Autonomous Vehicles Market Research Reports

Autonomous Driving is set to redefine the mobility eco system as we know it today. The industry is at the cusp of a paradigm shift that will open avenues for new entrants and drive existing participants to rethink.

There will be numerous business opportunities from within the automotive industry and outside, but there will be two key common denominators to all of these opportunities: data and utilization. The core element to success in this market is embracing this phenomenon and aligning any offering in this industry to that one factor. Frost & Sullivan’s Autonomous Driving program area focuses on all new and shifting trends across this lucrative market such as:

- Market trends impacting uptake of autonomous vehicles in the future

- Technology trends driving innovation in the autonomous driving space

- Emergence of new technology and service providers that provide the disruptive change to the industry

- Competitive assessment of OEM and supplier strategies towards achieving autonomous capabilities.

- Market evaluation and forecasting of autonomous driving enablers and autonomous vehicles.

We work closely with the world’s largest OEMs, suppliers, service providers and technology firms to help them find the opportunities in this sea of change. Our holistic yet substantial research services enable us to stay at the forefront of change in this dynamic market, and enable our clients to achieve the same.

-

21 Nov 2016 | Global | Market Research

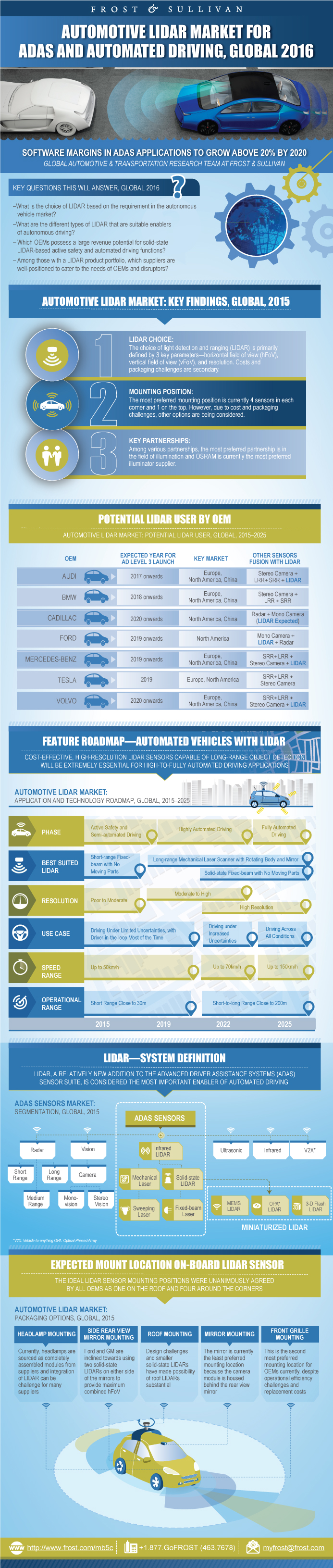

Automotive LIDAR Market for ADAS and Automated Driving, Global 2016

Software Margins in ADAS Applications to Grow Above 20% by 2020

This research service discusses LIDAR as a part of the ADAS sensor suite in the future generation of automated passenger vehicles. With OEMs accepting LIDAR as an integral part of the solution for partial to fully automated vehicles, this study details the type of LIDAR that would be best suited for enabling active safety and automated driving. Thi...

$4,950.00 -

07 Nov 2016 | North America | Market Research

Market Analysis of Premium European OEMs' ADAS and Automated Driving (AD) Strategies

Along with Level 3 and 4 Functions, Shared Mobility Portfolio to Play a Key Role in OEMs’ Future Business Models

While OEMs are racing towards achieving L4 and 5 automation features in their vehicles in developed markets such as NA and Europe, there will be major improvements in the ADAS sensors that will be used to achieve the desired features. Every OEM is working on a strategy that is different from others in terms of the level of automation desired. With ...

$4,950.00 -

31 Aug 2016 | Global | Market Research

Overview of Automotive Powertrain, Chassis, Body, and Materials Roadmaps, 2025

Innovative Material Strategy to Transform Automotive Design and Manufacturing

Scope of the report The research report includes the following segments: Product scope: Automotive Powertrain, Chassis, Body, and Materials Roadmaps Geographic scope: Global End-user scope: Passenger vehicle OEMs and suppliers The research provides an overview of the automotive powertrain, chassis, body, and materials roadmaps. It includes...

$4,950.00 -

24 Mar 2016 | North America | Market Research

Automotive Solution Business Models—Strategic Insights

Taxi eHailing, Public Transport and Shared Mobility Segments Display Potential as Commuter Focus Shifts from Value-for-Money to Value-for-Time Services

With autonomous vehicles soon to be a reality, it is necessary for OEMs, mobility providers, and anyone associated within the mobility value chain to look at different business models in order to be relevant to future times and be a profitable business. The study looks at the impact of autonomous vehicles on different segments within the automotive...

$4,950.00 -

17 Mar 2016 | North America | Market Research

Global Test Sites and Incentive Programs for Automated Cars, Forecast to 2022

Automated Vehicle Technologies Set for Take-Off, Early Wave Testers Include Ford Motor Company, Volvo AB and Big 3 German OEMs in Europe

Major automotive OEMs globally are now incorporating active safety and automated vehicle technologies in their future vehicle line-up to enhance safety and driver comfort. To gauge the suitability of each technology, continuous testing and validation is a must. Based on the supportive legislation, several regions across the globe have been identifi...

$4,950.00 -

01 Feb 2016 | Asia Pacific | Market Research

Autonomous Vehicle (AV) Evolution in Asia-Pacific, Forecast to 2030

Governments and OEMs Power Transformation, Japan at Forefront, to Showcase its Capabilities in Time for 2020 Tokyo Olympics

This market insight offers an analysis of the evolution of autonomous vehicles (AVs) in Asia-Pacific. It discusses key developments in AVs in Asia-Pacific countries, such as Japan, South Korea, Singapore, and China, from 2013 to 2030. The insight also assesses original equipment manufacturer (OEM) and government efforts for AVs, trials for AVs for ...

$2,500.00 -

28 Aug 2015 | North America | Market Research

LIDAR-based Strategies for Active Safety and Automated Driving from Major OEMs in Europe and North America

Seven of the Top-13 OEMs to Drive 8-fold Growth of LIDAR Revenue Potential by 2021

This study discusses LIDAR as a part of a sensor suite in Advanced Driver Assistance Systems (ADAS) in next-generation automated passenger vehicles. It analyses which type of LIDAR would best enable active safety and automated driving functions, especially as Original Equipment Manufacturers (OEMs) are now accepting LIDAR as integral for partial to...

$3,950.00