Future of ASEAN, Forecast to 2025

Future of ASEAN, Forecast to 2025

Potential Contribution of the Integration of 10 SEA Nations to Regional Growth and New Opportunities across Sectors

14-Mar-2017

Asia Pacific

$4,950.00

Special Price $3,712.50 save 25 %

Description

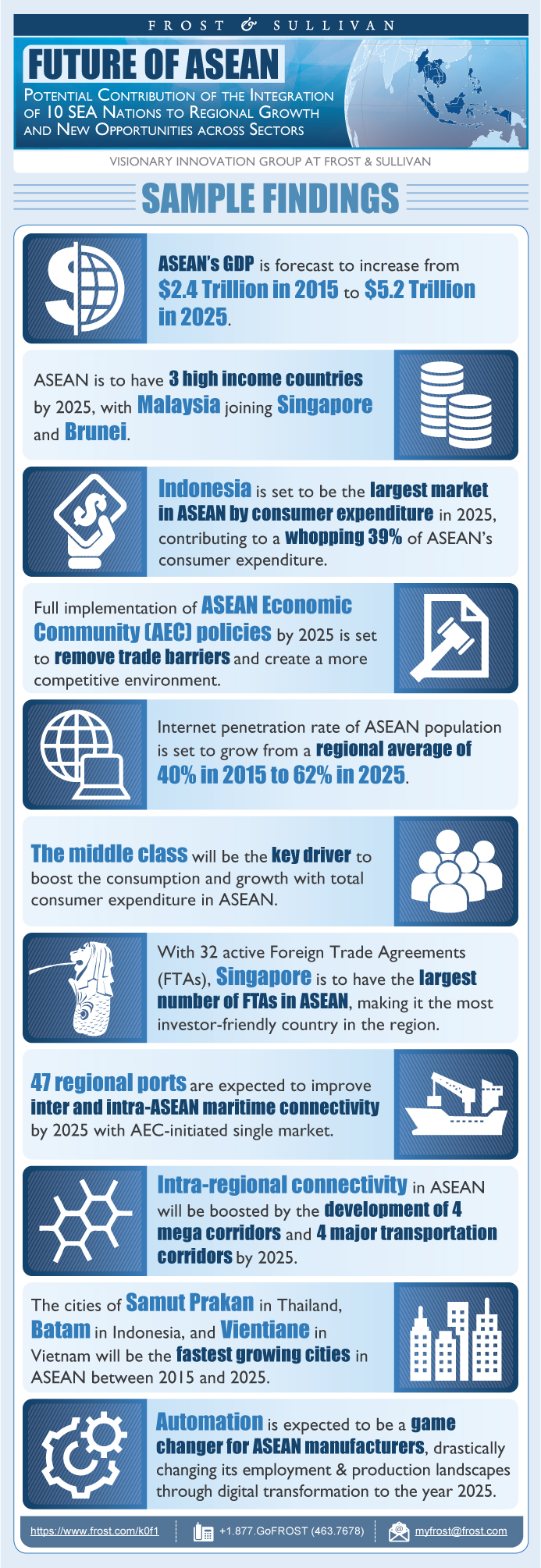

ASEAN’s GDP is forecast to increase from $2.4 Trillion in 2015 to $5.2 Trillion in 2025, largely due to the ongoing implementation of the AEC. This study examines the potential contributions of this integration to regional growth by analysing the impact of various Mega Trends and expanding on the predictions for each sector. It also analyses the new growth drivers and the areas of innovation most likely to seen in ASEAN until 2025. The study’s time frame is from 2015 to 2025.

ASEAN, at the current level of economic growth, is poised to become the fourth-largest market—after EU, US, and China—by 2030, supported by increased skilled workforce, abundant natural resources, and favourable geographic location for trade and commerce.

The huge regional economic integration of ASEAN would make ASEAN a single market and production base and create free movement of goods, services and labour like the European Union. This will boost the intra-regional trade both within ASEAN and among emerging Asia’s economies which will raise the economic growth levels.

Key Questions Addressed:

• What are the major Mega Trends the region will see in the next 10 years?

• What would be the impact of these Mega Trends on the economy and businesses of ASEAN?

• How the integration of ASEAN economy will impact the economy and business of the region

• What are the future prospects of this region that would lead to attract more global investments and market attention?

Key Features:

• Extensive research covering 11 Mega Trends that would have the most significant impact on ASEAN

• Each Mega Trend further divided into sub-trends to identify region-wise opportunities for investments in various sectors

• A macro-to-micro analysis to understand the unmet needs or inherent business opportunities in relevant industries

Key Topics:

• Implementation of the ASEAN Economic Community and its predicted effects of the economy of the region

• The Top 10 companies in ASEAN, in several sectors, including finance, manufacturing, telecommunication, O&G, mining and food production

• Economy and Trade: The expected growth in ASEAN economy as a result of regional integration, Foreign direct investment, foreign trade agreements, the forecast economic outlook of ASEAN nations until 2025

• Manufacturing: Contribution of manufacturing to ASEAN’s economy, the shift of manufacturing interest from China to ASEAN, the changing face of manufacturing in ASEAN as a result of technological advances, the growth of the Greater Mekong Sub region

• Digital trends: Connectivity in ASEAN, Internet economy, mobile economy, effects of an increasing digital population on businesses in ASEAN

• Infrastructure: Infrastructure funds in ASEAN, airports, rail network, ports, energy infrastructure

• Urbanization trends: Mega Cities, Mega Regions, Mega Corridors, and urbanization rate

• Social Trends: Demographic trends, middle class growth, women empowerment, and income distribution, consumer expenditure

• Future of energy: energy production and consumption, smart grids

• Future of mobility: multi-modal transport system, drone delivery, port automation, electronic road pricing, ride sharing apps, electric vehicles

• Future of Aviation: Open skies policy as a result of AEC, Airport traffic outlook, Aviation revenue

• Health and wellness: ASEAN healthcare revenue growth, healthcare opportunities, healthcare policies, healthcare services disparity across the region, healthcare IT trends

Future of Governance: South China Sea dispute, eGovernance, Government budgets,

ASEAN, a collaboration of 10 Southeast Asian nations (Brunei Darussalam, Myanmar, Cambodia, Indonesia, Laos, Malaysia, Philippines, Singapore, Thailand and Vietnam), is one of the fastest growing regions in Asia. Its growth over the next 10 years is expected to be driven by Mega Trends in various sectors. It is imperative that business and organizations with interests in the region equip themselves fully with knowledge on the present landscape and forecast changes, particularly as a result of the ongoing regional economic integration initiatives.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Top 10 Facts on the Future of ASEAN

Key Findings

The Frost & Sullivan ASEAN Index

Future of ASEAN—An Integrated Single Market

ASEAN Middle Class—363M people or 52% of the Population by 2025

Manufacturing—Expansion from China to ASEAN

Case Study—Singapore, ASEAN’s High-Value Manufacturing Capital

Connectivity in ASEAN

ASEAN Online Retail Sector to be Boosted by Increased Connectivity

Future of ASEAN Infrastructure

ASEAN Mega Regions—3 Mega Regions to Emerge in ASEAN by 2025

Social Trends—Population by Country

Future of Energy

Key Mobility Predictions for ASEAN, 2025

ASEAN Healthcare Policies & Business Opportunities

High Number of ASEAN FTAs to Accelerate Trade Growth

Research Scope

Research Aims and Objectives

Research Background

Research Methodology—From Macro to Micro

Definitions Used in the Study

List of Acronyms and Abbreviations

ASEAN Ranking Research Methodology

The Frost & Sullivan ASEAN Index

Parameters Used in the Frost & Sullivan ASEAN Index

Top ASEAN Companies by 2015 Revenue in Each Sector

Top 10 ASEAN Finance Companies, 2016

Top 10 ASEAN Manufacturing Companies, 2016

Top 10 ASEAN Telecommunication Companies, 2016

Top 10 ASEAN Infrastructure Companies, 2016

Top 10 ASEAN O&G Companies, 2016

Top 10 ASEAN Mining Companies, 2016

Top 10 ASEAN Food Producers, 2016

Top 10 ASEAN Energy Companies, 2016

Top 10 ASEAN Transportation Companies, 2016

Top 10 ASEAN Healthcare Companies, 2016

Top 10 Fastest Growing ASEAN Sectors, 2015

Top 10 ASEAN Cities of the Future (2015—2025)

Economic Trends—Highlights

2025 ASEAN Economic Dashboard

Future of the ASEAN Economy

2025 ASEAN Economic Outlook

ASEAN FDI Stock to be Worth $3.6 Trillion by 2025

ASEAN Economic Community—Timeline

High Number of ASEAN FTAs to Accelerate Trade Growth

ASEAN Member Nations in Negotiations for 3 Mega Regional FTAs

Implementation of AEC

Future of ASEAN Trade—Impact of AEC

Future of Manufacturing—Highlights

The Diverse Manufacturing Hotspots of ASEAN

Contribution of Manufacturing to ASEAN Economy

The Changing Face of Manufacturing in ASEAN

Future of Manufacturing in ASEAN

Shift in Manufacturing Focus from China to ASEAN

Manufacturing Expansion from China to ASEAN

The Greater Mekong Subregion

Future of ASEAN Manufacturing

Future of ASEAN

Key Challenges for ASEAN Manufacturers in 2025

Case Study—Thailand, the ASEAN Hub of Automotive Manufacturing

Case Study—Singapore, ASEAN’s High-Value Manufacturing Capital

ASEAN Food and Beverage Manufacturing

Future of ASEAN Manufacturing—Opportunities

Digital Trends—Highlights

Connectivity in ASEAN

Digital Trends—Social Media in ASEAN

Future of ASEAN Connectivity

ASEAN Online Retail Sector to be Boosted by Increased Connectivity

Connectivity in ASEAN

ASEAN Online Retail Opportunities

ASEAN Retail Sector

ASEAN Online Retail Platforms

Future of Infrastructure—Highlights

ASEAN Infrastructure Investment

ASEAN Infrastructure Fund (AIF)

Future of ASEAN Infrastructure

ASEAN Land Transportation Infrastructure Development

ASEAN Infrastructure—Maritime

ASEAN Energy Infrastructure Development until 2025

Trans-ASEAN Regional Gas Grid

Future of ASEAN Infrastructure—Rail Network

ASEAN Infrastructure—Airports

Green Buildings Market Dynamics

Urbanization Trends—Highlights

Main Trends in Urbanization

ASEAN Mega Cities—Five Mega Cities to Emerge in ASEAN by 2025

Fastest Growing ASEAN Cities

Mega City Case Study—Jakarta

ASEAN Mega Regions—3 Mega Regions to Emerge in ASEAN by 2025

Mega City Case Study—Malaysia

ASEAN Smart and Sustainable Cities

Case Study—Iskandar Smart City

ASEAN Mega Corridors

Elements of ASEAN Smart Cities

Singapore—An Aspirational Asian Smart City

Smart Traffic Management in Manila, Philippines

Urbanization Trends—Implications

Social Trends—Highlights

ASEAN’s Population Predicted to Reach 697 Million by 2025

Social Trends—Population Growth By Country

Social Trends—Gen Y Population by Country

Social Trends—Labor Pool

Social Trends—Job Opportunities

ASEAN Middle Class—363M People or 52% of the Population by 2025

Future of ASEAN Retail—Consumer Trends

Population— Other Indicators

Social Trends—Gender Gap

Social Trends—Female Work Participation

Future of ASEAN—Gender Equality

Future of Energy—Highlights

ASEAN Energy Landscape

Future of Energy

ASEAN Energy in the Age of Gas

LNG and Regasification Case Study—Indonesia

LNG and Regasification Case Study—Malaysia

Smart Grid Case Study—Putrajaya and Malacca in Malaysia

Tenaga Nasional Smart Meter Technology Roadmap

Future of ASEAN Smart Markets

Future of Mobility—Highlights

Key Mobility Predictions for ASEAN, 2025

Application of Technology to Ease Road Congestions in ASEAN Cities

Increasing Popularity of Mobile Apps for Transport in ASEAN

Future of Mobility—Automation

Future of Mobility—Urban Transportation

Future of Mobility—Multimodal Transport Options

Multi Modal Transport Options in Major ASEAN cities

Future of Mobility—Electric Vehicles

Future of Aviation—Highlights

ASEAN Aviation—Airport Traffic Outlook

Future of ASEAN Aviation

Future of ASEAN Aviation—Drivers

Health and Wellness—Highlights

ASEAN Healthcare Landscape

ASEAN Healthcare Services—Disparity Among Countries

ASEAN Healthcare Policies & Business Opportunities

ASEAN Healthcare Markets—Growth Forecast

ASEAN Healthcare—Market Trends

Future of ASEAN Healthcare—Impact of AEC on Healthcare

Future of ASEAN Healthcare—Areas of Opportunities

Key Trends in Healthcare Technologies

Mega Trends Impacting Growth of Healthcare IT in APAC

Future of ASEAN Healthcare—Remote Patient Monitoring

Future of ASEAN Healthcare—Aged Care

Future of ASEAN Healthcare—Medical Devices

Future of ASEAN Healthcare—Opportunities

Universal Health Coverage Roadmap in Select ASEAN Countries

Case Study—Integrated Health Information System, Singapore

South China Sea Dispute a Test of Unity for ASEAN

eGovernance—the Key to Transparency in ASEAN Nations

Very Slight Increases Forecast in ASEAN Government Budgets

Future of ASEAN—An Integrated Single Market

Full Implementation of AEC to Boost ASEAN Economic Growth

ASEAN to Become the World’s Next Factory Floor

Growing Number of ASEAN Netizens to Drive Online Retail Growth

Advancements in ASEAN Infrastructure to Support AEC Integration

ASEAN Food and Beverage Market to Develop New Tastes

High Urbanization Rates to Drive ASEAN Population to Cities

Increased Consumption by the Middle Class to Boost Retail Sales

Gas to Become ASEAN’s Main Energy Source

Higher Demand for Intra-ASEAN Travel due to AEC

Evolution of Healthcare Services to Meet the Needs of the Bulging Middle Class

Legal Disclaimer

- 1. Case Studies of Major Manufacturer’s Shift from China to ASEAN

- 2. Manufacturing Costs in Singapore, 2025

- 3. Key Digital Indicators, ASEAN, 2015

- 4. Top Product Categories in online retail (% of total retail of the product), ASEAN, 2025

- 5. Mega Regions and Potential Mega Regions, ASEAN, 2025

- 6. Gen Y Population by Country, ASEAN, 2025

- 7. Healthcare Policies & Business Opportunities, ASEAN, 2015–2025

- 8. ASEAN FTAs in Effect, 2015

- 9. Nominal GDP, ASEAN, 2015–2025 ($ Billion)

- 10. Drivers of Economic Growth, ASEAN, 2016–2025

- 11. Top 5 FDI Inflow, ASEAN, 2015

- 12. AEC Implementation Timeline, ASEAN, 2003–2030

- 13. Pending Mega-Regional Trade Agreement Trade Flows, Global, 2015

- 14. Manufacturing Hotspots, ASEAN, 2015

- 15. Average Industrial Land Price, ASEAN, 2015 (per sqm)

- 16. Average Office Rent, ASEAN, 2015 (per sqm)

- 17. Top Exports (% of total imports), GMS, 2005–2014

- 18. Key Challenges in Manufacturing, ASEAN, 2015–2025

- 19. Automotive Industry, Thailand, 2015

- 20. Manufacturing Costs in Singapore, 2025

- 21. Connectivity infrastructure, ASEAN, 2025

- 22. Major Maritime Ports, ASEAN, 2025

- 23. Trends in Maritime Infrastructure, ASEAN, 2015–2025

- 24. Plan of Action for Energy Cooperation (APAEC), ASEAN, 2016–2025

- 25. Regional Gas Grid, ASEAN, 2015–2025

- 26. Rail Network, ASEAN, 2025

- 27. Airport Infrastructure Developments, ASEAN, 2025

- 28. Mega Cities, ASEAN, 2025

- 29. Fastest Growing Second-Tier Cities, ASEAN, 2015–2025

- 30. Mega Cities, Indonesia, 2025

- 31. Mega Regions and Potential Mega Regions, ASEAN, 2025

- 32. Urbanisation and the Emergence of Mega Cities and Mega Regions, Malaysia, 2025

- 33. Smart and Sustainable Cities, ASEAN, 2025

- 34. Mega Corridors and Transportation Corridors, ASEAN, 2025

- 35. Other Population Indicators, ASEAN, 2015

- 36. Social trends, ASEAN, 2015–2025

- 37. Women’s Empowerment, ASEAN, 2015–2025

- 38. Gender Equality—Opportunities and Barriers, ASEAN, 2015–2025

- 39. Energy Predictions, ASEAN, 2015–2025

- 40. LNG and Regasification Projects, ASEAN, 2015–2025

- 41. LNG Liquefaction and Regasification Projects, Malaysia, 2015–2025

- 42. Integrated Urban Transport, ASEAN, 2025

- 43. Transport Options, ASEAN, 2015

- 44. Electric Vehicle Trends, ASEAN, 2014–2020

- 45. Airport Traffic Outlook, ASEAN, 2015–2025

- 46. Drivers of the Aviation Industry, ASEAN, 2016–2025

- 47. Healthcare Policies & Business Opportunities, ASEAN, 2015–2025

- 48. AEC Market Impact, ASEAN, 2015–2025

- 49. Opportunities in Healthcare, ASEAN, 2015–2025

- 50. Total Healthcare IT Market: Mega Trends Impacting Healthcare IT, APAC, 2015

- 51. Universal Health Coverage in Select ASEAN Countries, 2015

- 1. Middle Income Group Growth Analysis, ASEAN, China, India and LATAM, 2010 and 2025

- 2. Total Consumer Expenditure, ASEAN, 2015 and 2025

- 3. Internet Penetration Rate, ASEAN, 2025

- 4. Online Retail, ASEAN, 2015–2020

- 5. Gen Y Population (Million), ASEAN, 2015

- 6. Gen Y Population, ASEAN, 2025

- 7. Total Electricity Consumption, ASEAN, 2012–2020

- 8. Number of Concluded FTAs, ASEAN, 2014

- 9. Nominal GDP, ASEAN, 2015–2025 ($ Billion)

- 10. Top 5 Trade Partners, ASEAN, 2015, ($ Billion)

- 11. Trade as % of Global Trade, ASEAN, 2004–2025

- 12. GDP, ASEAN, 2015, 2020, and 2025

- 13. Estimated Time Required to Become High-Income Countries, ASEAN

- 14. Contributions to Additional GDP Growth due to AEC, ASEAN, 2025 (% of GDP)

- 15. FDI Stock, ASEAN, 2000–2030

- 16. Intra-ASEAN FDI Inflow

- 17. Shares by Sector, 2014 (%)

- 18. Number of Concluded FTAs, ASEAN, 2014

- 19. Manufacturing Value as a % of GDP, ASEAN, 2014

- 20. Employment in Each Subsector of Manufacturing, Select ASEAN Countries, 2014

- 21. GMS Merchandise Imports, Exports & Trade Balance, 2003–2025

- 22. FDI Flow, Greater Mekong Subregion, 2007–2025 ($ Million)

- 23. Quality of Trade-Related Infrastructure, ASEAN, 2007, 2014, and 2025

- 24. Cost to Export, ASEAN, 2005–2025

- 25. Time to Export, ASEAN, 2005–2025

- 26. GMS Intra-regional Trade Shares, ASEAN, 2010–2025

- 27. Automobile Production Capacity, Thailand, 2015

- 28. Rental Index of Industry Space, Singapore, 2013–2025

- 29. Packaged Food Retail, ASEAN, 2010–2025

- 30. Food Exports as a % of Total Exports, ASEAN, 2015

- 31. Social Media Users, ASEAN, 2015

- 32. Percentage of Netizens by Age Group, ASEAN, 2015

- 33. Average Internet Speed, ASEAN, 2015

- 34. Cost of Broadband as % of Gross Income, ASEAN 2014

- 35. Online Retail, ASEAN, 2015–2020

- 36. Retail Sales, Select ASEAN Countries, 2014–2025F

- 37. Infrastructure Investment Needs, ASEAN, 2025

- 38. Financing of AIF projects, ASEAN, 2012–2020

- 39. Building Construction Market Revenue Forecast, ASEAN, 2015–2020

- 40. Green Buildings Market: Opportunities Matrix, ASEAN, 2015–2025

- 41. Population by Age Group, ASEAN, 2015, 2025

- 42. Population by Country, ASEAN, 2025

- 43. Gen Y Population, ASEAN, 2015 (Million)

- 44. Gen Y Population, ASEAN, 2025 (Million)

- 45. Labor Force*, ASEAN, 2025

- 46. Change in Employment due to AEC, ASEAN, 2025

- 47. Changes in Wages with AEC Integration, ASEAN, 2025

- 48. Middle Income Group Growth Analysis, ASEAN, China, India and LATAM, 2010 and 2025

- 49. Total Consumer Expenditure, ASEAN, 2015 and 2025

- 50. Female Work Participation, ASEAN, 2015–2025

- 51. Share of Employment in Major Economic Sectors by Gender, ASEAN, 2015 and 2025

- 52. Total Electricity Consumption, ASEAN, 2012–2020

- 53. Installed Capacity, ASEAN, 2010–2025

- 54. Electric Generation Capacity, ASEAN, 2010–2025

- 55. % of Fossil & Carbon-free Power Generation, Global, 2030

- 56. Gas Production, Global, 2010–2025

- 57. Natural Gas Reserves, ASEAN, 2014

- 58. Smart Grid Market: Percent Revenue Forecast by Vertical Market, ASEAN, 2013–2019

- 59. Smart Grid Market: Sales by Country, ASEAN, 2014

- 60. Impact of Regional Integration on Renewable Energy, ASEAN, 2025

- 61. Future Mobility, ASEAN, 2025

- 62. Aviation Revenue, Southeast Asia, 2006–2025

- 63. Healthcare Market: Lifecycle Analysis by Nations, ASEAN, 2015

- 64. Country Indices, ASEAN, 2015

- 65. Private Hospital Service Market: Revenue, Select ASEAN Countries, 2014 and 2025

- 66. Healthcare Market Value, ASEAN, 2015 and 2025

- 67. Government Budgets, ASEAN, 2016 and 2020

- 68. Government Debt-to-GDP Ratio, ASEAN, 2014 and 2020

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Top 10 Facts on the Future of ASEAN~ || Key Findings~ || The Frost & Sullivan ASEAN Index~ || Future of ASEAN—An Integrated Single Market~ || ASEAN Middle Class—363M people or 52% of the Population by 2025~ || Manufacturing—Expansion from China to ASEAN~ || Case Study—Singapore, ASEAN’s High-Value Manufacturing Capital~ || Connectivity in ASEAN~ || ASEAN Online Retail Sector to be Boosted by Increased Connectivity~ || Future of ASEAN Infrastructure~ || ASEAN Mega Regions—3 Mega Regions to Emerge in ASEAN by 2025~ || Social Trends—Population by Country~ || Future of Energy~ || Key Mobility Predictions for ASEAN, 2025~ || ASEAN Healthcare Policies & Business Opportunities~ || High Number of ASEAN FTAs to Accelerate Trade Growth~ | Research Scope, Objective, and Methodology~ || Research Scope~ || Research Aims and Objectives~ || Research Background~ || Research Methodology—From Macro to Micro~ || Definitions Used in the Study~ || List of Acronyms and Abbreviations~ || ASEAN Ranking Research Methodology~ | The ASEAN Top 10~ || The Frost & Sullivan ASEAN Index~ || Parameters Used in the Frost & Sullivan ASEAN Index~ || Top ASEAN Companies by 2015 Revenue in Each Sector~ || Top 10 ASEAN Finance Companies, 2016~ || Top 10 ASEAN Manufacturing Companies, 2016~ || Top 10 ASEAN Telecommunication Companies, 2016~ || Top 10 ASEAN Infrastructure Companies, 2016~ || Top 10 ASEAN O&G Companies, 2016~ || Top 10 ASEAN Mining Companies, 2016~ || Top 10 ASEAN Food Producers, 2016~ || Top 10 ASEAN Energy Companies, 2016~ || Top 10 ASEAN Transportation Companies, 2016~ || Top 10 ASEAN Healthcare Companies, 2016~ || Top 10 Fastest Growing ASEAN Sectors, 2015~ || Top 10 ASEAN Cities of the Future (2015—2025)~ | Economic Trends~ || Economic Trends—Highlights~ || 2025 ASEAN Economic Dashboard~ || Future of the ASEAN Economy~ || 2025 ASEAN Economic Outlook~ || ASEAN FDI Stock to be Worth $3.6 Trillion by 2025~ || ASEAN Economic Community—Timeline~ || High Number of ASEAN FTAs to Accelerate Trade Growth~ || ASEAN Member Nations in Negotiations for 3 Mega Regional FTAs~ || Implementation of AEC~ || Future of ASEAN Trade—Impact of AEC~ | Future of Manufacturing~ || Future of Manufacturing—Highlights~ || The Diverse Manufacturing Hotspots of ASEAN~ || Contribution of Manufacturing to ASEAN Economy~ || The Changing Face of Manufacturing in ASEAN~ || Future of Manufacturing in ASEAN~ || Shift in Manufacturing Focus from China to ASEAN~ || Manufacturing Expansion from China to ASEAN~ || The Greater Mekong Subregion~ || Future of ASEAN Manufacturing~ || Future of ASEAN~ || Key Challenges for ASEAN Manufacturers in 2025~ || Case Study—Thailand, the ASEAN Hub of Automotive Manufacturing~ || Case Study—Singapore, ASEAN’s High-Value Manufacturing Capital~ || ASEAN Food and Beverage Manufacturing~ || Future of ASEAN Manufacturing—Opportunities~ | Digital Trends~ || Digital Trends—Highlights~ || Connectivity in ASEAN~ || Digital Trends—Social Media in ASEAN~ || Future of ASEAN Connectivity~ || ASEAN Online Retail Sector to be Boosted by Increased Connectivity~ || Connectivity in ASEAN~ || ASEAN Online Retail Opportunities~ || ASEAN Retail Sector~ || ASEAN Online Retail Platforms~ | Future of Infrastructure~ || Future of Infrastructure—Highlights~ || ASEAN Infrastructure Investment~ || ASEAN Infrastructure Fund (AIF)~ || Future of ASEAN Infrastructure~ || ASEAN Land Transportation Infrastructure Development~ || ASEAN Infrastructure—Maritime~ || ASEAN Energy Infrastructure Development until 2025~ || Trans-ASEAN Regional Gas Grid~ || Future of ASEAN Infrastructure—Rail Network~ || ASEAN Infrastructure—Airports~ || Green Buildings Market Dynamics~ | Urbanization Trends~ || Urbanization Trends—Highlights~ || Main Trends in Urbanization~ || ASEAN Mega Cities—Five Mega Cities to Emerge in ASEAN by 2025~ || Fastest Growing ASEAN Cities~ || Mega City Case Study—Jakarta~ || ASEAN Mega Regions—3 Mega Regions to Emerge in ASEAN by 2025~ || Mega City Case Study—Malaysia~ || ASEAN Smart and Sustainable Cities~ || Case Study—Iskandar Smart City~ || ASEAN Mega Corridors~ || Elements of ASEAN Smart Cities~ || Singapore—An Aspirational Asian Smart City~ || Smart Traffic Management in Manila, Philippines~ || Urbanization Trends—Implications~ | Social Trends~ || Social Trends—Highlights~ || ASEAN’s Population Predicted to Reach 697 Million by 2025~ || Social Trends—Population Growth By Country~ || Social Trends—Gen Y Population by Country~ || Social Trends—Labor Pool~ || Social Trends—Job Opportunities~ || ASEAN Middle Class—363M People or 52% of the Population by 2025~ || Future of ASEAN Retail—Consumer Trends~ || Population— Other Indicators~ || Social Trends—Gender Gap~ || Social Trends—Female Work Participation~ || Future of ASEAN—Gender Equality~ | Future of Energy~ || Future of Energy—Highlights~ || ASEAN Energy Landscape~ || Future of Energy~ || ASEAN Energy in the Age of Gas~ || LNG and Regasification Case Study—Indonesia~ || LNG and Regasification Case Study—Malaysia~ || Smart Grid Case Study—Putrajaya and Malacca in Malaysia~ || Tenaga Nasional Smart Meter Technology Roadmap~ || Future of ASEAN Smart Markets~ | Future of Mobility~ || Future of Mobility—Highlights~ || Key Mobility Predictions for ASEAN, 2025~ || Application of Technology to Ease Road Congestions in ASEAN Cities~ || Increasing Popularity of Mobile Apps for Transport in ASEAN~ || Future of Mobility—Automation~ || Future of Mobility—Urban Transportation~ || Future of Mobility—Multimodal Transport Options~ || Multi Modal Transport Options in Major ASEAN cities~ || Future of Mobility—Electric Vehicles~ | Future of Aviation~ || Future of Aviation—Highlights~ || ASEAN Aviation—Airport Traffic Outlook~ || Future of ASEAN Aviation~ || Future of ASEAN Aviation—Drivers~ | Health and Wellness~ || Health and Wellness—Highlights~ || ASEAN Healthcare Landscape~ || ASEAN Healthcare Services—Disparity Among Countries~ || ASEAN Healthcare Policies & Business Opportunities~ || ASEAN Healthcare Markets—Growth Forecast~ || ASEAN Healthcare—Market Trends~ || Future of ASEAN Healthcare—Impact of AEC on Healthcare~ || Future of ASEAN Healthcare—Areas of Opportunities~ || Key Trends in Healthcare Technologies~ || Mega Trends Impacting Growth of Healthcare IT in APAC~ || Future of ASEAN Healthcare—Remote Patient Monitoring~ || Future of ASEAN Healthcare—Aged Care~ || Future of ASEAN Healthcare—Medical Devices~ || Future of ASEAN Healthcare—Opportunities~ || Universal Health Coverage Roadmap in Select ASEAN Countries~ || Case Study—Integrated Health Information System, Singapore~ | Future of Governance~ || South China Sea Dispute a Test of Unity for ASEAN~ || eGovernance—the Key to Transparency in ASEAN Nations~ || Very Slight Increases Forecast in ASEAN Government Budgets~ | Future of ASEAN (In Summary)~ || Future of ASEAN—An Integrated Single Market~ || Full Implementation of AEC to Boost ASEAN Economic Growth~ || ASEAN to Become the World’s Next Factory Floor~ || Growing Number of ASEAN Netizens to Drive Online Retail Growth~ || Advancements in ASEAN Infrastructure to Support AEC Integration~ || ASEAN Food and Beverage Market to Develop New Tastes~ || High Urbanization Rates to Drive ASEAN Population to Cities~ || Increased Consumption by the Middle Class to Boost Retail Sales~ || Gas to Become ASEAN’s Main Energy Source~ || Higher Demand for Intra-ASEAN Travel due to AEC~ || Evolution of Healthcare Services to Meet the Needs of the Bulging Middle Class~ || Legal Disclaimer~ | The Frost & Sullivan Story~ |

| List of Charts and Figures | 1. Case Studies of Major Manufacturer’s Shift from China to ASEAN~ 2. Manufacturing Costs in Singapore, 2025~ 3. Key Digital Indicators, ASEAN, 2015~ 4. Top Product Categories in online retail (% of total retail of the product), ASEAN, 2025 ~ 5. Mega Regions and Potential Mega Regions, ASEAN, 2025~ 6. Gen Y Population by Country, ASEAN, 2025~ 7. Healthcare Policies & Business Opportunities, ASEAN, 2015–2025~ 8. ASEAN FTAs in Effect, 2015~ 9. Nominal GDP, ASEAN, 2015–2025 ($ Billion) ~ 10. Drivers of Economic Growth, ASEAN, 2016–2025~ 11. Top 5 FDI Inflow, ASEAN, 2015~ 12. AEC Implementation Timeline, ASEAN, 2003–2030~ 13. Pending Mega-Regional Trade Agreement Trade Flows, Global, 2015~ 14. Manufacturing Hotspots, ASEAN, 2015~ 15. Average Industrial Land Price, ASEAN, 2015 (per sqm)~ 16. Average Office Rent, ASEAN, 2015 (per sqm)~ 17. Top Exports (% of total imports), GMS, 2005–2014 ~ 18. Key Challenges in Manufacturing, ASEAN, 2015–2025~ 19. Automotive Industry, Thailand, 2015 ~ 20. Manufacturing Costs in Singapore, 2025~ 21. Connectivity infrastructure, ASEAN, 2025~ 22. Major Maritime Ports, ASEAN, 2025~ 23. Trends in Maritime Infrastructure, ASEAN, 2015–2025~ 24. Plan of Action for Energy Cooperation (APAEC), ASEAN, 2016–2025 ~ 25. Regional Gas Grid, ASEAN, 2015–2025~ 26. Rail Network, ASEAN, 2025~ 27. Airport Infrastructure Developments, ASEAN, 2025~ 28. Mega Cities, ASEAN, 2025~ 29. Fastest Growing Second-Tier Cities, ASEAN, 2015–2025~ 30. Mega Cities, Indonesia, 2025~ 31. Mega Regions and Potential Mega Regions, ASEAN, 2025~ 32. Urbanisation and the Emergence of Mega Cities and Mega Regions, Malaysia, 2025~ 33. Smart and Sustainable Cities, ASEAN, 2025~ 34. Mega Corridors and Transportation Corridors, ASEAN, 2025~ 35. Other Population Indicators, ASEAN, 2015~ 36. Social trends, ASEAN, 2015–2025~ 37. Women’s Empowerment, ASEAN, 2015–2025~ 38. Gender Equality—Opportunities and Barriers, ASEAN, 2015–2025~ 39. Energy Predictions, ASEAN, 2015–2025~ 40. LNG and Regasification Projects, ASEAN, 2015–2025~ 41. LNG Liquefaction and Regasification Projects, Malaysia, 2015–2025~ 42. Integrated Urban Transport, ASEAN, 2025~ 43. Transport Options, ASEAN, 2015~ 44. Electric Vehicle Trends, ASEAN, 2014–2020~ 45. Airport Traffic Outlook, ASEAN, 2015–2025~ 46. Drivers of the Aviation Industry, ASEAN, 2016–2025~ 47. Healthcare Policies & Business Opportunities, ASEAN, 2015–2025~ 48. AEC Market Impact, ASEAN, 2015–2025 ~ 49. Opportunities in Healthcare, ASEAN, 2015–2025~ 50. Total Healthcare IT Market: Mega Trends Impacting Healthcare IT, APAC, 2015~ 51. Universal Health Coverage in Select ASEAN Countries, 2015~| 1. Middle Income Group Growth Analysis, ASEAN, China, India and LATAM, 2010 and 2025 ~ 2. Total Consumer Expenditure, ASEAN, 2015 and 2025~ 3. Internet Penetration Rate, ASEAN, 2025 ~ 4. Online Retail, ASEAN, 2015–2020~ 5. Gen Y Population (Million), ASEAN, 2015~ 6. Gen Y Population, ASEAN, 2025 ~ 7. Total Electricity Consumption, ASEAN, 2012–2020~ 8. Number of Concluded FTAs, ASEAN, 2014~ 9. Nominal GDP, ASEAN, 2015–2025 ($ Billion) ~ 10. Top 5 Trade Partners, ASEAN, 2015, ($ Billion)~ 11. Trade as % of Global Trade, ASEAN, 2004–2025 ~ 12. GDP, ASEAN, 2015, 2020, and 2025~ 13. Estimated Time Required to Become High-Income Countries, ASEAN~ 14. Contributions to Additional GDP Growth due to AEC, ASEAN, 2025 (% of GDP)~ 15. FDI Stock, ASEAN, 2000–2030~ 16. Intra-ASEAN FDI Inflow ~ 17. Shares by Sector, 2014 (%)~ 18. Number of Concluded FTAs, ASEAN, 2014~ 19. Manufacturing Value as a % of GDP, ASEAN, 2014~ 20. Employment in Each Subsector of Manufacturing, Select ASEAN Countries, 2014~ 21. GMS Merchandise Imports, Exports & Trade Balance, 2003–2025~ 22. FDI Flow, Greater Mekong Subregion, 2007–2025 ($ Million)~ 23. Quality of Trade-Related Infrastructure, ASEAN, 2007, 2014, and 2025~ 24. Cost to Export, ASEAN, 2005–2025~ 25. Time to Export, ASEAN, 2005–2025~ 26. GMS Intra-regional Trade Shares, ASEAN, 2010–2025~ 27. Automobile Production Capacity, Thailand, 2015~ 28. Rental Index of Industry Space, Singapore, 2013–2025~ 29. Packaged Food Retail, ASEAN, 2010–2025~ 30. Food Exports as a % of Total Exports, ASEAN, 2015~ 31. Social Media Users, ASEAN, 2015~ 32. Percentage of Netizens by Age Group, ASEAN, 2015~ 33. Average Internet Speed, ASEAN, 2015~ 34. Cost of Broadband as % of Gross Income, ASEAN 2014~ 35. Online Retail, ASEAN, 2015–2020~ 36. Retail Sales, Select ASEAN Countries, 2014–2025F~ 37. Infrastructure Investment Needs, ASEAN, 2025~ 38. Financing of AIF projects, ASEAN, 2012–2020~ 39. Building Construction Market Revenue Forecast, ASEAN, 2015–2020 ~ 40. Green Buildings Market: Opportunities Matrix, ASEAN, 2015–2025 ~ 41. Population by Age Group, ASEAN, 2015, 2025 ~ 42. Population by Country, ASEAN, 2025~ 43. Gen Y Population, ASEAN, 2015 (Million) ~ 44. Gen Y Population, ASEAN, 2025 (Million) ~ 45. Labor Force*, ASEAN, 2025 ~ 46. Change in Employment due to AEC, ASEAN, 2025~ 47. Changes in Wages with AEC Integration, ASEAN, 2025~ 48. Middle Income Group Growth Analysis, ASEAN, China, India and LATAM, 2010 and 2025 ~ 49. Total Consumer Expenditure, ASEAN, 2015 and 2025~ 50. Female Work Participation, ASEAN, 2015–2025~ 51. Share of Employment in Major Economic Sectors by Gender, ASEAN, 2015 and 2025~ 52. Total Electricity Consumption, ASEAN, 2012–2020~ 53. Installed Capacity, ASEAN, 2010–2025 ~ 54. Electric Generation Capacity, ASEAN, 2010–2025~ 55. % of Fossil & Carbon-free Power Generation, Global, 2030~ 56. Gas Production, Global, 2010–2025~ 57. Natural Gas Reserves, ASEAN, 2014~ 58. Smart Grid Market: Percent Revenue Forecast by Vertical Market, ASEAN, 2013–2019~ 59. Smart Grid Market: Sales by Country, ASEAN, 2014~ 60. Impact of Regional Integration on Renewable Energy, ASEAN, 2025~ 61. Future Mobility, ASEAN, 2025~ 62. Aviation Revenue, Southeast Asia, 2006–2025~ 63. Healthcare Market: Lifecycle Analysis by Nations, ASEAN, 2015~ 64. Country Indices, ASEAN, 2015~ 65. Private Hospital Service Market: Revenue, Select ASEAN Countries, 2014 and 2025~ 66. Healthcare Market Value, ASEAN, 2015 and 2025~ 67. Government Budgets, ASEAN, 2016 and 2020~ 68. Government Debt-to-GDP Ratio, ASEAN, 2014 and 2020 ~ |

| Author | Anees Noor |

| Industries | Cross Industries |

| WIP Number | K0F1-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB