US DoD C4ISR

US DoD C4ISR

Systems and Commercial Technology Integration

RELEASE DATE

18-Sep-2015

18-Sep-2015

REGION

North America

North America

Deliverable Type

Market Research

Market Research

Research Code: NFA9-01-00-00-00

SKU: AE00086-NA-MR_00086

$4,950.00

In stock

SKU

AE00086-NA-MR_00086

Description

This research service focuses on the US Department of Defense (DoD) command and control, communications, computers, intelligence, and surveillance and reconnaissance (C4ISR) budget spending. Included in this study is an analysis of research, development, test, and evaluation (RDT&E); procurement; operations and maintenance (O&M); and a variety of services. Contract activity for the DoD C4ISR for 2014 is also included. The DoD C4ISR 2016 budget comprises of Army, Navy/Marine Corps, Air Force, and Joint Service spending plans, all of which are included. The base year for financial spending is 2014, and the market forecast is from 2014 to 2020.

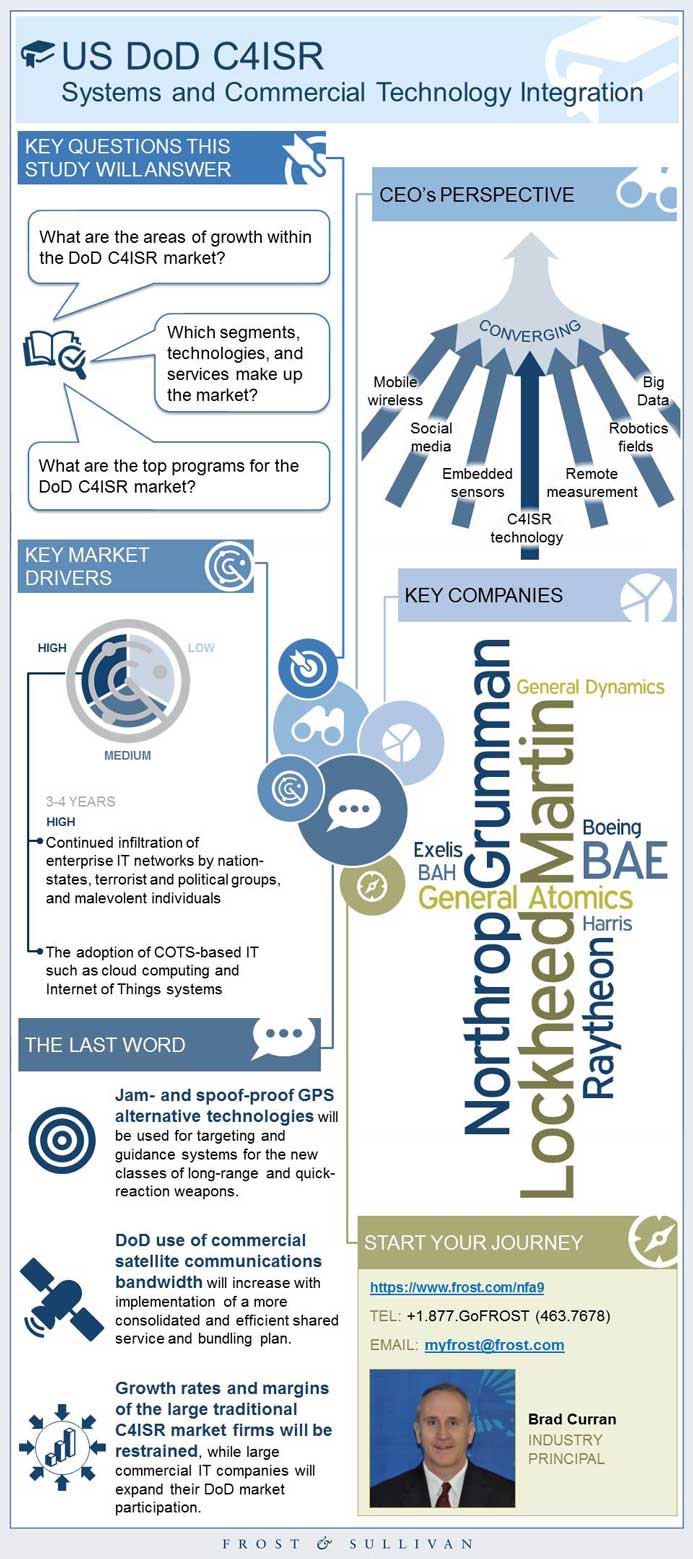

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

CEO’s Perspective

Market Definitions

Market Segmentation

Market Drivers

Market Restraints

DoD C4ISR Spending Forecast

Market Share

Market Share Analysis

Competitive Environment

Top 10 DoD C4ISR Contractors

- DoD C4ISR: Percent of Contract Value, US, 2014

Market Leaders by Technology

Command and Control (C2)

Communications

Computers

Intelligence

Intelligence

S&R

Multipurpose

EW/IO

- C2 Program Funding

- Top 10 C2 Contractors

- C2 Contracts by Technology

3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

- 1. DoD C4ISR: Spending Forecast by Department, US, 2014–2016

- 2. DoD C4ISR: Spending Forecast by Category, US, 2014–2016

- 3. DoD C4ISR: Spending Forecast by Segment, US, 2014–2016

- 4. DoD C4ISR: Company Market Share Analysis of Top 5 Participants, US, 2014

- 5. DoD C4ISR: Top 10 Contractors, US, 2014

- 6. DoD C4ISR: Market Leaders by Technology, US, 2014

- 7. DoD C4ISR: C2 Funding by Department, US, 2014–2016

- 8. DoD C4ISR: C2 Funding by Category, US, 2014–2016

- 9. DoD C4ISR: Top 10 C2 Contractors, US, 2014

- 10. DoD C4ISR: C2 Contracts by Technology, US, 2014

- 11. DoD C4ISR: Communications Funding by Department, US, 2014–2016

- 12. DoD C4ISR: Communications Funding by Category, US, 2014–2016

- 13. DoD C4ISR: Top 10 Communications Contractors, US, 2014

- 14. DoD C4ISR: Communications Contracts by Technology, US, 2014

- 15. DoD C4ISR: Computers Funding by Department, US, 2014–2016

- 16. DoD C4ISR: Computers Funding by Category, US, 2014–2016

- 17. DoD C4ISR: Top 10 Computers Contractors, US, 2014

- 18. DoD C4ISR: Computers Contracts by Technology, US, 2014

- 19. DoD C4ISR: Intelligence Funding by Department, US, 2014–2016

- 20. DoD C4ISR: Intelligence Funding by Category, US, 2014–2016

- 21. DoD C4ISR: Top 10 Intelligence Contractors, US, 2014

- 22. DoD C4ISR: Intelligence Contracts by Technology, US, 2014

- 23. DoD C4ISR: S&R Funding by Department, US, 2014–2016

- 24. DoD C4ISR: S&R Funding by Category, US, 2014–2016

- 25. DoD C4ISR: Top 10 S&R Contractors, US, 2014

- 26. DoD C4ISR: S&R Contracts by Technology, US, 2014

- 27. DoD C4ISR: Top 10 Multipurpose Contractors, US, 2014

- 28. DoD C4ISR: Multipurpose Contracts by Technology, US, 2014

- 29. DoD C4ISR: EW/IO Funding by Department, US, 2014–2016

- 30. DoD C4ISR: EW/IO Funding by Category, US, 2014–2016

- 31. DoD C4ISR: Top 10 EW/IO Contractors, US, 2014

- 32. DoD C4ISR: Electronic Warfare/Information Operations Contracts by Technology, US, 2014

- 1. DoD C4ISR: C4ISR Spending Forecast, US, 2014–2020

- 2. DoD C4ISR: Percent of Contract Value, US, 2014

Popular Topics

This research service focuses on the US Department of Defense (DoD) command and control, communications, computers, intelligence, and surveillance and reconnaissance (C4ISR) budget spending. Included in this study is an analysis of research, development, test, and evaluation (RDT&E); procurement; operations and maintenance (O&M); and a variety of services. Contract activity for the DoD C4ISR for 2014 is also included. The DoD C4ISR 2016 budget comprises of Army, Navy/Marine Corps, Air Force, and Joint Service spending plans, all of which are included. The base year for financial spending is 2014, and the market forecast is from 2014 to 2020.

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || CEO’s Perspective~ | C4ISR Market Overview~ || Market Definitions~ || Market Segmentation~ ||| DoD C4ISR: Segments, Technologies, and Services*, US, 2014~ |||| Command and Control (C2)~ |||| Communications~ |||| Computers~ |||| Intelligence~ |||| Others ~ | Drivers and Restraints—DoD C4ISR~ || Market Drivers~ ||| Continued infiltration of enterprise IT networks by nation-states, terrorist and political groups, and malevolent individuals~ ||| The adoption of COTS-based IT such as cloud computing and *IoT systems~ || Market Restraints~ ||| Non-competitive acquisition awards are accelerating~ ||| Force reductions~ | Forecast and Trends—DoD C4ISR~ || DoD C4ISR Spending Forecast~ | Market Share and Competitive Analysis— DoD C4ISR~ || Market Share~ ||| DoD C4ISR: Percent of Contract Value, US, 2014~ |||| Lockheed Martin~ |||| Northrop Grumman~ |||| BAE~ |||| Raytheon~ |||| Others~ || Market Share Analysis~ || Competitive Environment~ || Top 10 DoD C4ISR Contractors~ || Market Leaders by Technology~ | C4ISR Breakdown~ || Command and Control (C2)~ ||| C2 Program Funding~ ||| Top 10 C2 Contractors~ ||| C2 Contracts by Technology~ || Communications~ ||| Program Funding~ ||| Top 10 Communications Contractors~ ||| Communications Contracts by Technology ~ || Computers~ ||| Program Funding~ ||| Top 10 Computers Contractors~ ||| Computers Contracts by Technology~ || Intelligence~ ||| Program Funding~ ||| Top 10 Computers Contractors~ ||| Computers Contracts by Technology~ || Intelligence~ ||| Program Funding~ ||| Top 10 Intelligence Contractors~ ||| Intelligence Contracts by Technology~ || S&R~ ||| Program Funding~ ||| Top 10 S&R Contractors~ || Multipurpose~ ||| Top 10 Multipurpose Contractors~ ||| Multipurpose Contracts by Technology~ || EW/IO~ ||| Program Funding~ ||| Top 10 EW/IO Contractors~ ||| EW/IO Contracts by Technology~ | The Last Word~ || 3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ |

| List of Charts and Figures | 1. DoD C4ISR: Spending Forecast by Department, US, 2014–2016~ 2. DoD C4ISR: Spending Forecast by Category, US, 2014–2016~ 3. DoD C4ISR: Spending Forecast by Segment, US, 2014–2016~ 4. DoD C4ISR: Company Market Share Analysis of Top 5 Participants, US, 2014~ 5. DoD C4ISR: Top 10 Contractors, US, 2014~ 6. DoD C4ISR: Market Leaders by Technology, US, 2014~ 7. DoD C4ISR: C2 Funding by Department, US, 2014–2016~ 8. DoD C4ISR: C2 Funding by Category, US, 2014–2016~ 9. DoD C4ISR: Top 10 C2 Contractors, US, 2014~ 10. DoD C4ISR: C2 Contracts by Technology, US, 2014~ 11. DoD C4ISR: Communications Funding by Department, US, 2014–2016~ 12. DoD C4ISR: Communications Funding by Category, US, 2014–2016~ 13. DoD C4ISR: Top 10 Communications Contractors, US, 2014~ 14. DoD C4ISR: Communications Contracts by Technology, US, 2014~ 15. DoD C4ISR: Computers Funding by Department, US, 2014–2016~ 16. DoD C4ISR: Computers Funding by Category, US, 2014–2016~ 17. DoD C4ISR: Top 10 Computers Contractors, US, 2014~ 18. DoD C4ISR: Computers Contracts by Technology, US, 2014~ 19. DoD C4ISR: Intelligence Funding by Department, US, 2014–2016~ 20. DoD C4ISR: Intelligence Funding by Category, US, 2014–2016~ 21. DoD C4ISR: Top 10 Intelligence Contractors, US, 2014~ 22. DoD C4ISR: Intelligence Contracts by Technology, US, 2014~ 23. DoD C4ISR: S&R Funding by Department, US, 2014–2016~ 24. DoD C4ISR: S&R Funding by Category, US, 2014–2016~ 25. DoD C4ISR: Top 10 S&R Contractors, US, 2014~ 26. DoD C4ISR: S&R Contracts by Technology, US, 2014~ 27. DoD C4ISR: Top 10 Multipurpose Contractors, US, 2014~ 28. DoD C4ISR: Multipurpose Contracts by Technology, US, 2014~ 29. DoD C4ISR: EW/IO Funding by Department, US, 2014–2016~ 30. DoD C4ISR: EW/IO Funding by Category, US, 2014–2016~ 31. DoD C4ISR: Top 10 EW/IO Contractors, US, 2014~ 32. DoD C4ISR: Electronic Warfare/Information Operations Contracts by Technology, US, 2014~| 1. DoD C4ISR: C4ISR Spending Forecast, US, 2014–2020~ 2. DoD C4ISR: Percent of Contract Value, US, 2014~ |

| Author | Brad Curran |

| Industries | Aerospace, Defence and Security |

| WIP Number | NFA9-01-00-00-00 |

| Is Prebook | No |