Analysis of the US and European Diabetes Diagnostics Market

Analysis of the US and European Diabetes Diagnostics Market

Constricting Reimbursement Policies Restrain Market Growth

01-Jul-2015

North America

Description

The diabetes diagnostics markets in the United States and Europe have been in a mature stage for many years. Growth is sustained due to the high prevalence of diabetes in both regions. The segments covered in the study are self-monitoring of blood glucose (SMBG), point-of-care testing (POCT), and lab-based HbA1c testing. The emerging market of non-invasive technologies is disrupting this market space as it reduces patient pain points while providing accurate and sensitive results. Due to more hospital-centric care in the EU region, the POCT segment here experiences stronger growth than in the United States. POCT has the potential to grow the fastest due to its efficient, cost-effective solution and increasing adoption by physicians.

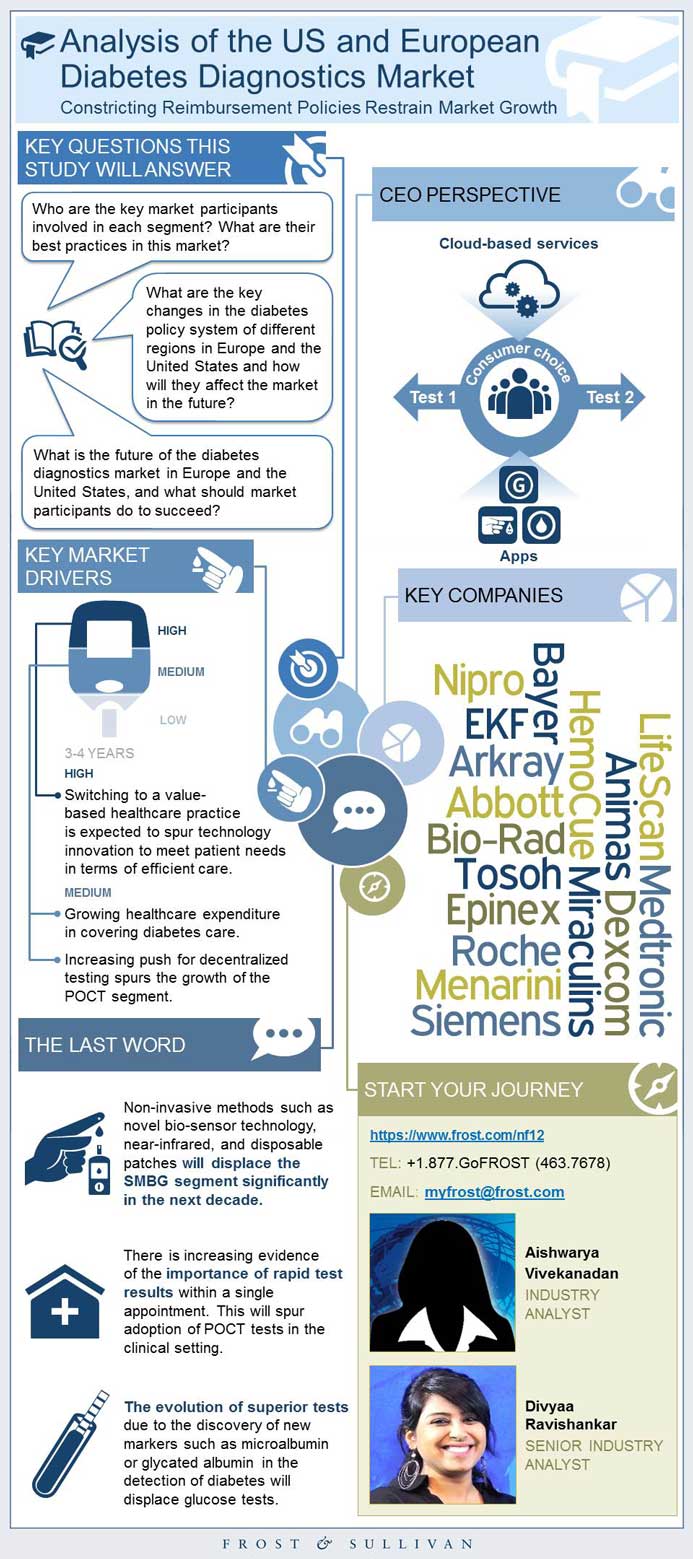

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Scope and Segmentation

Market Engineering Measurements

CEO’s Perspective

Key Companies to Watch

- HemoCue (US and Europe)

- NovioSense (US)

- Miraculins (US)

3 Big Predictions

Introduction to Diabetes

Market Overview

Market Segmentation

Segment Life Cycle Analysis

Competitive Segment Analysis

Defining Healthcare Trends in the Future

Diabetes Diagnostics Market—Competitive Landscape

New Market Opportunities

Competitive Analysis

Market Engineering Measurements

Revenue Forecast

Segment Overview

Revenue Forecast by Segment

Market Drivers

Market Restraints

Market Engineering Measurements

US Revenue Forecast

Segment Overview

Revenue Forecast by Segment

Market Engineering Measurements

Revenue Forecast

Revenue Forecast by Segment

Market Share Analysis

Market Engineering Measurements

Revenue Forecast

Revenue Forecast by Segment

Market Share Analysis

Market Engineering Measurements

Revenue Forecast

Market Share Analysis

Lab-based Testing Trends

Comparison of Lab-based Tests

Market Engineering Measurements

Revenue Forecast

Revenue Forecast by Region

Segment Overview

Market Engineering Measurements

Revenue Forecast

Revenue Forecast by Segment

Market Share Analysis

Market Engineering Measurements

Revenue Forecast

Market Share Analysis

Lab-based Testing Trends

Comparison of Lab-based Tests

Regional Overview

Revenue Forecast—The United Kingdom

UK Regulations and Reimbursements

Revenue Forecast by Segment—The United Kingdom

Market Impact of Top 10 Trends

Revenue Forecast—Germany

Germany Reimbursements and Regulations

Revenue Forecast by Segment—Germany

Revenue Forecast—France

France Reimbursements and Regulations

Revenue Forecast by Segment—France

Revenue Forecast—Italy

Italy Reimbursements and Regulations

Revenue Forecast by Segment—Italy

Revenue Forecast—Spain

Spain Reimbursements and Regulations

Revenue Forecast by Segment—Spain

Revenue Forecast—Benelux (Belgium, the Netherlands, Luxembourg)

Benelux Reimbursements and Regulations

Revenue Forecast by Segment—Benelux

Revenue Forecast—Scandinavia

Scandinavia Reimbursements and Regulations

Revenue Forecast by Segment—Scandinavia

HemoCue

NovioSense

Miraculins

3 Big Predictions

Market Engineering Methodology

- 1. Total Diabetes Diagnostics Market: Competitive Segment Analysis, US and Europe, 2014

- 2. Total Diabetes Diagnostics Market: Market Outlook, US and Europe, 2014 and 2024

- 3. Total Diabetes Diagnostics Market: Game-changing Strategies, US and Europe, 2014

- 4. Total Diabetes Diagnostics Market: Top Product Analysis, US and Europe, 2014

- 5. Total Diabetes Diagnostics Market: Market Engineering Measurements, US and Europe, 2014

- 6. Diabetes Diagnostics Market: Key Market Drivers, US, 2015–2020

- 7. Diabetes Diagnostics Market: Key Market Restraints, US, 2015–2020

- 8. Diabetes Diagnostics Market: Market Engineering Measurements, US, 2014

- 9. SMBG Segment: Market Engineering Measurements, US, 2014

- 10. SMBG Segment: Market Positions of the Leading Participants, US, 2014

- 11. POCT Segment: Market Engineering Measurements, US, 2014

- 12. Lab-based HbA1c Testing Segment: Market Engineering Measurements, US, 2014

- 13. Diabetes Diagnostics Market: Market Engineering Measurements, Europe, 2014

- 14. SMBG Segment: Market Engineering Measurements, Europe, 2014

- 15. POCT Segment: Market Engineering Measurements, Europe, 2014

- 16. Lab-based HbA1c Testing Segment: Market Engineering Measurements, Europe, 2014

- 1. Total Diabetes Diagnostics Market: Market Engineering Measurements, US and Europe, 2014

- 2. Total Diabetes Diagnostics Market: Percent Prevalence of Diabetes, Global, 2014

- 3. Total Diabetes Diagnostics Market: Market Segmentation, US and Europe, 2014

- 4. Total Diabetes Diagnostics Market: Segment Life Cycle Analysis, US and Europe, 2014

- 5. Total Diabetes Diagnostics Market: Percent Revenue Breakdown, US and Europe, 2014

- 6. Total Diabetes Diagnostics Market: Competitive Landscape, US and Europe, 2014

- 7. Total Diabetes Diagnostics Market: Revenue Forecast, US and Europe, 2011–2020

- 8. Total Diabetes Diagnostics Market by Segment: Percent Sales Breakdown, US and Europe, 2014

- 9. Total Diabetes Diagnostics Market: Percent Sales Breakdown, US and Europe, 2020

- 10. Total Diabetes Diagnostics Market: Revenue Forecast by Segment, US and Europe, 2011–2020

- 11. Diabetes Diagnostics Market: Revenue Forecast, US, 2011–2020

- 12. Diabetes Diagnostics Market: Percent Sales Breakdown, US, 2014

- 13. Diabetes Diagnostics Market: Percent Sales Breakdown, US, 2020

- 14. Diabetes Diagnostics Market: Revenue Forecast by Segment, US, 2011–2020

- 15. SMBG Segment: Revenue Forecast, US, 2011–2020

- 16. SMBG Segment: Revenue Forecast by Sub-Segment, US, 2011–2020

- 17. SMBG Segment: Percent Revenue Breakdown, US, 2014

- 18. POCT Segment: Revenue Forecast, US, 2011–2020

- 19. POCT Segment: Revenue Forecast by Sub-Segment, US, 2011–2020

- 20. POCT Segment: Percent Revenue Breakdown, US, 2014

- 21. Lab-based HbA1c Testing Segment: Revenue Forecast, US, 2011–2020

- 22. Lab-based Testing Segment: Percent Revenue Breakdown, US, 2014

- 23. Diabetes Diagnostics Market: Trends of Lab-based Tests, US, 2014

- 24. FPG Testing: Market Potential, US, 2014

- 25. OGTT Testing: Market Potential, US, 2014

- 26. HbA1c Testing: Market Potential, US, 2014

- 27. Microalbumin: Market Potential, US, 2014

- 28. Diabetes Diagnostics Market: Revenue Forecast, Europe, 2011–2020

- 29. Diabetes Diagnostics Market: Revenue Forecast by Region, Europe, 2011–2020

- 30. Diabetes Diagnostics Market: Percent Sales Breakdown, Europe, 2014

- 31. Diabetes Diagnostics Market: Percent Sales Breakdown, Europe, 2020

- 32. SMBG Segment: Revenue Forecast, Europe, 2011–2020

- 33. SMBG Segment: Revenue Forecast by Segment, Europe, 2011–2020

- 34. SMBG Segment: Percent Revenue Breakdown, Europe, 2014

- 35. POCT Segment: Revenue Forecast, Europe, 2011–2020

- 36. POCT Segment: Revenue Forecast by Segment, Europe, 2011–2020

- 37. POCT Segment: Percent Revenue Breakdown, Europe, 2014

- 38. Lab-based HbA1c Testing Segment: Revenue Forecast, Europe, 2011–2020

- 39. Lab-based Testing Segment: Percent Revenue Breakdown, Europe, 2014

- 40. Diabetes Diagnostics Market: Trends of Lab-based Tests, Europe, 2014

- 41. FPG Testing: Market Potential, Europe, 2014

- 42. OGTT Testing: Market Potential, Europe, 2014

- 43. HbA1c Testing: Market Potential, Europe, 2014

- 44. Microalbumin: Market Potential, Europe, 2014

- 45. Diabetes Diagnostics Market: Percent Sales Breakdown by Region, Europe, 2014

- 46. Diabetes Diagnostics Market: Revenue Forecast, UK, 2011–2020

- 47. Diabetes Diagnostics Market: Demographic Information, UK, 2014

- 48. Diabetes Diagnostics Market: Revenue Forecast by Segment, UK, 2011–2020

- 49. Diabetes Diagnostics Market: Impact of Top 10 Trends, UK, 2014

- 50. Diabetes Diagnostics Market: Revenue Forecast, Germany, 2011–2020

- 51. Diabetes Diagnostics Market: Demographic Information, Germany, 2014

- 52. Diabetes Diagnostics Market: Revenue Forecast by Segment, Germany, 2011–2020

- 53. Diabetes Diagnostics Market: Impact of Top 10 Trends, Germany, 2014

- 54. Diabetes Diagnostics Market: Revenue Forecast, France, 2011–2020

- 55. Diabetes Diagnostics Market: Demographic Information, France, 2014

- 56. Diabetes Diagnostics Market: Revenue Forecast by Segment, France, 2011–2020

- 57. Diabetes Diagnostics Market: Impact of Top 10 Trends, France, 2014

- 58. Diabetes Diagnostics Market: Revenue Forecast, Italy, 2011–2020

- 59. Diabetes Diagnostics Market: Demographic Information, Italy, 2014

- 60. Diabetes Diagnostics Market: Revenue Forecast by Segment, Italy, 2011–2020

- 61. Diabetes Diagnostics Market: Impact of Top 10 Trends, Italy, 2014

- 62. Diabetes Diagnostics Market: Revenue Forecast, Spain, 2011–2020

- 63. Diabetes Diagnostics Market: Demographic Information, Spain, 2014

- 64. Diabetes Diagnostics Market: Revenue Forecast by Segment, Spain, 2011–2020

- 65. Diabetes Diagnostics Market: Impact of Top 10 Trends, Spain, 2014

- 66. Diabetes Diagnostics Market: Revenue Forecast, Benelux, 2011–2020

- 67. Diabetes Diagnostics Market: Demographic Information, Belgium, 2014

- 68. Diabetes Diagnostics Market: Demographic Information, the Netherlands, 2014

- 69. Diabetes Diagnostics Market: Revenue Forecast by Segment, Benelux, 2011–2020

- 70. Diabetes Diagnostics Market: Revenue Forecast, Scandinavia, 2011–2020

- 71. Diabetes Diagnostics Market: Demographic Information, Scandinavia, 2014

- 72. Diabetes Diagnostics Market: Revenue Forecast by Segment, Scandinavia, 2011–2020

- 73. Diabetes Diagnostics Market: Impact of Top 10 Trends, Benelux and Scandinavia, 2014

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Scope and Segmentation~ || Market Engineering Measurements~ || CEO’s Perspective~ || Key Companies to Watch~ ||| HemoCue (US and Europe)~ ||| NovioSense (US)~ ||| Miraculins (US)~ || 3 Big Predictions~ | Market Overview~ || Introduction to Diabetes~ || Market Overview~ || Market Segmentation~ || Segment Life Cycle Analysis~ || Competitive Segment Analysis~ || Defining Healthcare Trends in the Future~ | Competitive Playbook~ || Diabetes Diagnostics Market—Competitive Landscape~ || New Market Opportunities~ || Competitive Analysis~ | Total Market Analysis~ || Market Engineering Measurements~ || Revenue Forecast~ || Segment Overview~ || Revenue Forecast by Segment~ | US Analysis~ || Market Drivers~ ||| Switching to a value-based healthcare practice~ ||| Growing healthcare expenditure~ ||| Increasing push for decentralized testing~ ||| Growing trend of integrating technology with mobile devices~ ||| Increase in consumer-specific products~ || Market Restraints~ ||| Strained laboratory budgets~ ||| Competitive pricing~ ||| Tougher US regulatory environment~ || Market Engineering Measurements~ || US Revenue Forecast~ || Segment Overview~ || Revenue Forecast by Segment~ | US SMBG Segment~ || Market Engineering Measurements~ || Revenue Forecast~ || Revenue Forecast by Segment~ || Market Share Analysis~ | US POCT Segment~ || Market Engineering Measurements~ || Revenue Forecast~ || Revenue Forecast by Segment~ || Market Share Analysis~ | US Lab-based Testing Segment~ || Market Engineering Measurements~ || Revenue Forecast~ || Market Share Analysis~ || Lab-based Testing Trends~ || Comparison of Lab-based Tests~ | Europe Analysis~ || Market Engineering Measurements~ || Revenue Forecast~ || Revenue Forecast by Region~ || Segment Overview~ | Europe SMBG Segment~ || Market Engineering Measurements~ || Revenue Forecast~ || Revenue Forecast by Segment~ || Market Share Analysis~ | Europe POCT Segment~ | Europe Lab-based Testing Segment~ || Market Engineering Measurements~ || Revenue Forecast~ || Market Share Analysis~ || Lab-based Testing Trends~ || Comparison of Lab-based Tests~ | Europe—Regional Analysis~ || Regional Overview~ || Revenue Forecast—The United Kingdom~ || UK Regulations and Reimbursements~ || Revenue Forecast by Segment—The United Kingdom~ || Market Impact of Top 10 Trends~ || Revenue Forecast—Germany~ || Germany Reimbursements and Regulations~ || Revenue Forecast by Segment—Germany~ || Revenue Forecast—France~ || France Reimbursements and Regulations~ || Revenue Forecast by Segment—France~ || Revenue Forecast—Italy~ || Italy Reimbursements and Regulations~ || Revenue Forecast by Segment—Italy~ || Revenue Forecast—Spain~ || Spain Reimbursements and Regulations~ || Revenue Forecast by Segment—Spain~ || Revenue Forecast—Benelux (Belgium, the Netherlands, Luxembourg)~ || Benelux Reimbursements and Regulations~ || Revenue Forecast by Segment—Benelux~ || Revenue Forecast—Scandinavia~ || Scandinavia Reimbursements and Regulations~ || Revenue Forecast by Segment—Scandinavia~ | Key Companies to Watch~ || HemoCue~ || NovioSense~ || Miraculins~ | The Last Word~ || 3 Big Predictions~ | Appendix~ || Market Engineering Methodology~ |

| List of Charts and Figures | 1. Total Diabetes Diagnostics Market: Competitive Segment Analysis, US and Europe, 2014~ 2. Total Diabetes Diagnostics Market: Market Outlook, US and Europe, 2014 and 2024~ 3. Total Diabetes Diagnostics Market: Game-changing Strategies, US and Europe, 2014~ 4. Total Diabetes Diagnostics Market: Top Product Analysis, US and Europe, 2014~ 5. Total Diabetes Diagnostics Market: Market Engineering Measurements, US and Europe, 2014~ 6. Diabetes Diagnostics Market: Key Market Drivers, US, 2015–2020~ 7. Diabetes Diagnostics Market: Key Market Restraints, US, 2015–2020~ 8. Diabetes Diagnostics Market: Market Engineering Measurements, US, 2014~ 9. SMBG Segment: Market Engineering Measurements, US, 2014~ 10. SMBG Segment: Market Positions of the Leading Participants, US, 2014~ 11. POCT Segment: Market Engineering Measurements, US, 2014~ 12. Lab-based HbA1c Testing Segment: Market Engineering Measurements, US, 2014~ 13. Diabetes Diagnostics Market: Market Engineering Measurements, Europe, 2014~ 14. SMBG Segment: Market Engineering Measurements, Europe, 2014~ 15. POCT Segment: Market Engineering Measurements, Europe, 2014~ 16. Lab-based HbA1c Testing Segment: Market Engineering Measurements, Europe, 2014~| 1. Total Diabetes Diagnostics Market: Market Engineering Measurements, US and Europe, 2014~ 2. Total Diabetes Diagnostics Market: Percent Prevalence of Diabetes, Global, 2014~ 3. Total Diabetes Diagnostics Market: Market Segmentation, US and Europe, 2014~ 4. Total Diabetes Diagnostics Market: Segment Life Cycle Analysis, US and Europe, 2014~ 5. Total Diabetes Diagnostics Market: Percent Revenue Breakdown, US and Europe, 2014~ 6. Total Diabetes Diagnostics Market: Competitive Landscape, US and Europe, 2014~ 7. Total Diabetes Diagnostics Market: Revenue Forecast, US and Europe, 2011–2020~ 8. Total Diabetes Diagnostics Market by Segment: Percent Sales Breakdown, US and Europe, 2014~ 9. Total Diabetes Diagnostics Market: Percent Sales Breakdown, US and Europe, 2020~ 10. Total Diabetes Diagnostics Market: Revenue Forecast by Segment, US and Europe, 2011–2020~ 11. Diabetes Diagnostics Market: Revenue Forecast, US, 2011–2020~ 12. Diabetes Diagnostics Market: Percent Sales Breakdown, US, 2014~ 13. Diabetes Diagnostics Market: Percent Sales Breakdown, US, 2020~ 14. Diabetes Diagnostics Market: Revenue Forecast by Segment, US, 2011–2020~ 15. SMBG Segment: Revenue Forecast, US, 2011–2020~ 16. SMBG Segment: Revenue Forecast by Sub-Segment, US, 2011–2020~ 17. SMBG Segment: Percent Revenue Breakdown, US, 2014~ 18. POCT Segment: Revenue Forecast, US, 2011–2020~ 19. POCT Segment: Revenue Forecast by Sub-Segment, US, 2011–2020~ 20. POCT Segment: Percent Revenue Breakdown, US, 2014~ 21. Lab-based HbA1c Testing Segment: Revenue Forecast, US, 2011–2020~ 22. Lab-based Testing Segment: Percent Revenue Breakdown, US, 2014~ 23. Diabetes Diagnostics Market: Trends of Lab-based Tests, US, 2014~ 24. FPG Testing: Market Potential, US, 2014~ 25. OGTT Testing: Market Potential, US, 2014~ 26. HbA1c Testing: Market Potential, US, 2014~ 27. Microalbumin: Market Potential, US, 2014~ 28. Diabetes Diagnostics Market: Revenue Forecast, Europe, 2011–2020~ 29. Diabetes Diagnostics Market: Revenue Forecast by Region, Europe, 2011–2020~ 30. Diabetes Diagnostics Market: Percent Sales Breakdown, Europe, 2014~ 31. Diabetes Diagnostics Market: Percent Sales Breakdown, Europe, 2020~ 32. SMBG Segment: Revenue Forecast, Europe, 2011–2020~ 33. SMBG Segment: Revenue Forecast by Segment, Europe, 2011–2020~ 34. SMBG Segment: Percent Revenue Breakdown, Europe, 2014~ 35. POCT Segment: Revenue Forecast, Europe, 2011–2020~ 36. POCT Segment: Revenue Forecast by Segment, Europe, 2011–2020~ 37. POCT Segment: Percent Revenue Breakdown, Europe, 2014~ 38. Lab-based HbA1c Testing Segment: Revenue Forecast, Europe, 2011–2020~ 39. Lab-based Testing Segment: Percent Revenue Breakdown, Europe, 2014~ 40. Diabetes Diagnostics Market: Trends of Lab-based Tests, Europe, 2014~ 41. FPG Testing: Market Potential, Europe, 2014~ 42. OGTT Testing: Market Potential, Europe, 2014~ 43. HbA1c Testing: Market Potential, Europe, 2014~ 44. Microalbumin: Market Potential, Europe, 2014~ 45. Diabetes Diagnostics Market: Percent Sales Breakdown by Region, Europe, 2014~ 46. Diabetes Diagnostics Market: Revenue Forecast, UK, 2011–2020~ 47. Diabetes Diagnostics Market: Demographic Information, UK, 2014~ 48. Diabetes Diagnostics Market: Revenue Forecast by Segment, UK, 2011–2020~ 49. Diabetes Diagnostics Market: Impact of Top 10 Trends, UK, 2014 ~ 50. Diabetes Diagnostics Market: Revenue Forecast, Germany, 2011–2020~ 51. Diabetes Diagnostics Market: Demographic Information, Germany, 2014~ 52. Diabetes Diagnostics Market: Revenue Forecast by Segment, Germany, 2011–2020~ 53. Diabetes Diagnostics Market: Impact of Top 10 Trends, Germany, 2014 ~ 54. Diabetes Diagnostics Market: Revenue Forecast, France, 2011–2020~ 55. Diabetes Diagnostics Market: Demographic Information, France, 2014~ 56. Diabetes Diagnostics Market: Revenue Forecast by Segment, France, 2011–2020~ 57. Diabetes Diagnostics Market: Impact of Top 10 Trends, France, 2014 ~ 58. Diabetes Diagnostics Market: Revenue Forecast, Italy, 2011–2020~ 59. Diabetes Diagnostics Market: Demographic Information, Italy, 2014~ 60. Diabetes Diagnostics Market: Revenue Forecast by Segment, Italy, 2011–2020~ 61. Diabetes Diagnostics Market: Impact of Top 10 Trends, Italy, 2014 ~ 62. Diabetes Diagnostics Market: Revenue Forecast, Spain, 2011–2020~ 63. Diabetes Diagnostics Market: Demographic Information, Spain, 2014~ 64. Diabetes Diagnostics Market: Revenue Forecast by Segment, Spain, 2011–2020~ 65. Diabetes Diagnostics Market: Impact of Top 10 Trends, Spain, 2014 ~ 66. Diabetes Diagnostics Market: Revenue Forecast, Benelux, 2011–2020~ 67. Diabetes Diagnostics Market: Demographic Information, Belgium, 2014~ 68. Diabetes Diagnostics Market: Demographic Information, the Netherlands, 2014~ 69. Diabetes Diagnostics Market: Revenue Forecast by Segment, Benelux, 2011–2020~ 70. Diabetes Diagnostics Market: Revenue Forecast, Scandinavia, 2011–2020~ 71. Diabetes Diagnostics Market: Demographic Information, Scandinavia, 2014~ 72. Diabetes Diagnostics Market: Revenue Forecast by Segment, Scandinavia, 2011–2020~ 73. Diabetes Diagnostics Market: Impact of Top 10 Trends, Benelux and Scandinavia, 2014~ |

| Author | Aish Vivekanadan |

| WIP Number | NF12-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB