Top 50 Start-ups Advancing Decarbonization and Digitalization in the Global Homes & Buildings Industry

Top 50 Start-ups Advancing Decarbonization and Digitalization in the Global Homes & Buildings Industry

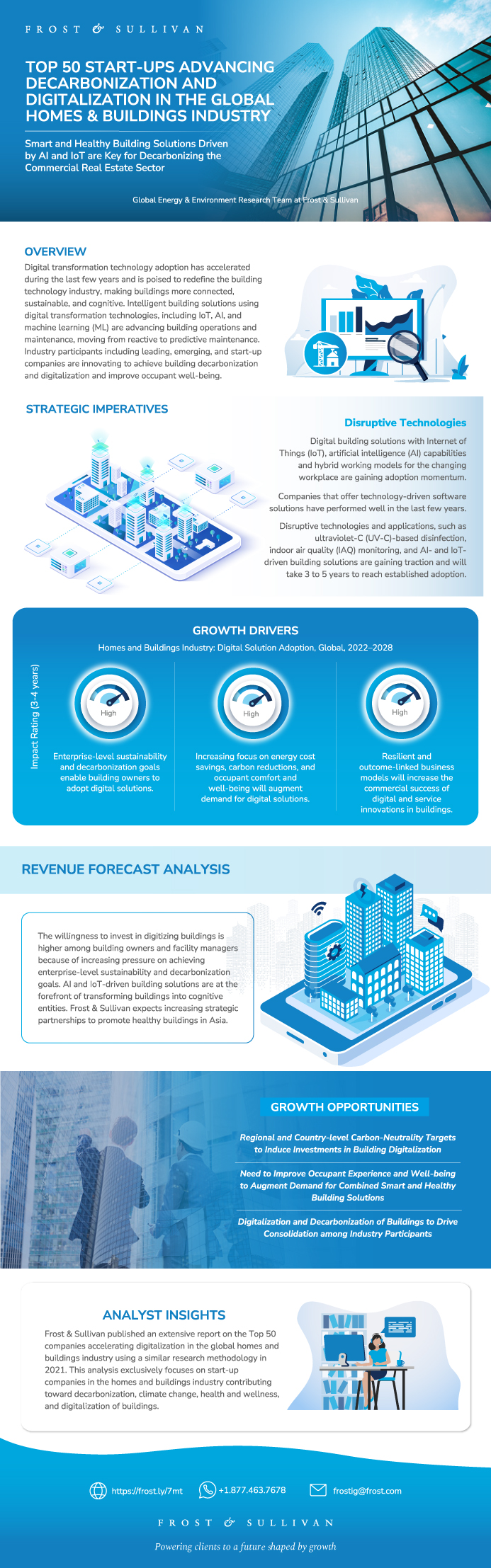

Smart and Healthy Building Solutions Driven by AI and IoT are Key for Decarbonizing the Commercial Real Estate Sector

30-Aug-2022

Global

Market Research

$4,950.00

Special Price $4,207.50 save 15 %

Description

Digital transformation technology adoption has accelerated during the last few years and is poised to transform the building technology industry, making buildings more connected, sustainable, and cognitive. Intelligent building solutions using digital transformation technologies, including IoT, AI, and machine learning (ML), are advancing building operations and maintenance, moving from reactive to predictive maintenance. Industry participants, including leading, emerging, and start-up companies, innovate to achieve building decarbonization and digitalization and improve occupant well-being.

Frost & Sullivan published an extensive report on the Top 50 companies accelerating digitalization in the global homes and buildings industry using a similar research methodology in 2021. This research exclusively focuses on start-up companies in the homes and buildings industry contributing toward decarbonization, climate change, health and wellness, and digitalization of buildings. Frost & Sullivan estimates the global venture capital, private equity, and corporate investments into smart building technology start-ups to be $13 billion for 2021, double the $6 billion investment in 2020. Using scientific methods, industry expert dialogues, and decision support matrices, we have identified the top 50 digital start-up best practitioners across the homes and buildings industry.

Author: Anirudh Bhaskaran

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why is it Increasingly Difficult To Grow?

The Strategic Imperative 8™

The Impact of the Top 3 Strategic Imperatives on the Homes and Buildings Industry

Growth Opportunities Fuel the Growth Pipeline Engine™

Research Overview

How You Can Leverage This Research—Reader-based View

Top 50 Start-up Best Practitioners

Top 50 Start-up Best Practitioners (continued)

Top 50 Start-up Best Practitioners (continued)

Top 50 Start-up Best Practitioners (continued)

Top 50 Start-up Best Practitioners (continued)

Top 50 Start-up Best Practitioners (continued)

Top 50 Start-up Best Practitioners (continued)

Top 50 Start-ups—Segmentation by Region and Market Segments

Top 50 Start-ups—Segmentation by Funding Received and Estimated Revenue

Top Start-ups by Total Disclosed Funding

Research Scope

Industry Segmentation

Definition of Digital Services this Research Considers

Start-up Analysis and Research Methodology

Start-up Analysis and Research Methodology (continued)

Start-up Analysis and Research Methodology (continued)

Executive Dashboard

Investments in Smart Building Technologies through Private Equity, Venture Capital, and Corporate Sector

Partnerships, Acquisitions, and Investments by Leading Companies Since 2020

Partnerships, Acquisitions, and Investments by Leading Companies Since 2020 (continued)

Partnerships, Acquisitions, and Investments by Leading Companies Since 2020 (continued)

Partnerships, Acquisitions, and Investments by Leading Companies Since 2020 (continued)

Total Addressable Market of Digital Solutions in Homes and Buildings Industry

Growth Drivers for Digital Solution Adoption across the Homes and Buildings Industry

Growth Restraints for Digital Solution Adoption across the Homes and Buildings Industry

Forecast Assumptions

Revenue Forecast

Digital Solution Revenue Forecast by Service Components

Revenue Forecast Analysis

Ambi Labs

Arloid Automation

Augury

Brain4Energy

Braiven

Citron

Clairify

Comfy

Cohesion

Cortex

DABBEL

DARWIN

Deepki

Elevation

Eliq

Energyly

Envio Systems

Facil.ai

Facilio

GrowFlux

Guru Systems

Hank

HAVEN IAQ

Hello Energy

Innowatts

IOTomation

Kapacity.io

Kognition

Kontrol Technologies

Leanheat

Metrikus

METRON

Nomad Go

Numina

Nuuka

One Concern

Openergy

PHYSEE

qlair

Resync

R8tech

Sensemetrics

SpaceIQ

Spaceti

Sobre Energie

Tibber

Tignis

Ventive

VergeSense

Wattsense

Growth Opportunity 1—Regional and Country-level Carbon-Neutrality Targets to Induce Investments in Building Digitalization

Growth Opportunity 1—Regional and Country-level Carbon-Neutrality Targets to Induce Investments in Building Digitalization (continued)

Growth Opportunity 2—Need to Improve Occupant Experience and Wellbeing to Augment Demand for Combined Smart and Healthy Building Solutions

Growth Opportunity 2—Need to Improve Occupant Experience and Wellbeing to Augment Demand for Combined Smart and Healthy Building Solutions (continued)

Growth Opportunity 3—Digitalization and Decarbonization of Buildings to Drive Consolidation among Industry Participants

Growth Opportunity 3—Digitalization and Decarbonization of Buildings to Drive Consolidation among Industry Participants (continued)

1. Engage with Our Growth Pipeline as a Service (GPaaS) Platform to Understand the Need for Strategic Pivots and to Thrive Tomorrow

2. Develop the Industry’s Best and Credible Portfolio to Amplify Your Product Positioning and Accelerate the Demand Generation Needs

3. Study License for Reprint & Integration with Landing Page

4. Virtual Think Tanks, Led and Moderated by Frost & Sullivan

5. Consulting Services Portfolio to Meet Your Bespoke Requirements

Your Next Steps

Why Frost, Why Now?

List of Exhibits

Legal Disclaimer

Popular Topics

| Deliverable Type | Market Research |

|---|---|

| Author | Anirudh Bhaskaran |

| Industries | Environment |

| No Index | No |

| Is Prebook | No |

| Keyword 1 | digitalization of buildings |

| Keyword 2 | climate change |

| Keyword 3 | decarbonization |

| Podcast | No |

| WIP Number | PD49-01-00-00-00 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB