Global Defence Outlook, 2020

Global Defence Outlook, 2020

Continuing High Global Tensions will Call for a Spike in Military Spending; However, the COVID-19 Induced Economic Recession will Severely Restrict Defence Budgets

16-Jun-2020

North America

Market Outlook

$4,950.00

Special Price $3,712.50 save 25 %

Description

The defence outlook for 2020 will be driven primarily by a period of instability and high levels of tension due to various factors, including a global pandemic (Coronavirus 2019 or COVID-19), which will be explored by region in this research. The effects of COVID-19 on the defence industry are still to be fully understood. The impact will predominantly be on the supply chain. There are several major points of interest that could have an impact on geopolitical relations and a cascading effect on the wider defence industry, specifically with regards to supply chains and competition. Such points of interest include the upcoming US presidential election, the ramifications of Brexit, China’s economic expansion through the “one belt one road” project, North Korean nuclear armament and missile testing, Iran-US tensions, Turkish-Syrian conflict, the ceasefire agreement with the Taliban in Afghanistan, and political instability in Venezuela. Major drivers within the defence industry are the arms race between the United States, Russia, and China, as well as the looming threats that China and Russia are perceived to pose. The tripartite arms race is predominantly central to the development of hypersonic technology, with both Russia and China claiming to have functioning weapons in production. The threat from Russia will continue to be the major driver of the defence spending of North Atlantic Treaty Organisation (NATO), especially amongst the Eastern European nations. However, the recent NATO conference in London established China as a growing adversary.

This report identifies six key emerging concepts of operations: counterterrorism, cyberwarfare, hybrid warfare, urban warfare, advancing ballistic missile capabilities, and conflicts over resources. These changing operational environments will drive defence requirements and procurement over the year – examples are counterterrorism operations driving the procurement of mine-resistant ambush protected (MRAP) and armoured personnel vehicle (APV) vehicle programmes; and advancing ballistic missile capabilities, such as hypersonics, driving air defence requirements. Terrorism is on the rise around the world with the proliferation of non-state actors such as Islamic State (IS) related organisations and other separatist movements. As digitisation increases around the world, states and non-state actors are utilising the technology to spread their influence and presence, as well as wage cyberwarfare, thereby opening up a new front. War is no longer fought only on the battlefield against a known adversary but is increasingly against non-state actors and guerrilla-style tactics. It is waged in conjunction with diplomatic, economic, and technological means. As the global population and population density increases with urbanisation of cities, warfare will see a shift towards urban-centric operations. As resources continue to become sparse, and pressure increases from a growing population, conflicts will likely begin to be triggered over resources – case in point is the Arctic arms race as the melting of the Arctic ice due to global warming opens up new routes within the Arctic Circle.

This defence outlook breaks down the defence environment into the air, land, and maritime domains. It analyses trends and drivers of these markets, as well as highlights current major programmes and the competitive environment in each domain. It also briefly discusses major technological areas and their respective impact on the defence industry. A total of 27 such areas are covered ranging from cloud computing and neuro-electronics to swarm robotics. Regional outlooks are also provided, detailing opportunities and on-going procurements. Each regional outlook covers the major geopolitical issues of the region, the defence outlook and economic standing of the top five countries in each region, the major procurement programmes, and the defence industry landscape amongst the top 100 defence industries (by revenue).

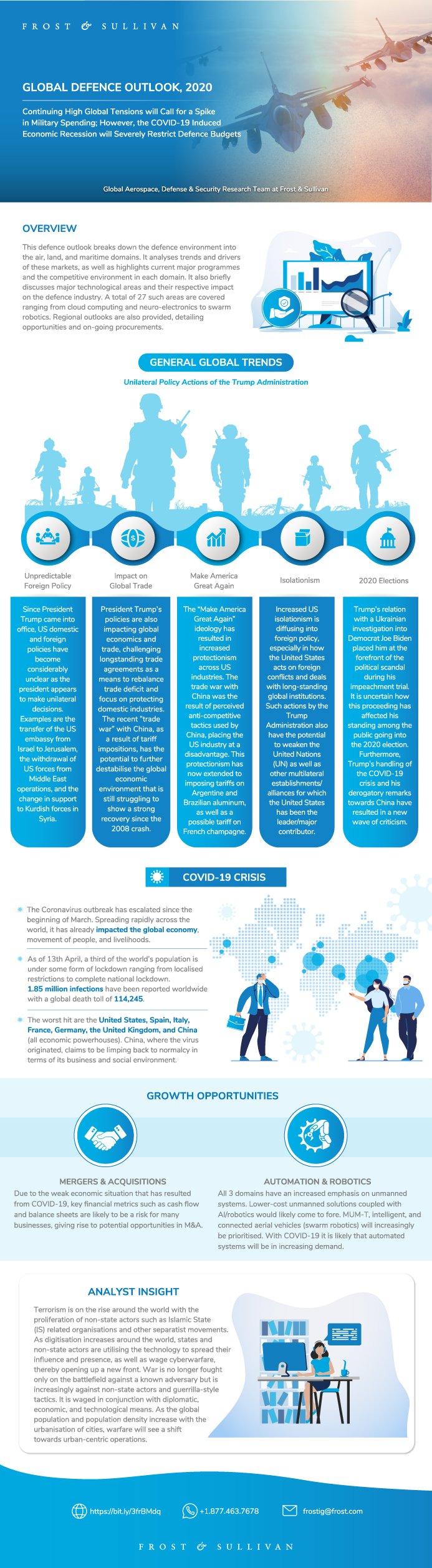

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Geopolitical Overview

Growing Impact of COVID-19

Changing Concepts of Operation

Key Takeaways

Research Scope

Research Objectives and Questions

Major Events in The Last 12 Months

General Global Trends

General Global Trends (continued)

General Global Trends (continued)

General Global Trends (continued)

General Global Trends (continued)

Spheres of Political Influence of the “Major” Powers

Spheres of Political Influence of the “Major” Powers (continued)

General Global Trends

Summary

COVID-19 Overview

Impact to the Defence Industry—Supply Chains

Impact to the Defence Industry—Other

Key Action Points for the Industry

General Overview

COVID-19 Impact on the Economy

COVID-19 Impact on the Economy (continued)

Change in Nature and Characteristics of Various Threats

Counterterrorism

Cyberwarfare and Cybersecurity

Hybrid Warfare

Urban Warfare

Advancing Ballistic Missile Capabilities

Conflicts Over Resources

The Last 12 Months—Highlights

Air Domain—Generational Trends

Major Programmes Driving the Market

The Last 12 Months—Highlights

Combat Vehicle—Generational Trends

Major Programmes Driving the Market

The Last 12 Months—Highlights

Surface Vessel—Generational Trends and Drivers

Submarine—Generational Trends and Drivers

Technology Trends

Geopolitics Trends and Issues

Conflicts and Threats

Defence Spending

Operational Requirements

Industry

Strategic Conclusions

Geopolitics Trends and Issues

Conflicts and Threats

Defence Spending

Operational Requirements

Changing Shape of the Asia-Pacific Defence Technology Industrial Base (DTIB)

Strategic Conclusions

Geopolitics Trends and Issues

Existing Alliances and Relationships

Conflicts and Threats

Defence Spending

Operational Requirements

Changing Shape of the Central & South Asia DTIB

Strategic Conclusions

Geopolitics Trends and Issues

Existing Alliances and Relationships

Conflicts and Threats

Defence Spending

Operational Requirements

Changing Shape of the European DTIB

Strategic Conclusions

Geopolitics Trends and Issues

Conflicts and Threats

Defence Spending

Operational Requirements

Changing Shape of the Middle East DTIB

Strategic Conclusions

Geopolitics Trends and Issues

Conflicts and Threats

Defence Spending

Operational Requirements

Changing Shape of the North America DTIB*

Strategic Conclusions

Geopolitics Trends and Issues

Conflicts and Threats

Defence Spending

Operational Requirements

Changing Shape of the South America DTIB

Strategic Conclusions

Technology Overview

Technology Overview (continued)

Technology Overview (continued)

Growth Opportunity 1—Mergers & Acquisitions

Growth Opportunity 2—Automation & Robotics

Strategic Imperatives for Growth

The Last Word—3 Big Predictions

Legal Disclaimer

Abbreviations

List of Exhibits

List of Exhibits (continued)

Popular Topics

| Deliverable Type | Market Outlook |

|---|---|

| No Index | No |

| Podcast | No |

| Author | Alexander Clark |

| Industries | Aerospace, Defence and Security |

| WIP Number | MF34-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9000-A1 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB