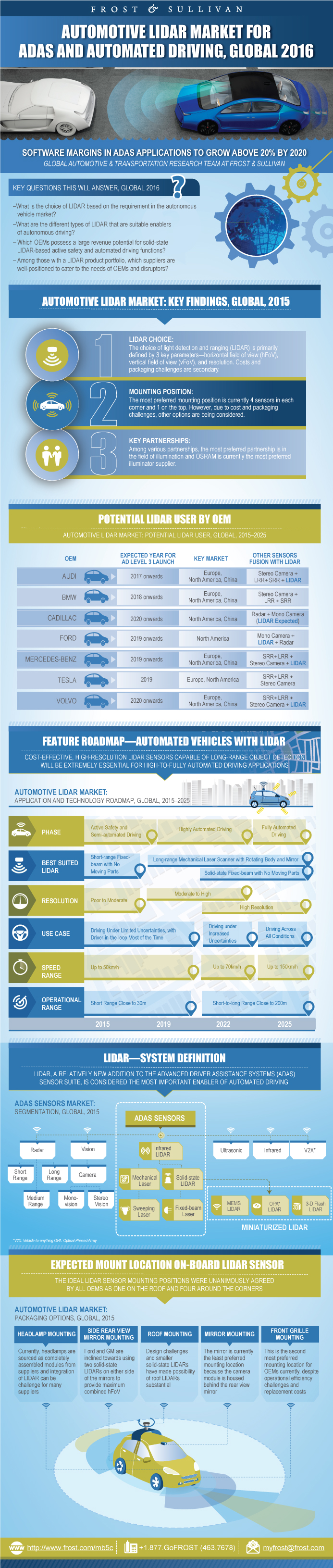

Automotive LIDAR Market for ADAS and Automated Driving, Global 2016

Automotive LIDAR Market for ADAS and Automated Driving, Global 2016

Software Margins in ADAS Applications to Grow Above 20% by 2020

21-Nov-2016

Global

$4,950.00

Special Price $3,712.50 save 25 %

Description

This research service discusses LIDAR as a part of the ADAS sensor suite in the future generation of automated passenger vehicles. With OEMs accepting LIDAR as an integral part of the solution for partial to fully automated vehicles, this study details the type of LIDAR that would be best suited for enabling active safety and automated driving. This study also discusses the market penetration of LIDAR-based solutions in the passenger vehicle market and the OEMs that possess a large revenue potential. Suppliers catering to participating OEMs have also been compared in order to evaluate which of them is better equipped to cater to OEMs needs. Finally, the price point of a LIDAR solution that could be commercially viable by 2022 is discussed.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Feature Roadmap—Automated Vehicles with LIDAR

Potential LIDAR User by OEM

Research Scope

Research Background

Key Participant Groups Compared in This Study

LIDAR—System Definition

Detailed Definitions of Product and System

Current Specifications of Automotive-grade LIDAR

Requirements of LIDAR

Expected Mount Location On-board LIDAR Sensor

Automated Vehicles with LIDAR—The Foreseeable Future

Configurations with LIDAR

Functional Matrix for Active Safety and Automated Driving

Market Drivers

Market Restraints

Estimated Unit Shipment

BMW—Functional Roadmap

Mercedes-Benz—Functional Roadmap

Volvo Cars Group—Functional Roadmap

Ford Motor Company—Functional Roadmap

General Motors—Functional Roadmap

Toyota—Functional Roadmap

OEM Strategy and Comparative Analysis

Competitive Positioning of Select OEMs

Continental AG

Robert Bosch GmbH

Ibeo Automotive

Quanergy Systems

Valeo S.A.

Velodyne Inc.

Supplier-OEM Partnership Snapshot

Key Conclusions

Appendix

Legal Disclaimer

Market Engineering Methodology

- 1. Automotive LIDAR Market: Application and Technology Roadmap, Global, 2015–2025

- 2. Automotive LIDAR Market: Potential LIDAR User, Global, 2015–2025

- 3. Automotive LIDAR Market: Key Definitions, Global, 2015

- 4. Automotive LIDAR Market: Current Specifications of Automotive-grade LIDAR, Global, 2015

- 5. Automotive LIDAR Market: Application Parameters, Global, 2015

- 6. Automotive LIDAR Market: Packaging options, Global, 2015

- 7. Automotive LIDAR Market: Stages of Development, Global, 2015–2025

- 8. Automotive LIDAR Market: Possible LIDAR Configurations, Global, 2015

- 9. Automotive LIDAR Market: Functional Matrix for LIDAR, Global, 2012–2025

- 10. Automotive LIDAR Market: Market Drivers, Global, 2016–2025

- 11. Automotive LIDAR Market: Market Restraints, Global, 2016–2025

- 12. Automotive LIDAR Market: OEM Strategy and Comparative Analysis, Global, 2015

- 13. Automotive LIDAR Market: Competitive Positioning of Select OEMs, Global, 2015

- 14. Automotive LIDAR Market: Key Conclusions, Global, 2015

- 1. ADAS Sensors Market: Segmentation, Global, 2015

- 2. Automotive LIDAR Market: Estimated Unit Shipment, Global, 2015–2025

- 3. Automotive LIDAR Market: BMW Functional Roadmap, Global, 2015–2025

- 4. Automotive LIDAR Market: Mercedes-Benz Functional Roadmap, Global, 2015–2025

- 5. Automotive LIDAR Market: Volvo Cars Functional Roadmap, Global, 2015–2025

- 6. Automotive LIDAR Market: Ford Motor Company—Functional Roadmap, Global, 2015–2025

- 7. Automotive LIDAR Market: General Motors Functional Roadmap, Global, 2015–2025

- 8. Automotive LIDAR Market: Toyota—Functional Roadmap, Global, 2015–2025

- 9. Automotive LIDAR Market: Tier I Supplier Product and LIDAR Portfolio Snapshot, Global, 2015

- 10. Automotive LIDAR Market: Tier-I Supplier Product and LIDAR Portfolio Snapshot, Global, 2015

- 11. Automotive LIDAR Market: Tier II Supplier Product and LIDAR Portfolio Snapshot, Global, 2015

- 12. Automotive LIDAR Market: Tier II Supplier Product and LIDAR Portfolio Snapshot, Global, 2015

- 13. Automotive LIDAR Market: Tier I Supplier Product and LIDAR Portfolio Snapshot, Global, 2015

- 14. Automotive LIDAR Market: Tier II Supplier Product and LIDAR Portfolio Snapshot, Global, 2015

- 15. Automotive LIDAR Market: Supplier—OEM Partnership Snapshot, Global, 2015

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Feature Roadmap—Automated Vehicles with LIDAR~ || Potential LIDAR User by OEM~ | Research Scope, Objectives, Background, and Methodology~ || Research Scope~ || Research Background~ || Key Participant Groups Compared in This Study~ | Definitions and Segmentation~ || LIDAR—System Definition~ || Detailed Definitions of Product and System~ | Technical Trends of LIDAR Type for Automotive Applications~ || Current Specifications of Automotive-grade LIDAR~ || Requirements of LIDAR~ || Expected Mount Location On-board LIDAR Sensor~ | LIDAR Business and Technology Roadmap~ || Automated Vehicles with LIDAR—The Foreseeable Future~ || Configurations with LIDAR~ || Functional Matrix for Active Safety and Automated Driving~ | Drivers and Restraints for LIDAR Adoption~ || Market Drivers~ || Market Restraints~ | Estimated Unit Shipment—Automotive LIDAR Market~ || Estimated Unit Shipment~ | OEM Roadmaps for LIDAR Adoption~ || BMW—Functional Roadmap~ || Mercedes-Benz—Functional Roadmap~ || Volvo Cars Group—Functional Roadmap~ || Ford Motor Company—Functional Roadmap~ || General Motors—Functional Roadmap~ || Toyota—Functional Roadmap~ || OEM Strategy and Comparative Analysis~ || Competitive Positioning of Select OEMs~ | Key LIDAR Suppliers—Company Profilesand Value Chain Analysis~ || Continental AG~ || Robert Bosch GmbH~ || Ibeo Automotive~ || Quanergy Systems~ || Valeo S.A.~ || Velodyne Inc.~ || Supplier-OEM Partnership Snapshot~ | Conclusion and Key Findings~ || Key Conclusions~ || Appendix~ || Legal Disclaimer~ || Market Engineering Methodology~ |

| List of Charts and Figures | 1. Automotive LIDAR Market: Application and Technology Roadmap, Global, 2015–2025~ 2. Automotive LIDAR Market: Potential LIDAR User, Global, 2015–2025~ 3. Automotive LIDAR Market: Key Definitions, Global, 2015~ 4. Automotive LIDAR Market: Current Specifications of Automotive-grade LIDAR, Global, 2015~ 5. Automotive LIDAR Market: Application Parameters, Global, 2015~ 6. Automotive LIDAR Market: Packaging options, Global, 2015~ 7. Automotive LIDAR Market: Stages of Development, Global, 2015–2025~ 8. Automotive LIDAR Market: Possible LIDAR Configurations, Global, 2015~ 9. Automotive LIDAR Market: Functional Matrix for LIDAR, Global, 2012–2025~ 10. Automotive LIDAR Market: Market Drivers, Global, 2016–2025~ 11. Automotive LIDAR Market: Market Restraints, Global, 2016–2025~ 12. Automotive LIDAR Market: OEM Strategy and Comparative Analysis, Global, 2015~ 13. Automotive LIDAR Market: Competitive Positioning of Select OEMs, Global, 2015~ 14. Automotive LIDAR Market: Key Conclusions, Global, 2015~| 1. ADAS Sensors Market: Segmentation, Global, 2015~ 2. Automotive LIDAR Market: Estimated Unit Shipment, Global, 2015–2025 ~ 3. Automotive LIDAR Market: BMW Functional Roadmap, Global, 2015–2025~ 4. Automotive LIDAR Market: Mercedes-Benz Functional Roadmap, Global, 2015–2025~ 5. Automotive LIDAR Market: Volvo Cars Functional Roadmap, Global, 2015–2025~ 6. Automotive LIDAR Market: Ford Motor Company—Functional Roadmap, Global, 2015–2025~ 7. Automotive LIDAR Market: General Motors Functional Roadmap, Global, 2015–2025~ 8. Automotive LIDAR Market: Toyota—Functional Roadmap, Global, 2015–2025~ 9. Automotive LIDAR Market: Tier I Supplier Product and LIDAR Portfolio Snapshot, Global, 2015~ 10. Automotive LIDAR Market: Tier-I Supplier Product and LIDAR Portfolio Snapshot, Global, 2015~ 11. Automotive LIDAR Market: Tier II Supplier Product and LIDAR Portfolio Snapshot, Global, 2015~ 12. Automotive LIDAR Market: Tier II Supplier Product and LIDAR Portfolio Snapshot, Global, 2015~ 13. Automotive LIDAR Market: Tier I Supplier Product and LIDAR Portfolio Snapshot, Global, 2015~ 14. Automotive LIDAR Market: Tier II Supplier Product and LIDAR Portfolio Snapshot, Global, 2015~ 15. Automotive LIDAR Market: Supplier—OEM Partnership Snapshot, Global, 2015~ |

| Author | Arunprasad Nandakumar |

| Industries | Automotive |

| WIP Number | MB5C-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB