European Home Automation Systems Market, Forecast to 2022

European Home Automation Systems Market, Forecast to 2022

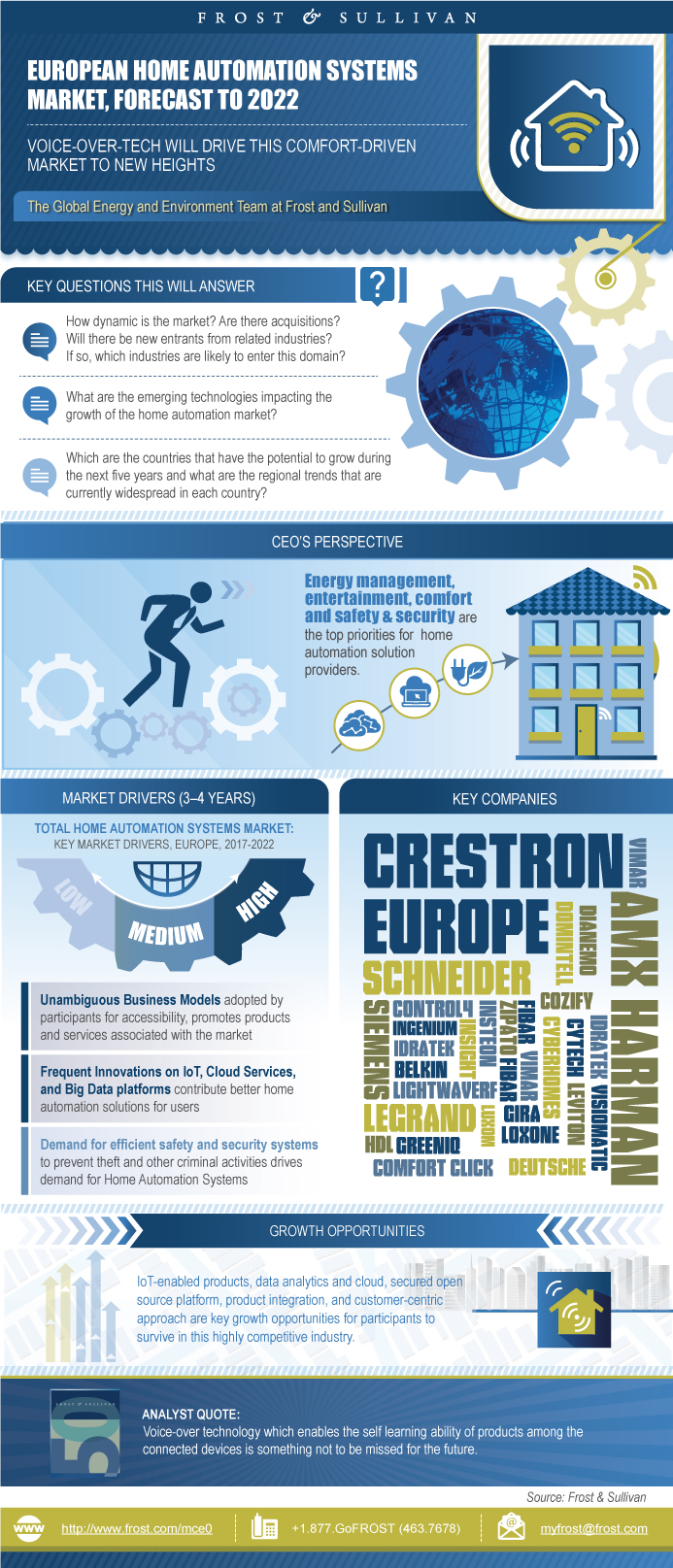

Voice-over-tech will Drive this Comfort-driven Market to New Heights

06-Sep-2017

Europe

Description

In the past couple of years, products and services associated with home automation and smart and connected homes have changed the consumer perception on technological innovations. Homes are no longer simply a place for eating, sleeping, and relaxing. Rather, they are being remodelled everyday into a connected and personalised ecosystem of services. Home automation systems (HAS) and solutions have been creating an environment whereby a seamless experience and high comfort levels can be achieved at home, especially in the ‘luxury’ end of the market. Connectivity and response from establishing user-interactive features are becoming high-impact trends and accelerating growth in home automation.

This study describes how the Internet of Things (IoT) has influenced technologies such as near field communication (NFC), wearable technology, and smartphones and the inexorable penetration of Wi-Fi and Bluetooth (which has enabled people to afford smart devices and connect in ways that were never possible earlier) and how it is being remodelled every day into a connected and personalised ecosystem of services. In this study, we have segmented the home automation market based on its scope as hardware and software. Hardware includes home measuring and monitoring devices, home controller units/master hubs and plug and play devices, whereas software includes applications to control and automate home functions.

The study includes revenue forecasts by country and region, technology trends, competitive analysis, and identification of growth opportunities in this dynamic market. Amongst the main future trends is voice-over-technology that enables users to interact with the home automation system directly. It can be remodelled using self-learning and artificial intelligence, which is expected to make the HAS experience into a seamless one. With an extraordinary growth projected across Europe in line with the increasing connectivity and convergence, Frost & Sullivan expects this market to continue attracting new entrants with continuous innovation, thereby proving to be a dynamic space with great potential for new and innovative business opportunities.

Key questions this study will answer:

• Is the market growing? How long will it continue to grow, and at what rate?

• Are the existing competitors structured correctly to meet customer needs?

• How dynamic is the market? Are there acquisitions? Will there be new entrants from related industries? If so, which industries are likely to

enter this domain?

• What are the emerging technologies impacting the growth of the home automation market?

• Which countries have the potential to grow during the next five years and what are the regional trends that are currently widespread in each

country?

• What are the different sales distributions channels present in the home automation market? Are they likely to change in the future?

Key Companies:

• Crestron Europe

• Legrand

• Loxone

• Zipato

• Control4

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Emerging Technology Roadmap

Market Engineering Measurements

CEO’s Perspective

Market Definitions

Market Segmentation

Market Distribution Channels

Market Drivers

Market Restraints

Market Engineering Measurements

Unit Shipment and Revenue Forecast

Mass Segment—Pricing Trends and Forecast

Luxury Segment—Pricing Trends and Forecast

Percent Revenue Forecast by Region

Revenue Forecast by Region

Revenue Forecast by Segment

Percent Revenue Forecast by Distribution Channel

Percent Revenue Forecast Discussion by Distribution Channel

Market Share

Competitive Environment

Growth Opportunity 1—IoT-enabled Devices

Growth Opportunity 2—Big Data and Cloud

Growth Opportunity 3—Product Integration

Strategic Imperatives for Success and Growth

Home Automation Market—Mega Trends Impact

European Home Automation Market—Mega Trends Impact

Luxury Segment Key Findings

Market Engineering Measurements

Unit Shipment and Revenue Forecast

Luxury Segment—Pricing Trends and Forecast

Market Share

Mass Segment Key Findings

Market Engineering Measurements

Unit Shipment and Revenue Forecast

Mass Segment—Pricing Trends and Forecast

Market Share

Luxury Segment—Unit Shipment and Revenue Forecast

Mass Segment—Unit Shipment and Revenue Forecast

Luxury Segment—Market Share

Mass Segment—Market Share

Market Share Analysis

Luxury Segment—Unit Shipment and Revenue Forecast

Mass Segment—Unit Shipment and Revenue Forecast

Luxury Segment—Market Share

Mass Segment—Market Share

Market Share Analysis

3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

List of Companies—Tier II and “Others”

- 1. Total Home Automation Systems Market: Key Market Drivers, Europe, 2017–2022

- 2. Total Home Automation Systems Market: Key Market Drivers, Europe, 2017–2022

- 3. Total Home Automation Systems Market: Market Engineering Measurements, Europe, 2016

- 4. Total Home Automation Systems Market: Approximate Price Range, Europe, 2016

- 5. Total Home Automation Systems Market: Revenue Forecast by Region, Europe, 2014–2022

- 6. Total Home Automation Systems Market: Percent Revenue Forecast by Distribution Channel, Europe, 2016 and 2022

- 7. Total Home Automation Systems Market: Company Market Share Analysis of Top 5 Participants, Europe, 2016

- 8. Total Home Automation Systems Market: Competitive Structure, Europe, 2016

- 9. Total Home Automation Systems Market: Mega Trends Impact, Europe, 2017–2022

- 10. Luxury Segment: Market Engineering Measurements, Europe, 2016

- 11. Luxury Segment: Company Market Share Analysis of Top 5 Participants, Europe, 2016

- 12. Mass Segment: Market Engineering Measurements, Europe, 2016

- 13. Mass Segment: Company Market Share Analysis of Top 5 Participants, Europe, 2016

- 14. Home Automation Systems Market: Company Market Share Analysis of Major Participants, United Kingdom, 2016

- 15. Home Automation Systems Market: Company Market Share Analysis of Major Participants, Germany, 2016

- 16. Home Automation Systems Market: Company Market Share Analysis of Major Participants, France, 2016

- 17. Home Automation Systems Market: Company Market Share Analysis of Major Participants, Italy, 2016

- 18. Home Automation Systems Market: Company Market Share Analysis of Major Participants, Spain, 2016

- 19. Home Automation Systems Market: Company Market Share Analysis of Major Participants, Poland, 2016

- 20. Home Automation Systems Market: Company Market Share Analysis of Major Participants, Scandinavia, 2016

- 21. Home Automation Systems Market: Company Market Share Analysis of Major Participants, Benelux, 2016

- 22. Home Automation Systems Market: Company Market Share Analysis of Major Participants, RoE, 2016

- 1. Total Home Automation Systems Market: Road Map, Global, 2014–2022

- 2. Total Home Automation Systems Market: Market Engineering Measurements, Europe, 2016

- 3. Total Home Automation Systems Market: Percent Revenue Breakdown, Europe, 2016

- 4. Total Home Automation Market: Distribution Channel Analysis, Europe, 2016

- 5. Total Home Automation Systems Market: Unit Shipment and Revenue Forecast, Europe, 2014–2022

- 6. Total Home Automation Systems Market: Average Price for Mass Segment, Europe, 2014–2022

- 7. Total Home Automation Systems Market: Average Price for Luxury Segment, Europe, 2014–2022

- 8. Total Home Automation Systems Market: Percent Revenue Forecast by Country, Europe, 2014–2022

- 9. Total Home Automation Systems Market: Revenue Forecast by Vertical Market, Europe, 2014–2022

- 10. Total Home Automation Systems Market: Percent Revenue Forecast by Distribution Channel, Europe, 2014–2022

- 11. Total Home Automation Systems Market: Percent Revenue Breakdown, Europe, 2016

- 12. Luxury Segment: Percent Revenue Breakdown, Europe, 2016

- 13. Luxury Segment: Unit Shipment and Revenue Forecast, Europe, 2014–2022

- 14. Luxury Segment: Average Price for Hardware Products, Europe, 2014–2022

- 15. Luxury Segment: Percent Revenue Breakdown, Europe, 2016

- 16. Mass Segment: Percent Revenue Breakdown, Europe, 2016

- 17. Mass Segment: Unit Shipment and Revenue Forecast, Europe, 2014–2022

- 18. Mass Segment: Average Price for Hardware Products, Europe, 2014–2022

- 19. Mass Segment: Percent Revenue Breakdown, Europe, 2016

- 20. Luxury Segment: Unit Shipment and Revenue Forecast, United Kingdom, 2014–2022

- 21. Mass Segment: Unit Shipment and Revenue Forecast, United Kingdom, 2014–2022

- 22. Luxury Segment: Percent Revenue Breakdown, United Kingdom, 2016

- 23. Mass Segment: Percent Revenue Breakdown, United Kingdom, 2016

- 24. Luxury Segment: Unit Shipment and Revenue Forecast, Germany, 2014–2022

- 25. Mass Segment: Unit Shipment and Revenue Forecast, Germany, 2014–2022

- 26. Luxury Segment: Percent Revenue Breakdown, Germany, 2016

- 27. Mass Segment: Percent Revenue Breakdown, Germany, 2016

- 28. Luxury Segment: Unit Shipment and Revenue Forecast, France, 2014–2022

- 29. Mass Segment: Unit Shipment and Revenue Forecast, France, 2014–2022

- 30. Luxury Segment: Percent Revenue Breakdown, France, 2016

- 31. Mass Segment: Percent Revenue Breakdown, France, 2016

- 32. Luxury Segment: Unit Shipment and Revenue Forecast, Italy, 2014–2022

- 33. Mass Segment: Unit Shipment and Revenue Forecast, Italy, 2014–2022

- 34. Luxury Segment: Percent Revenue Breakdown, Italy, 2016

- 35. Mass Segment: Percent Revenue Breakdown, Italy, 2016

- 36. Luxury Segment: Unit Shipment and Revenue Forecast, Spain, 2014–2022

- 37. Mass Segment: Unit Shipment and Revenue Forecast, Spain, 2014–2022

- 38. Luxury Segment: Percent Revenue Breakdown, Spain, 2016

- 39. Mass Segment: Percent Revenue Breakdown, Spain, 2016

- 40. Luxury Segment: Unit Shipment and Revenue Forecast, Poland, 2014–2022

- 41. Mass Segment: Unit Shipment and Revenue Forecast, Poland, 2014–2022

- 42. Luxury Segment: Percent Revenue Breakdown, Poland, 2016

- 43. Luxury Segment: Percent Revenue Breakdown, Poland, 2016

- 44. Luxury Segment: Unit Shipment and Revenue Forecast, Scandinavia, 2014–2022

- 45. Mass Segment: Unit Shipment and Revenue Forecast, Scandinavia, 2014–2022

- 46. Luxury Segment: Percent Revenue Breakdown, Scandinavia, 2016

- 47. Mass Segment: Percent Revenue Breakdown, Scandinavia, 2016

- 48. Luxury Segment: Unit Shipment and Revenue Forecast, Benelux, 2014–2022

- 49. Mass Segment: Unit Shipment and Revenue Forecast, Benelux, 2014–2022

- 50. Luxury Segment: Percent Revenue Breakdown, Benelux, 2016

- 51. Mass Segment: Percent Revenue Breakdown, Benelux, 2016

- 52. Luxury Segment: Unit Shipment and Revenue Forecast, RoE, 2014–2022

- 53. Mass Segment: Unit Shipment and Revenue Forecast, RoE, 2014–2022

- 54. Luxury Segment: Percent Revenue Breakdown, RoE, 2016

- 55. Mass Segment: Percent Revenue Breakdown, RoE, 2016

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Emerging Technology Roadmap~ || Market Engineering Measurements~ || CEO’s Perspective~ | Market Overview~ || Market Definitions~ || Market Segmentation~ || Market Distribution Channels~ | Drivers and Restraints—Total Home Automation Systems Market~ || Market Drivers~ || Market Restraints~ | Forecasts and Trends—Total Home Automation Systems Market~ || Market Engineering Measurements~ || Unit Shipment and Revenue Forecast~ || Mass Segment—Pricing Trends and Forecast~ || Luxury Segment—Pricing Trends and Forecast~ || Percent Revenue Forecast by Region~ || Revenue Forecast by Region~ || Revenue Forecast by Segment~ || Percent Revenue Forecast by Distribution Channel~ || Percent Revenue Forecast Discussion by Distribution Channel~ | Market Share and Competitive Analysis—Total Home Automation Systems Market~ || Market Share~ || Competitive Environment~ | Growth Opportunities and Companies to Action~ || Growth Opportunity 1—IoT-enabled Devices~ || Growth Opportunity 2—Big Data and Cloud~ || Growth Opportunity 3—Product Integration~ || Strategic Imperatives for Success and Growth~ | Mega Trends and Industry Convergence Implications~ || Home Automation Market—Mega Trends Impact~ || European Home Automation Market—Mega Trends Impact~ | Luxury Segment Breakdown~ || Luxury Segment Key Findings~ || Market Engineering Measurements~ || Unit Shipment and Revenue Forecast~ || Luxury Segment—Pricing Trends and Forecast~ || Market Share~ | Mass Segment Breakdown~ || Mass Segment Key Findings~ || Market Engineering Measurements~ || Unit Shipment and Revenue Forecast~ || Mass Segment—Pricing Trends and Forecast~ || Market Share~ | United Kingdom Analysis~ || Luxury Segment—Unit Shipment and Revenue Forecast~ || Mass Segment—Unit Shipment and Revenue Forecast~ || Luxury Segment—Market Share~ || Mass Segment—Market Share~ || Market Share Analysis~ | Germany Analysis~ || Luxury Segment—Unit Shipment and Revenue Forecast~ || Mass Segment—Unit Shipment and Revenue Forecast~ || Luxury Segment—Market Share~ || Mass Segment—Market Share~ || Market Share Analysis~ | France Analysis~ | Italy Analysis~ | Spain Analysis~ | Poland Analysis~ | Scandinavia Analysis~ | Benelux Analysis~ | Rest of Europe Analysis~ | The Last Word~ || 3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || List of Companies—Tier II and “Others”~ |

| List of Charts and Figures | 1. Total Home Automation Systems Market: Key Market Drivers, Europe, 2017–2022~ 2. Total Home Automation Systems Market: Key Market Drivers, Europe, 2017–2022~ 3. Total Home Automation Systems Market: Market Engineering Measurements, Europe, 2016~ 4. Total Home Automation Systems Market: Approximate Price Range, Europe, 2016 ~ 5. Total Home Automation Systems Market: Revenue Forecast by Region, Europe, 2014–2022~ 6. Total Home Automation Systems Market: Percent Revenue Forecast by Distribution Channel, Europe, 2016 and 2022~ 7. Total Home Automation Systems Market: Company Market Share Analysis of Top 5 Participants, Europe, 2016~ 8. Total Home Automation Systems Market: Competitive Structure, Europe, 2016~ 9. Total Home Automation Systems Market: Mega Trends Impact, Europe, 2017–2022~ 10. Luxury Segment: Market Engineering Measurements, Europe, 2016~ 11. Luxury Segment: Company Market Share Analysis of Top 5 Participants, Europe, 2016~ 12. Mass Segment: Market Engineering Measurements, Europe, 2016~ 13. Mass Segment: Company Market Share Analysis of Top 5 Participants, Europe, 2016~ 14. Home Automation Systems Market: Company Market Share Analysis of Major Participants, United Kingdom, 2016~ 15. Home Automation Systems Market: Company Market Share Analysis of Major Participants, Germany, 2016~ 16. Home Automation Systems Market: Company Market Share Analysis of Major Participants, France, 2016~ 17. Home Automation Systems Market: Company Market Share Analysis of Major Participants, Italy, 2016~ 18. Home Automation Systems Market: Company Market Share Analysis of Major Participants, Spain, 2016~ 19. Home Automation Systems Market: Company Market Share Analysis of Major Participants, Poland, 2016~ 20. Home Automation Systems Market: Company Market Share Analysis of Major Participants, Scandinavia, 2016~ 21. Home Automation Systems Market: Company Market Share Analysis of Major Participants, Benelux, 2016~ 22. Home Automation Systems Market: Company Market Share Analysis of Major Participants, RoE, 2016~| 1. Total Home Automation Systems Market: Road Map, Global, 2014–2022~ 2. Total Home Automation Systems Market: Market Engineering Measurements, Europe, 2016~ 3. Total Home Automation Systems Market: Percent Revenue Breakdown, Europe, 2016~ 4. Total Home Automation Market: Distribution Channel Analysis, Europe, 2016~ 5. Total Home Automation Systems Market: Unit Shipment and Revenue Forecast, Europe, 2014–2022~ 6. Total Home Automation Systems Market: Average Price for Mass Segment, Europe, 2014–2022~ 7. Total Home Automation Systems Market: Average Price for Luxury Segment, Europe, 2014–2022~ 8. Total Home Automation Systems Market: Percent Revenue Forecast by Country, Europe, 2014–2022~ 9. Total Home Automation Systems Market: Revenue Forecast by Vertical Market, Europe, 2014–2022~ 10. Total Home Automation Systems Market: Percent Revenue Forecast by Distribution Channel, Europe, 2014–2022~ 11. Total Home Automation Systems Market: Percent Revenue Breakdown, Europe, 2016~ 12. Luxury Segment: Percent Revenue Breakdown, Europe, 2016~ 13. Luxury Segment: Unit Shipment and Revenue Forecast, Europe, 2014–2022~ 14. Luxury Segment: Average Price for Hardware Products, Europe, 2014–2022~ 15. Luxury Segment: Percent Revenue Breakdown, Europe, 2016~ 16. Mass Segment: Percent Revenue Breakdown, Europe, 2016~ 17. Mass Segment: Unit Shipment and Revenue Forecast, Europe, 2014–2022~ 18. Mass Segment: Average Price for Hardware Products, Europe, 2014–2022~ 19. Mass Segment: Percent Revenue Breakdown, Europe, 2016~ 20. Luxury Segment: Unit Shipment and Revenue Forecast, United Kingdom, 2014–2022~ 21. Mass Segment: Unit Shipment and Revenue Forecast, United Kingdom, 2014–2022~ 22. Luxury Segment: Percent Revenue Breakdown, United Kingdom, 2016~ 23. Mass Segment: Percent Revenue Breakdown, United Kingdom, 2016~ 24. Luxury Segment: Unit Shipment and Revenue Forecast, Germany, 2014–2022~ 25. Mass Segment: Unit Shipment and Revenue Forecast, Germany, 2014–2022~ 26. Luxury Segment: Percent Revenue Breakdown, Germany, 2016~ 27. Mass Segment: Percent Revenue Breakdown, Germany, 2016~ 28. Luxury Segment: Unit Shipment and Revenue Forecast, France, 2014–2022~ 29. Mass Segment: Unit Shipment and Revenue Forecast, France, 2014–2022~ 30. Luxury Segment: Percent Revenue Breakdown, France, 2016~ 31. Mass Segment: Percent Revenue Breakdown, France, 2016~ 32. Luxury Segment: Unit Shipment and Revenue Forecast, Italy, 2014–2022~ 33. Mass Segment: Unit Shipment and Revenue Forecast, Italy, 2014–2022~ 34. Luxury Segment: Percent Revenue Breakdown, Italy, 2016~ 35. Mass Segment: Percent Revenue Breakdown, Italy, 2016~ 36. Luxury Segment: Unit Shipment and Revenue Forecast, Spain, 2014–2022~ 37. Mass Segment: Unit Shipment and Revenue Forecast, Spain, 2014–2022~ 38. Luxury Segment: Percent Revenue Breakdown, Spain, 2016~ 39. Mass Segment: Percent Revenue Breakdown, Spain, 2016~ 40. Luxury Segment: Unit Shipment and Revenue Forecast, Poland, 2014–2022~ 41. Mass Segment: Unit Shipment and Revenue Forecast, Poland, 2014–2022~ 42. Luxury Segment: Percent Revenue Breakdown, Poland, 2016~ 43. Luxury Segment: Percent Revenue Breakdown, Poland, 2016~ 44. Luxury Segment: Unit Shipment and Revenue Forecast, Scandinavia, 2014–2022~ 45. Mass Segment: Unit Shipment and Revenue Forecast, Scandinavia, 2014–2022~ 46. Luxury Segment: Percent Revenue Breakdown, Scandinavia, 2016~ 47. Mass Segment: Percent Revenue Breakdown, Scandinavia, 2016~ 48. Luxury Segment: Unit Shipment and Revenue Forecast, Benelux, 2014–2022~ 49. Mass Segment: Unit Shipment and Revenue Forecast, Benelux, 2014–2022~ 50. Luxury Segment: Percent Revenue Breakdown, Benelux, 2016~ 51. Mass Segment: Percent Revenue Breakdown, Benelux, 2016~ 52. Luxury Segment: Unit Shipment and Revenue Forecast, RoE, 2014–2022~ 53. Mass Segment: Unit Shipment and Revenue Forecast, RoE, 2014–2022~ 54. Luxury Segment: Percent Revenue Breakdown, RoE, 2016~ 55. Mass Segment: Percent Revenue Breakdown, RoE, 2016~ |

| Author | Harini Shankar |

| Industries | Environment |

| WIP Number | MCE0-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9343-A4,9596,9B07-C1,GETE |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB