, 2014(PAGE-56)~ |

| Industries | Aerospace, Defence and Security |

| WIP Number | NF85-01-00-00-00 |

| Keyword 1 | US DoD Helicopter |

| Keyword 2 | US Helicopter |

| Keyword 3 | Civil Helicopter |

| Is Prebook | No |