Global Medical Food Growth Opportunities

Global Medical Food Growth Opportunities

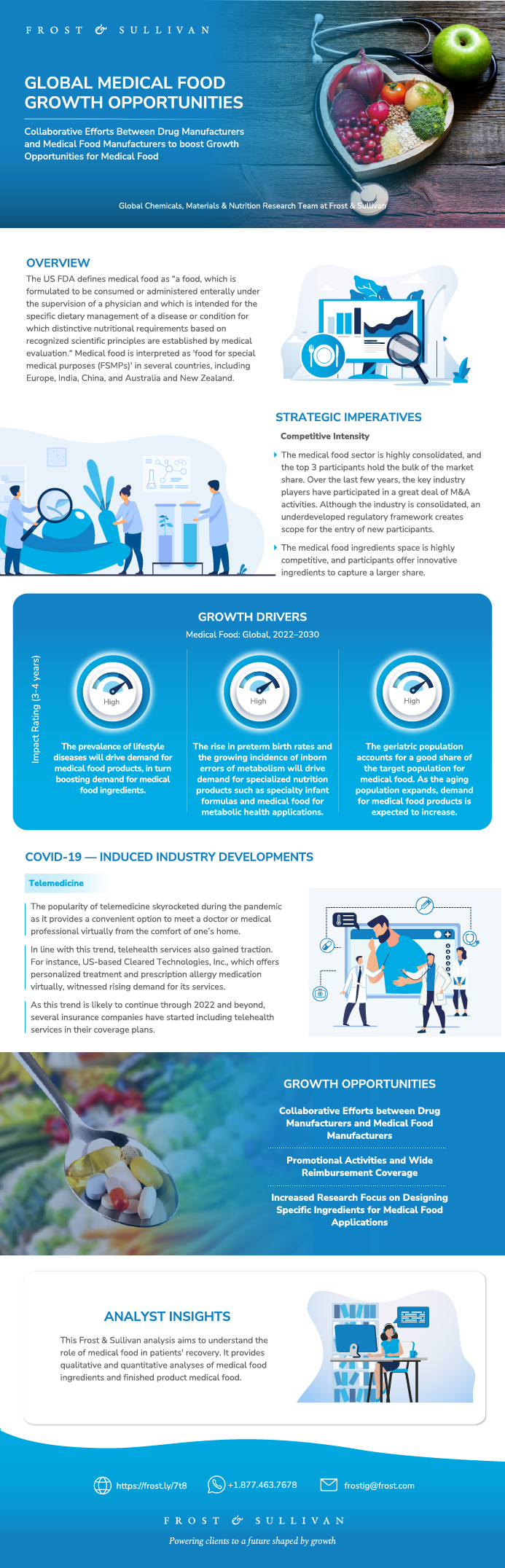

Collaborative Efforts Between Drug Manufacturers and Medical Food Manufacturers to Boost Growth Opportunities for Medical Food

14-Sep-2022

Global

$4,950.00

Special Price $4,207.50 save 15 %

Description

The US FDA defines medical food as “a food, which is formulated to be consumed or administered enterally under the supervision of a physician and which is intended for the specific dietary management of a disease or condition for which distinctive nutritional requirements, based on recognized scientific principles, are established by medical evaluation.“ Medical food is interpreted as 'food for special medical purposes (FSMPs)' in several countries, including Europe, India, China, and Australia and New Zealand. In Japan, medical food is interpreted as 'food for sick'. In Canada, medical food is governed by food for special dietary use (FSDU) and infant food regulations.

Globally, the regulatory landscape for medical food is not clearly defined, even in developed economies. As medical food is not intended to prevent or treat diseases, it is not subject to the same regulatory requirements as pharmaceutical drugs.

This Frost & Sullivan study aims to understand the role of medical food in patients' recovery. It provides qualitative and quantitative analyses of medical food ingredients and finished product medical food.

By ingredient, the medical food market is divided into vitamins and minerals; protein ingredients (animal and plant); nutritional lipids; prebiotics; and others (amino acids and probiotics). Of these, protein ingredients held the majority share of 64.0% (2021) in the total medical food ingredients market due to the important role they play in trauma and illness recovery.

Geographically, the study covers North America, Europe, Asia-Pacitfic, and Latin America and the Middle East and Africa (LAMEA). North America and Europe accounted for most of the market share for both medical food ingredients and finished product medical food in 2021 due to the rising physician awareness and the increasing medical adherence by patients. Factors supporting market growth in these regions are the expanding geriatric population, the prevalence of chronic diseases, and policymakers' growing emphasis on malnutrition management.

The impact of the COVID-19 pandemic is taken into account in the analysis. The pandemic induced both positive and negative changes in the medical food market. Supply chain disruptions due to the shutting down of processing facilities and other lockdown measures affected the sale of ingredients and finished medical food. However, the negaitve effects were reduced to some extent due to the growing consumer awareness and research highlighting the benefits of medical food in patients' recovery.

Key Features

By finished product, the medical food market is segmented by type, mode of administration, and application.

- By type, the medical food market is fragmented into prescription and nonprescription food. Prescription medical food dominated the medical food market with a 60.0% share in 2021 due to strong demand from developed economies for use in fatal health conditions such as oncology health, critical care and trauma, cardiovascular health, diabetes health, and cognitive health. Key market participants, such as Abbott, Nestle Health Science, and Nutricia, offer vast product portfolios of prescription medical food to meet the growing demand.

- By mode of administration, the medical food market is categorized into oral (food or supplement format) and enteral tube feeding. The oral mode accounted for the larger market share of 75.0% in 2021. Preference for orally administered products, ease of availability without prescriptions, and supportive initiatives are key factors driving demand for orally administered medical food.

- By application, the medical food market is segmented into malnutrition (including oncology health, immune health, and general malnutrition); metabolic health; digestive health; critical care and trauma; diabetes health; cardiovascular health; musculoskeletal health; and cognitive and central nervous system (CNS) health. Malnutrition, metabolic disorders, digestive disorders, and critical care and trauma are the top target diseases for medical food. Brain and cognitive health remains a small segment; nevertheless, it is one of the fastest-growing application areas for medical food.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why is it Increasingly Difficult To Grow?

The Strategic Imperative 8™

The Impact of the Top 3 Strategic Imperatives on the Medical Food Industry

Growth Opportunities Fuel The Growth Pipeline Engine™

Scope of Analysis

Medical Food—Definition

Differences between Dietary Supplements, Medical Food, and Pharmaceutical Drugs

Segmentation

Segmentation (continued)

Definition by Ingredient Type

Definition by Type and Mode of Administration

Definition by Application

Key Competitors

Value Chain

Growth Drivers

Growth Restraints

Forecast Assumptions

Forecast Assumptions (continued)

Impact of the COVID-19 Pandemic on the Medical Food Market

COVID-19—Induced Research

COVID-19—Induced Market Trends

Regulatory Landscape

Regulatory Landscape—North America

Regulatory Landscape—Europe

Regulatory Landscape—Asia-Pacific

Regulatory Landscape—Asia-Pacific (continued)

Insurance Coverage and Reimbursement Scenario

Insurance Coverage and Reimbursement Scenario (continued)

Growth Metrics

Role of Ingredients in Patient Recovery—Protein Ingredients

Role of Ingredients in Patient Recovery—Nutritional Lipids

Role of Ingredients in Patient Recovery—Nutritional Lipids (continued)

Role of Ingredients in Patient Recovery—Prebiotics

Role of Ingredients in Patient Recovery—Vitamins and Minerals

Role of Ingredients in Patient Recovery—Vitamins and Minerals (continued)

Role of Ingredients in Patient Recovery—Vitamins and Minerals (continued)

Ingredient Trends

Ingredient Trends (continued)

Ingredient Trends (continued)

Revenue Forecast

Revenue Forecast by Ingredient

Revenue Forecast Analysis by Ingredients

Revenue Forecast Analysis by Ingredients (continued)

Revenue Forecast Analysis by Ingredients (continued)

Revenue Forecast by Region

Revenue Forecast Analysis by Region

Revenue Forecast Analysis by Region (continued)

Competitive Environment

Competitive Product Matrix

Product Launches—Medical Food Ingredients: 2021 and 2022

Product Launches—Medical Food Ingredients: 2021

Product Launches—Medical Food Ingredients: 2020 and 2022

Product Launches—Medical Food Ingredients: 2019 and 2020

Growth Metrics

Prescription Medical Food—Examples

Nonprescription Medical Food—Examples

Role of Medical Food in Malnutrition Condition

Role of Medical Food in Malnutrition Condition (continued)

Role of Medical Food in Malnutrition Condition (continued)

Role of Medical Food in Metabolic Health

Role of Medical Food in Metabolic Health (continued)

Role of Medical Food in Digestive Health

Role of Medical Food in Critical Care and Trauma

Role of Medical Food in Musculoskeletal Health

Role of Medical Food in Cognitive and CNS Health

Role of Medical Food in Diabetes Health

Role of Medical Food in Cardiovascular Health

Revenue Forecast

Revenue Forecast Analysis

Revenue Forecast Analysis (continued)

Revenue Forecast by Type

Revenue Forecast Analysis by Type

Revenue Forecast by Mode of Administration

Revenue Forecast Analysis by Mode of Administration

Revenue Forecast Analysis by Mode of Administration (continued)

Revenue Forecast by Region

Revenue Forecast Analysis by Region

Revenue Forecast Analysis by Region (continued)

Revenue Forecast Analysis by Region (continued)

Revenue Forecast Analysis by Region (continued)

Revenue Forecast Analysis by Region (continued)

Percent Revenue by Application and Market Penetration

Competitive Environment

Revenue Share

Recent Acquisitions—2019–2022

Recent Product Launches—2019, 2020, and 2021

Growth Opportunity 1: Collaborative Efforts between Drug Manufacturers and Medical Food Manufacturers

Growth Opportunity 1: Collaborative Efforts between Drug Manufacturers and Medical Food Manufacturers (continued)

Growth Opportunity 2: Promotional Activities and Wide Reimbursement Coverage

Growth Opportunity 2: Promotional Activities and Wide Reimbursement Coverage (continued)

Growth Opportunity 3: Increased Research Focus on Designing Specific Ingredients for Medical Food Applications

Growth Opportunity 3: Increased Research Focus on Designing Specific Ingredients for Medical Food Applications (continued)

Growth Opportunity 4: Innovation in Functional Ingredients

Growth Opportunity 4: Innovation in Functional Ingredients (continued)

Your Next Steps

Why Frost, Why Now?

List of Exhibits

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

Key Features

By finished product, the medical food market is segmented by type, mode of administration, and application.

- By type, the medical food market is fragmented into prescription and nonprescription food. Prescription medical food dominated the medical food market with a 60.0% share in 2021 due to strong demand from developed economies for use in fatal health conditions such as oncology health, critical care and trauma, cardiovascular health, diabetes health, and cognitive health. Key market participants, such as Abbott, Nestle Health Science, and Nutricia, offer vast product portfolios of prescription medical food to meet the growing demand.

- By mode of administration, the medical food market is categorized into oral (food or supplement format) and enteral tube feeding. The oral mode accounted for the larger market share of 75.0% in 2021. Preference for orally administered products, ease of availability without prescriptions, and supportive initiatives are key factors driving demand for orally administered medical food.

- By application, the medical food market is segmented into malnutrition (including oncology health, immune health, and general malnutrition); metabolic health; digestive health; critical care and trauma; diabetes health; cardiovascular health; musculoskeletal health; and cognitive and central nervous system (CNS) health. Malnutrition, metabolic disorders, digestive disorders, and critical care and trauma are the top target diseases for medical food. Brain and cognitive health remains a small segment; nevertheless, it is one of the fastest-growing application areas for medical food.

| Author | Nimisha Dhomne |

|---|---|

| Industries | Agriculture and Nutrition |

| No Index | No |

| Is Prebook | No |

| Keyword 1 | Medical Foods Market |

| Keyword 2 | healthy food market |

| Keyword 3 | Health and Wellness Food Market |

| Podcast | No |

| WIP Number | PD5F-01-00-00-00 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB